Noam Nisan

Learning to Maximize Gains From Trade in Small Markets

Jan 21, 2024

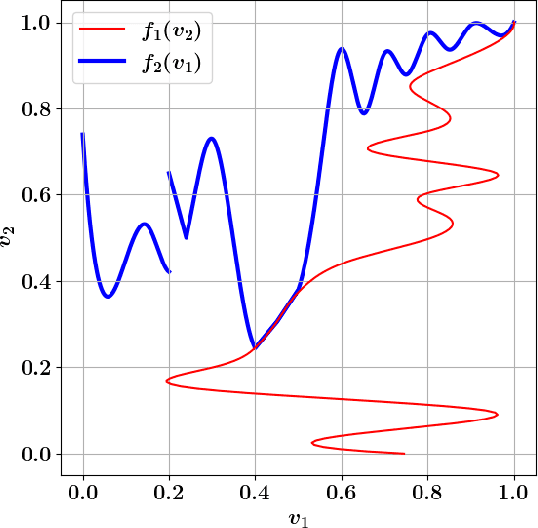

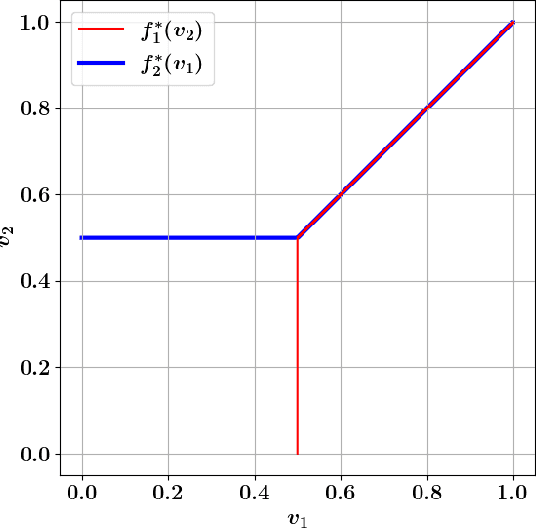

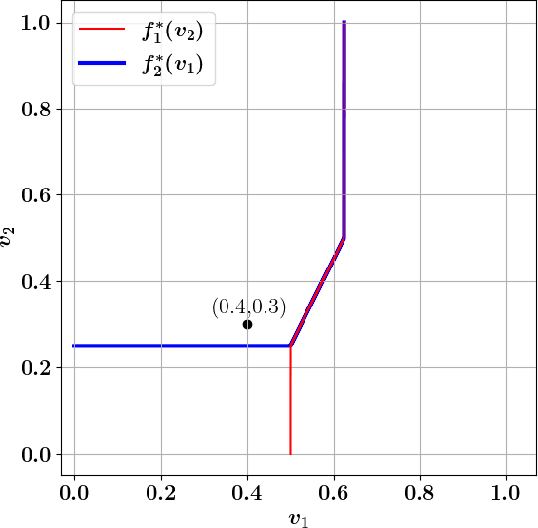

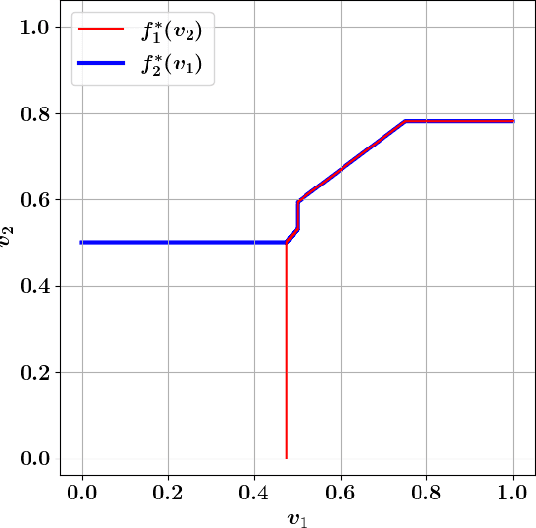

Abstract:We study the problem of designing a two-sided market (double auction) to maximize the gains from trade (social welfare) under the constraints of (dominant-strategy) incentive compatibility and budget-balance. Our goal is to do so for an unknown distribution from which we are given a polynomial number of samples. Our first result is a general impossibility for the case of correlated distributions of values even between just one seller and two buyers, in contrast to the case of one seller and one buyer (bilateral trade) where this is possible. Our second result is an efficient learning algorithm for one seller and two buyers in the case of independent distributions which is based on a novel algorithm for computing optimal mechanisms for finitely supported and explicitly given independent distributions. Both results rely heavily on characterizations of (dominant-strategy) incentive compatible mechanisms that are strongly budget-balanced.

How and Why to Manipulate Your Own Agent

Dec 14, 2021

Abstract:We consider strategic settings where several users engage in a repeated online interaction, assisted by regret-minimizing agents that repeatedly play a "game" on their behalf. We study the dynamics and average outcomes of the repeated game of the agents, and view it as inducing a meta-game between the users. Our main focus is on whether users can benefit in this meta-game from "manipulating" their own agent by mis-reporting their parameters to it. We formally define this "user-agent meta-game" model for general games, discuss its properties under different notions of convergence of the dynamics of the automated agents and analyze the equilibria induced on the users in 2x2 games in which the dynamics converge to a single equilibrium.

Auctions Between Regret-Minimizing Agents

Oct 22, 2021

Abstract:We analyze a scenario in which software agents implemented as regret minimizing algorithms engage in a repeated auction on behalf of their users. We study first price and second price auctions, as well as their generalized versions (e.g., as those used for ad auctions). Using both theoretical analysis and simulations, we show that, surprisingly, in second price auctions the players have incentives to mis-report their true valuations to their own learning agents, while in the first price auction it is a dominant strategy for all players to truthfully report their valuations to their agents.

A Quantitative Version of the Gibbard-Satterthwaite Theorem for Three Alternatives

May 25, 2011Abstract:The Gibbard-Satterthwaite theorem states that every non-dictatorial election rule among at least three alternatives can be strategically manipulated. We prove a quantitative version of the Gibbard-Satterthwaite theorem: a random manipulation by a single random voter will succeed with a non-negligible probability for any election rule among three alternatives that is far from being a dictatorship and from having only two alternatives in its range.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge