Vikram Duvvur

VisualWebArena: Evaluating Multimodal Agents on Realistic Visual Web Tasks

Jan 24, 2024

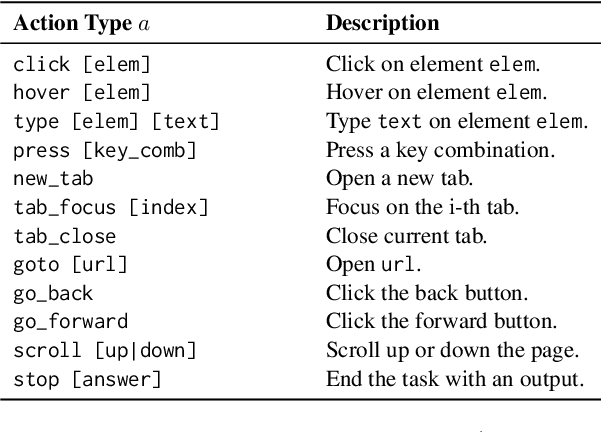

Abstract:Autonomous agents capable of planning, reasoning, and executing actions on the web offer a promising avenue for automating computer tasks. However, the majority of existing benchmarks primarily focus on text-based agents, neglecting many natural tasks that require visual information to effectively solve. Given that most computer interfaces cater to human perception, visual information often augments textual data in ways that text-only models struggle to harness effectively. To bridge this gap, we introduce VisualWebArena, a benchmark designed to assess the performance of multimodal web agents on realistic \textit{visually grounded tasks}. VisualWebArena comprises of a set of diverse and complex web-based tasks that evaluate various capabilities of autonomous multimodal agents. To perform on this benchmark, agents need to accurately process image-text inputs, interpret natural language instructions, and execute actions on websites to accomplish user-defined objectives. We conduct an extensive evaluation of state-of-the-art LLM-based autonomous agents, including several multimodal models. Through extensive quantitative and qualitative analysis, we identify several limitations of text-only LLM agents, and reveal gaps in the capabilities of state-of-the-art multimodal language agents. VisualWebArena provides a framework for evaluating multimodal autonomous language agents, and offers insights towards building stronger autonomous agents for the web. Our code, baseline models, and data is publicly available at https://jykoh.com/vwa.

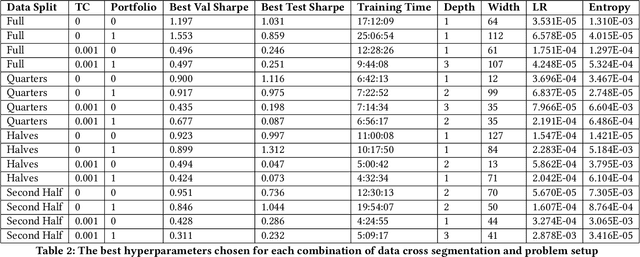

Data Cross-Segmentation for Improved Generalization in Reinforcement Learning Based Algorithmic Trading

Jul 18, 2023

Abstract:The use of machine learning in algorithmic trading systems is increasingly common. In a typical set-up, supervised learning is used to predict the future prices of assets, and those predictions drive a simple trading and execution strategy. This is quite effective when the predictions have sufficient signal, markets are liquid, and transaction costs are low. However, those conditions often do not hold in thinly traded financial markets and markets for differentiated assets such as real estate or vehicles. In these markets, the trading strategy must consider the long-term effects of taking positions that are relatively more difficult to change. In this work, we propose a Reinforcement Learning (RL) algorithm that trades based on signals from a learned predictive model and addresses these challenges. We test our algorithm on 20+ years of equity data from Bursa Malaysia.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge