Polina Pilyugina

NeuralProphet: Explainable Forecasting at Scale

Nov 29, 2021

Abstract:We introduce NeuralProphet, a successor to Facebook Prophet, which set an industry standard for explainable, scalable, and user-friendly forecasting frameworks. With the proliferation of time series data, explainable forecasting remains a challenging task for business and operational decision making. Hybrid solutions are needed to bridge the gap between interpretable classical methods and scalable deep learning models. We view Prophet as a precursor to such a solution. However, Prophet lacks local context, which is essential for forecasting the near-term future and is challenging to extend due to its Stan backend. NeuralProphet is a hybrid forecasting framework based on PyTorch and trained with standard deep learning methods, making it easy for developers to extend the framework. Local context is introduced with auto-regression and covariate modules, which can be configured as classical linear regression or as Neural Networks. Otherwise, NeuralProphet retains the design philosophy of Prophet and provides the same basic model components. Our results demonstrate that NeuralProphet produces interpretable forecast components of equivalent or superior quality to Prophet on a set of generated time series. NeuralProphet outperforms Prophet on a diverse collection of real-world datasets. For short to medium-term forecasts, NeuralProphet improves forecast accuracy by 55 to 92 percent.

TOTOPO: Classifying univariate and multivariate time series with Topological Data Analysis

Oct 10, 2020

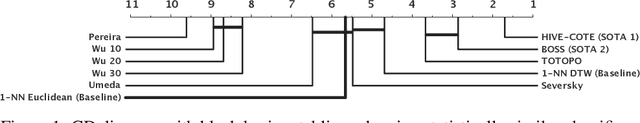

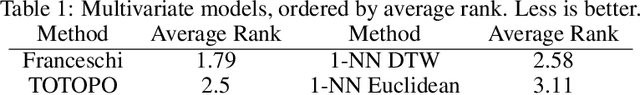

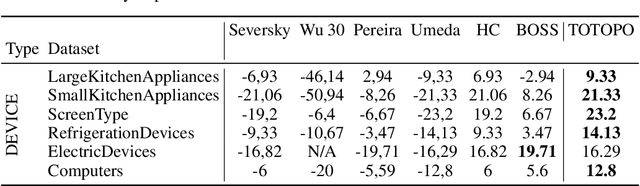

Abstract:This work is devoted to a comprehensive analysis of topological data analysis fortime series classification. Previous works have significant shortcomings, such aslack of large-scale benchmarking or missing state-of-the-art methods. In this work,we propose TOTOPO for extracting topological descriptors from different types ofpersistence diagrams. The results suggest that TOTOPO significantly outperformsexisting baselines in terms of accuracy. TOTOPO is also competitive with thestate-of-the-art, being the best on 20% of univariate and 40% of multivariate timeseries datasets. This work validates the hypothesis that TDA-based approaches arerobust to small perturbations in data and are useful for cases where periodicity andshape help discriminate between classes.

Topology-based Clusterwise Regression for User Segmentation and Demand Forecasting

Sep 08, 2020

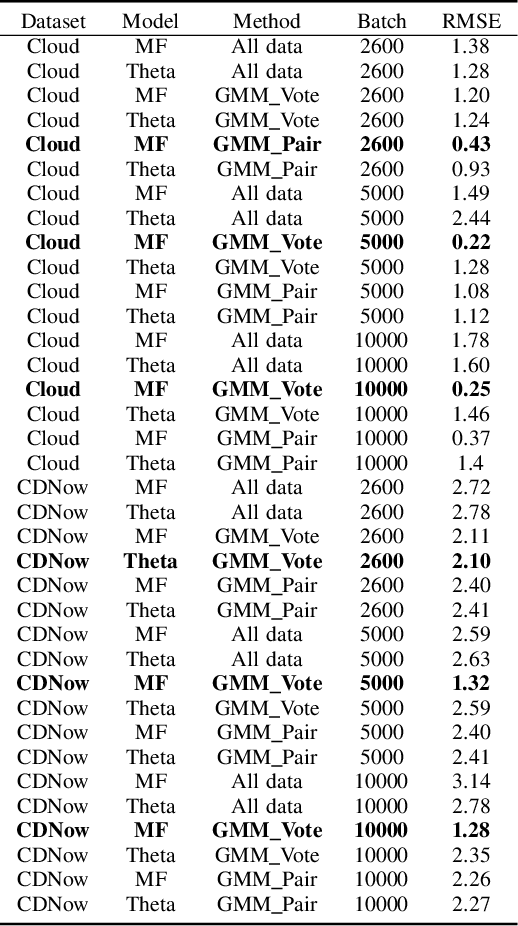

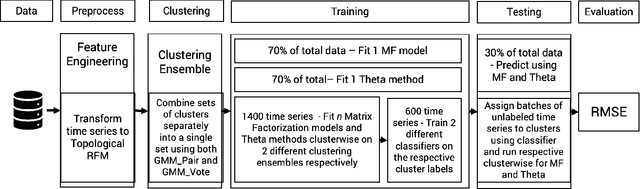

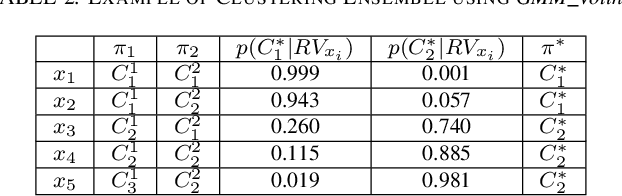

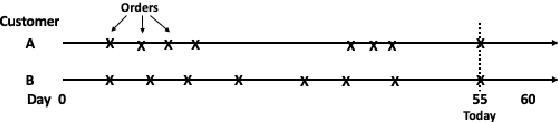

Abstract:Topological Data Analysis (TDA) is a recent approach to analyze data sets from the perspective of their topological structure. Its use for time series data has been limited. In this work, a system developed for a leading provider of cloud computing combining both user segmentation and demand forecasting is presented. It consists of a TDA-based clustering method for time series inspired by a popular managerial framework for customer segmentation and extended to the case of clusterwise regression using matrix factorization methods to forecast demand. Increasing customer loyalty and producing accurate forecasts remain active topics of discussion both for researchers and managers. Using a public and a novel proprietary data set of commercial data, this research shows that the proposed system enables analysts to both cluster their user base and plan demand at a granular level with significantly higher accuracy than a state of the art baseline. This work thus seeks to introduce TDA-based clustering of time series and clusterwise regression with matrix factorization methods as viable tools for the practitioner.

Topological Data Analysis for Portfolio Management of Cryptocurrencies

Sep 07, 2020

Abstract:Portfolio management is essential for any investment decision. Yet, traditional methods in the literature are ill-suited for the characteristics and dynamics of cryptocurrencies. This work presents a method to build an investment portfolio consisting of more than 1500 cryptocurrencies covering 6 years of market data. It is centred around Topological Data Analysis (TDA), a recent approach to analyze data sets from the perspective of their topological structure. This publication proposes a system combining persistence landscapes to identify suitable investment opportunities in cryptocurrencies. Using a novel and comprehensive data set of cryptocurrency prices, this research shows that the proposed system enables analysts to outperform a classic method from the literature without requiring any feature engineering or domain knowledge in TDA. This work thus introduces TDA-based portfolio management of cryptocurrencies as a viable tool for the practitioner.

DeepFolio: Convolutional Neural Networks for Portfolios with Limit Order Book Data

Aug 27, 2020

Abstract:This work proposes DeepFolio, a new model for deep portfolio management based on data from limit order books (LOB). DeepFolio solves problems found in the state-of-the-art for LOB data to predict price movements. Our evaluation consists of two scenarios using a large dataset of millions of time series. The improvements deliver superior results both in cases of abundant as well as scarce data. The experiments show that DeepFolio outperforms the state-of-the-art on the benchmark FI-2010 LOB. Further, we use DeepFolio for optimal portfolio allocation of crypto-assets with rebalancing. For this purpose, we use two loss-functions - Sharpe ratio loss and minimum volatility risk. We show that DeepFolio outperforms widely used portfolio allocation techniques in the literature.

Topological Data Analysis of Time Series Data for B2B Customer Relationshop Management

May 26, 2019

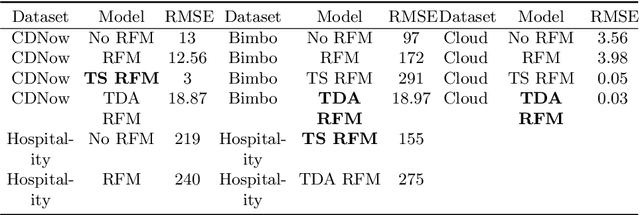

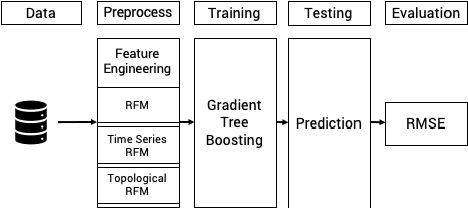

Abstract:Topological Data Analysis (TDA) is a recent approach to analyze data sets from the perspective of their topological structure. Its use for time series data has been limited to the field of financial time series primarily and as a method for feature generation in machine learning applications. In this work, TDA is presented as a technique to gain additional understanding of the customers' loyalty for business-to-business customer relationship management. Increasing loyalty and strengthening relationships with key accounts remain an active topic of discussion both for researchers and managers. Using two public and two proprietary data sets of commercial data, this research shows that the technique enables analysts to better understand their customer base and identify prospective opportunities. In addition, the approach can be used as a clustering method to increase the accuracy of a predictive model for loyalty scoring. This work thus seeks to introduce TDA as a viable tool for data analysis to the quantitate marketing practitioner.

* 9 pages, 2 figures, 1 table

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge