Every Corporation Owns Its Structure: Corporate Credit Ratings via Graph Neural Networks

Paper and Code

Nov 27, 2020

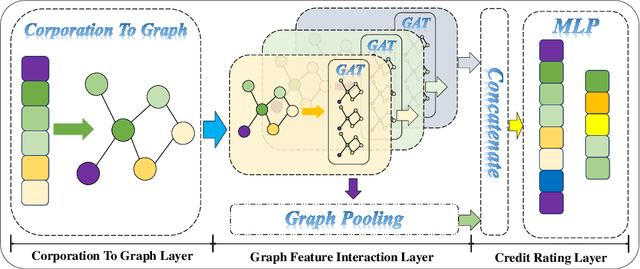

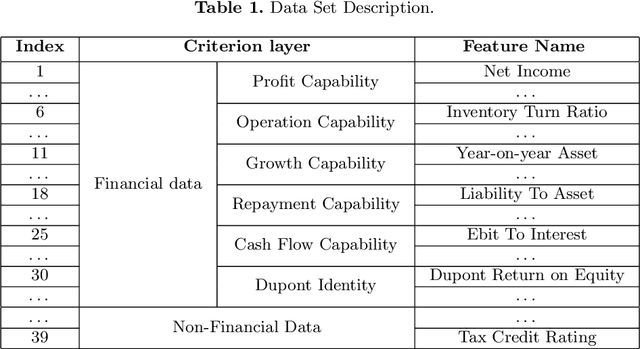

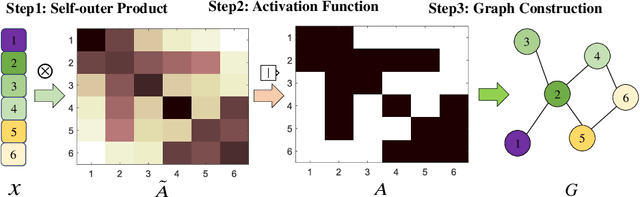

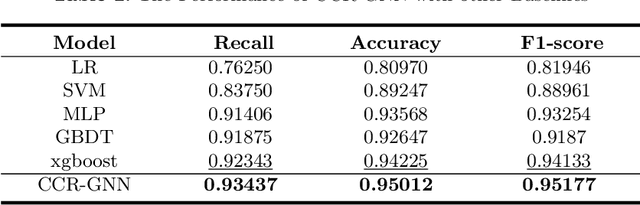

Credit rating is an analysis of the credit risks associated with a corporation, which reflects the level of the riskiness and reliability in investing, and plays a vital role in financial risk. There have emerged many studies that implement machine learning and deep learning techniques which are based on vector space to deal with corporate credit rating. Recently, considering the relations among enterprises such as loan guarantee network, some graph-based models are applied in this field with the advent of graph neural networks. But these existing models build networks between corporations without taking the internal feature interactions into account. In this paper, to overcome such problems, we propose a novel model, Corporate Credit Rating via Graph Neural Networks, CCR-GNN for brevity. We firstly construct individual graphs for each corporation based on self-outer product and then use GNN to model the feature interaction explicitly, which includes both local and global information. Extensive experiments conducted on the Chinese public-listed corporate rating dataset, prove that CCR-GNN outperforms the state-of-the-art methods consistently.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge