Qianwen Xing

Gradient Boosting Decision Tree with LSTM for Investment Prediction

May 29, 2025

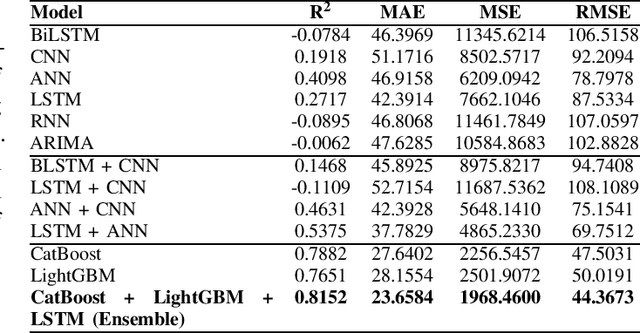

Abstract:This paper proposes a hybrid framework combining LSTM (Long Short-Term Memory) networks with LightGBM and CatBoost for stock price prediction. The framework processes time-series financial data and evaluates performance using seven models: Artificial Neural Networks (ANNs), Convolutional Neural Networks (CNNs), Bidirectional LSTM (BiLSTM), vanilla LSTM, XGBoost, LightGBM, and standard Neural Networks (NNs). Key metrics, including MAE, R-squared, MSE, and RMSE, are used to establish benchmarks across different time scales. Building on these benchmarks, we develop an ensemble model that combines the strengths of sequential and tree-based approaches. Experimental results show that the proposed framework improves accuracy by 10 to 15 percent compared to individual models and reduces error during market changes. This study highlights the potential of ensemble methods for financial forecasting and provides a flexible design for integrating new machine learning techniques.

Advanced User Credit Risk Prediction Model using LightGBM, XGBoost and Tabnet with SMOTEENN

Aug 07, 2024Abstract:Bank credit risk is a significant challenge in modern financial transactions, and the ability to identify qualified credit card holders among a large number of applicants is crucial for the profitability of a bank'sbank's credit card business. In the past, screening applicants'applicants' conditions often required a significant amount of manual labor, which was time-consuming and labor-intensive. Although the accuracy and reliability of previously used ML models have been continuously improving, the pursuit of more reliable and powerful AI intelligent models is undoubtedly the unremitting pursuit by major banks in the financial industry. In this study, we used a dataset of over 40,000 records provided by a commercial bank as the research object. We compared various dimensionality reduction techniques such as PCA and T-SNE for preprocessing high-dimensional datasets and performed in-depth adaptation and tuning of distributed models such as LightGBM and XGBoost, as well as deep models like Tabnet. After a series of research and processing, we obtained excellent research results by combining SMOTEENN with these techniques. The experiments demonstrated that LightGBM combined with PCA and SMOTEENN techniques can assist banks in accurately predicting potential high-quality customers, showing relatively outstanding performance compared to other models.

Advanced Payment Security System:XGBoost, CatBoost and SMOTE Integrated

Jun 07, 2024Abstract:With the rise of various online and mobile payment systems, transaction fraud has become a significant threat to financial security. This study explores the application of advanced machine learning models, specifically XGBoost and LightGBM, for developing a more accurate and robust Payment Security Protection Model.To enhance data reliability, we meticulously processed the data sources and used SMOTE (Synthetic Minority Over-sampling Technique) to address class imbalance and improve data representation. By selecting highly correlated features, we aimed to strengthen the training process and boost model performance.We conducted thorough performance evaluations of our proposed models, comparing them against traditional methods including Random Forest, Neural Network, and Logistic Regression. Key metrics such as Precision, Recall, and F1 Score were used to rigorously assess their effectiveness.Our detailed analyses and comparisons reveal that the combination of SMOTE with XGBoost and LightGBM offers a highly efficient and powerful mechanism for payment security protection. The results show that these models not only outperform traditional approaches but also hold significant promise for advancing the field of transaction fraud prevention.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge