Jose Miguel Hernandez Lobato

Position Paper: Bayesian Deep Learning in the Age of Large-Scale AI

Feb 06, 2024

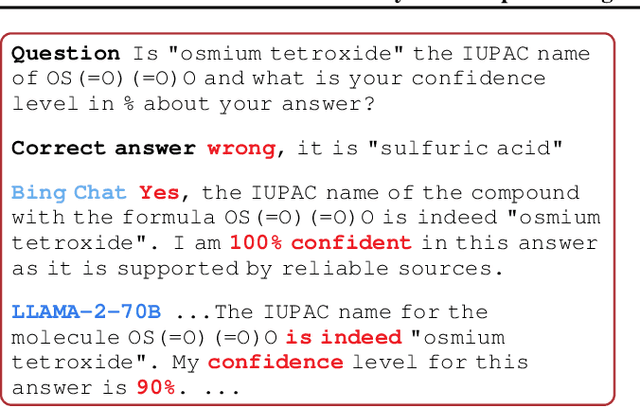

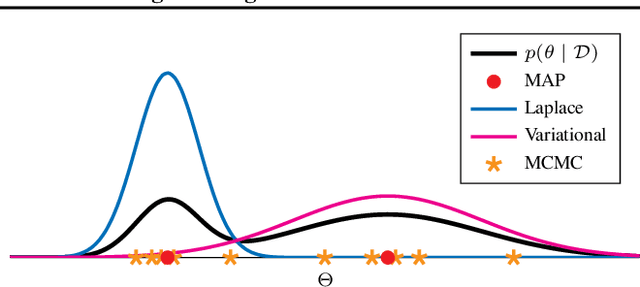

Abstract:In the current landscape of deep learning research, there is a predominant emphasis on achieving high predictive accuracy in supervised tasks involving large image and language datasets. However, a broader perspective reveals a multitude of overlooked metrics, tasks, and data types, such as uncertainty, active and continual learning, and scientific data, that demand attention. Bayesian deep learning (BDL) constitutes a promising avenue, offering advantages across these diverse settings. This paper posits that BDL can elevate the capabilities of deep learning. It revisits the strengths of BDL, acknowledges existing challenges, and highlights some exciting research avenues aimed at addressing these obstacles. Looking ahead, the discussion focuses on possible ways to combine large-scale foundation models with BDL to unlock their full potential.

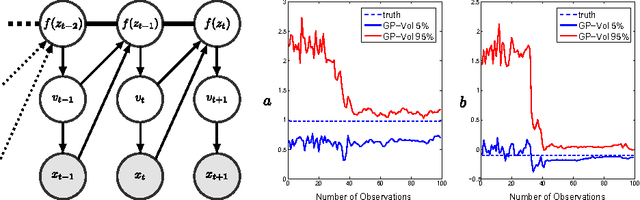

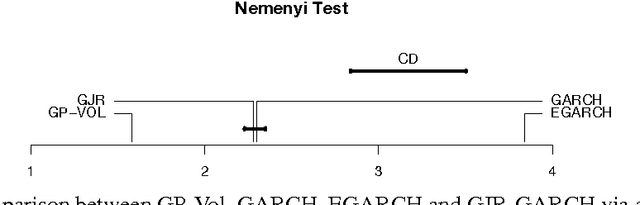

Gaussian Process Volatility Model

Feb 13, 2014

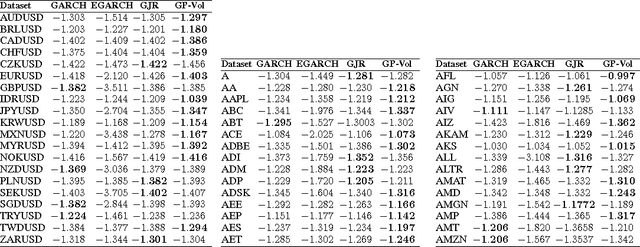

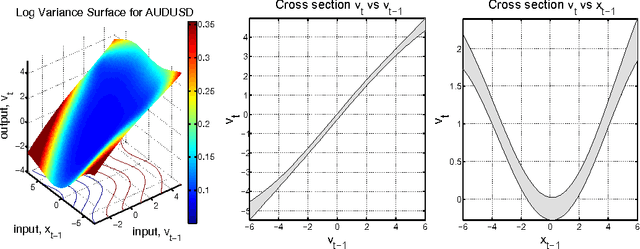

Abstract:The accurate prediction of time-changing variances is an important task in the modeling of financial data. Standard econometric models are often limited as they assume rigid functional relationships for the variances. Moreover, function parameters are usually learned using maximum likelihood, which can lead to overfitting. To address these problems we introduce a novel model for time-changing variances using Gaussian Processes. A Gaussian Process (GP) defines a distribution over functions, which allows us to capture highly flexible functional relationships for the variances. In addition, we develop an online algorithm to perform inference. The algorithm has two main advantages. First, it takes a Bayesian approach, thereby avoiding overfitting. Second, it is much quicker than current offline inference procedures. Finally, our new model was evaluated on financial data and showed significant improvement in predictive performance over current standard models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge