Moshe Babaioff

Learning to Maximize Gains From Trade in Small Markets

Jan 21, 2024

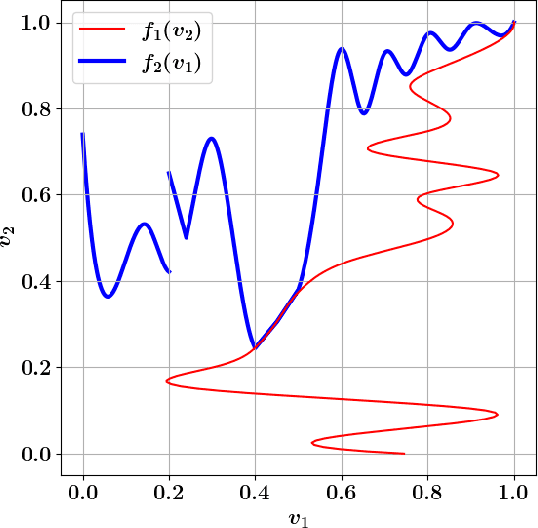

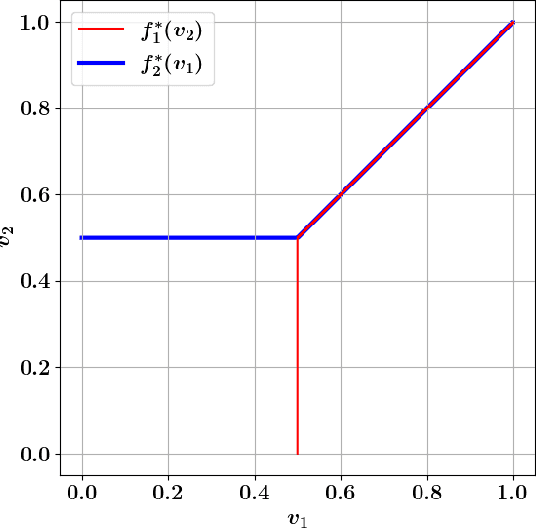

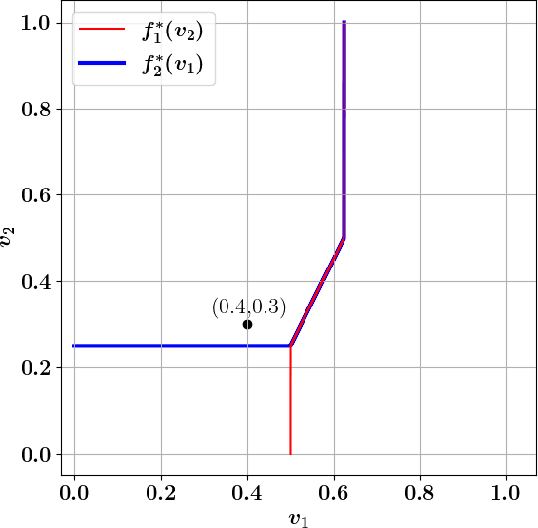

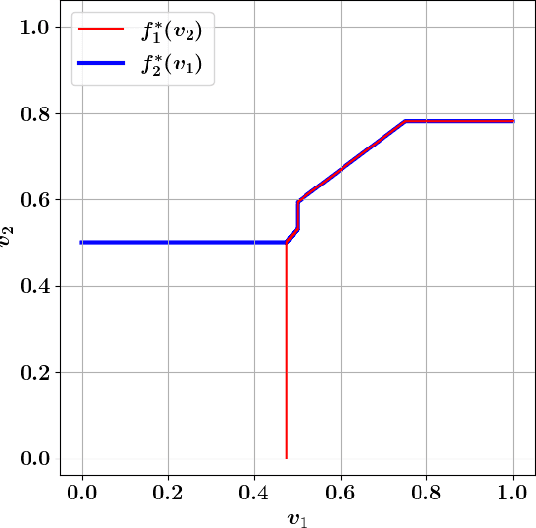

Abstract:We study the problem of designing a two-sided market (double auction) to maximize the gains from trade (social welfare) under the constraints of (dominant-strategy) incentive compatibility and budget-balance. Our goal is to do so for an unknown distribution from which we are given a polynomial number of samples. Our first result is a general impossibility for the case of correlated distributions of values even between just one seller and two buyers, in contrast to the case of one seller and one buyer (bilateral trade) where this is possible. Our second result is an efficient learning algorithm for one seller and two buyers in the case of independent distributions which is based on a novel algorithm for computing optimal mechanisms for finitely supported and explicitly given independent distributions. Both results rely heavily on characterizations of (dominant-strategy) incentive compatible mechanisms that are strongly budget-balanced.

Fair Shares: Feasibility, Domination and Incentives

May 16, 2022Abstract:We consider fair allocation of a set $M$ of indivisible goods to $n$ equally-entitled agents, with no monetary transfers. Every agent $i$ has a valuation $v_i$ from some given class of valuation functions. A share $s$ is a function that maps a pair $(v_i,n)$ to a value, with the interpretation that if an allocation of $M$ to $n$ agents fails to give agent $i$ a bundle of value at least equal to $s(v_i,n)$, this serves as evidence that the allocation is not fair towards $i$. For such an interpretation to make sense, we would like the share to be feasible, meaning that for any valuations in the class, there is an allocation that gives every agent at least her share. The maximin share was a natural candidate for a feasible share for additive valuations. However, Kurokawa, Procaccia and Wang [2018] show that it is not feasible. We initiate a systematic study of the family of feasible shares. We say that a share is \emph{self maximizing} if truth-telling maximizes the implied guarantee. We show that every feasible share is dominated by some self-maximizing and feasible share. We seek to identify those self-maximizing feasible shares that are polynomial time computable, and offer the highest share values. We show that a SM-dominating feasible share -- one that dominates every self-maximizing (SM) feasible share -- does not exist for additive valuations (and beyond). Consequently, we relax the domination property to that of domination up to a multiplicative factor of $\rho$ (called $\rho$-dominating). For additive valuations we present shares that are feasible, self-maximizing and polynomial-time computable. For $n$ agents we present such a share that is $\frac{2n}{3n-1}$-dominating. For two agents we present such a share that is $(1 - \epsilon)$-dominating. Moreover, for these shares we present poly-time algorithms that compute allocations that give every agent at least her share.

Submultiplicative Glivenko-Cantelli and Uniform Convergence of Revenues

Nov 06, 2017Abstract:In this work we derive a variant of the classic Glivenko-Cantelli Theorem, which asserts uniform convergence of the empirical Cumulative Distribution Function (CDF) to the CDF of the underlying distribution. Our variant allows for tighter convergence bounds for extreme values of the CDF. We apply our bound in the context of revenue learning, which is a well-studied problem in economics and algorithmic game theory. We derive sample-complexity bounds on the uniform convergence rate of the empirical revenues to the true revenues, assuming a bound on the $k$th moment of the valuations, for any (possibly fractional) $k>1$. For uniform convergence in the limit, we give a complete characterization and a zero-one law: if the first moment of the valuations is finite, then uniform convergence almost surely occurs; conversely, if the first moment is infinite, then uniform convergence almost never occurs.

Dynamic Pricing with Limited Supply

Nov 26, 2013Abstract:We consider the problem of dynamic pricing with limited supply. A seller has $k$ identical items for sale and is facing $n$ potential buyers ("agents") that are arriving sequentially. Each agent is interested in buying one item. Each agent's value for an item is an IID sample from some fixed distribution with support $[0,1]$. The seller offers a take-it-or-leave-it price to each arriving agent (possibly different for different agents), and aims to maximize his expected revenue. We focus on "prior-independent" mechanisms -- ones that do not use any information about the distribution. They are desirable because knowing the distribution is unrealistic in many practical scenarios. We study how the revenue of such mechanisms compares to the revenue of the optimal offline mechanism that knows the distribution ("offline benchmark"). We present a prior-independent dynamic pricing mechanism whose revenue is at most $O((k \log n)^{2/3})$ less than the offline benchmark, for every distribution that is regular. In fact, this guarantee holds without *any* assumptions if the benchmark is relaxed to fixed-price mechanisms. Further, we prove a matching lower bound. The performance guarantee for the same mechanism can be improved to $O(\sqrt{k} \log n)$, with a distribution-dependent constant, if $k/n$ is sufficiently small. We show that, in the worst case over all demand distributions, this is essentially the best rate that can be obtained with a distribution-specific constant. On a technical level, we exploit the connection to multi-armed bandits (MAB). While dynamic pricing with unlimited supply can easily be seen as an MAB problem, the intuition behind MAB approaches breaks when applied to the setting with limited supply. Our high-level conceptual contribution is that even the limited supply setting can be fruitfully treated as a bandit problem.

Characterizing Truthful Multi-Armed Bandit Mechanisms

Jun 03, 2013

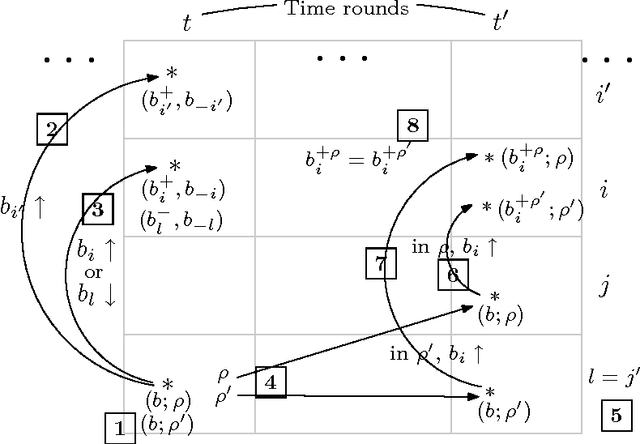

Abstract:We consider a multi-round auction setting motivated by pay-per-click auctions for Internet advertising. In each round the auctioneer selects an advertiser and shows her ad, which is then either clicked or not. An advertiser derives value from clicks; the value of a click is her private information. Initially, neither the auctioneer nor the advertisers have any information about the likelihood of clicks on the advertisements. The auctioneer's goal is to design a (dominant strategies) truthful mechanism that (approximately) maximizes the social welfare. If the advertisers bid their true private values, our problem is equivalent to the "multi-armed bandit problem", and thus can be viewed as a strategic version of the latter. In particular, for both problems the quality of an algorithm can be characterized by "regret", the difference in social welfare between the algorithm and the benchmark which always selects the same "best" advertisement. We investigate how the design of multi-armed bandit algorithms is affected by the restriction that the resulting mechanism must be truthful. We find that truthful mechanisms have certain strong structural properties -- essentially, they must separate exploration from exploitation -- and they incur much higher regret than the optimal multi-armed bandit algorithms. Moreover, we provide a truthful mechanism which (essentially) matches our lower bound on regret.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge