Ken Yew Chan

Data Cross-Segmentation for Improved Generalization in Reinforcement Learning Based Algorithmic Trading

Jul 18, 2023

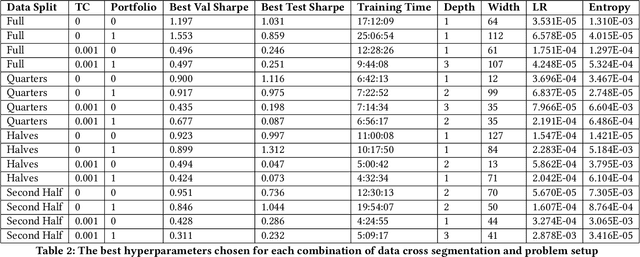

Abstract:The use of machine learning in algorithmic trading systems is increasingly common. In a typical set-up, supervised learning is used to predict the future prices of assets, and those predictions drive a simple trading and execution strategy. This is quite effective when the predictions have sufficient signal, markets are liquid, and transaction costs are low. However, those conditions often do not hold in thinly traded financial markets and markets for differentiated assets such as real estate or vehicles. In these markets, the trading strategy must consider the long-term effects of taking positions that are relatively more difficult to change. In this work, we propose a Reinforcement Learning (RL) algorithm that trades based on signals from a learned predictive model and addresses these challenges. We test our algorithm on 20+ years of equity data from Bursa Malaysia.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge