Jiahe Lin

Covariate-dependent Graphical Model Estimation via Neural Networks with Statistical Guarantees

Apr 23, 2025Abstract:Graphical models are widely used in diverse application domains to model the conditional dependencies amongst a collection of random variables. In this paper, we consider settings where the graph structure is covariate-dependent, and investigate a deep neural network-based approach to estimate it. The method allows for flexible functional dependency on the covariate, and fits the data reasonably well in the absence of a Gaussianity assumption. Theoretical results with PAC guarantees are established for the method, under assumptions commonly used in an Empirical Risk Minimization framework. The performance of the proposed method is evaluated on several synthetic data settings and benchmarked against existing approaches. The method is further illustrated on real datasets involving data from neuroscience and finance, respectively, and produces interpretable results.

Reweighting Improves Conditional Risk Bounds

Jan 04, 2025

Abstract:In this work, we study the weighted empirical risk minimization (weighted ERM) schema, in which an additional data-dependent weight function is incorporated when the empirical risk function is being minimized. We show that under a general ``balanceable" Bernstein condition, one can design a weighted ERM estimator to achieve superior performance in certain sub-regions over the one obtained from standard ERM, and the superiority manifests itself through a data-dependent constant term in the error bound. These sub-regions correspond to large-margin ones in classification settings and low-variance ones in heteroscedastic regression settings, respectively. Our findings are supported by evidence from synthetic data experiments.

Deep Learning-based Approaches for State Space Models: A Selective Review

Dec 15, 2024Abstract:State-space models (SSMs) offer a powerful framework for dynamical system analysis, wherein the temporal dynamics of the system are assumed to be captured through the evolution of the latent states, which govern the values of the observations. This paper provides a selective review of recent advancements in deep neural network-based approaches for SSMs, and presents a unified perspective for discrete time deep state space models and continuous time ones such as latent neural Ordinary Differential and Stochastic Differential Equations. It starts with an overview of the classical maximum likelihood based approach for learning SSMs, reviews variational autoencoder as a general learning pipeline for neural network-based approaches in the presence of latent variables, and discusses in detail representative deep learning models that fall under the SSM framework. Very recent developments, where SSMs are used as standalone architectural modules for improving efficiency in sequence modeling, are also examined. Finally, examples involving mixed frequency and irregularly-spaced time series data are presented to demonstrate the advantage of SSMs in these settings.

Prediction-Enhanced Monte Carlo: A Machine Learning View on Control Variate

Dec 15, 2024

Abstract:Despite being an essential tool across engineering and finance, Monte Carlo simulation can be computationally intensive, especially in large-scale, path-dependent problems that hinder straightforward parallelization. A natural alternative is to replace simulation with machine learning or surrogate prediction, though this introduces challenges in understanding the resulting errors.We introduce a Prediction-Enhanced Monte Carlo (PEMC) framework where we leverage machine learning prediction as control variates, thus maintaining unbiased evaluations instead of the direct use of ML predictors. Traditional control variate methods require knowledge of means and focus on per-sample variance reduction. In contrast, PEMC aims at overall cost-aware variance reduction, eliminating the need for mean knowledge. PEMC leverages pre-trained neural architectures to construct effective control variates and replaces computationally expensive sample-path generation with efficient neural network evaluations. This allows PEMC to address scenarios where no good control variates are known. We showcase the efficacy of PEMC through two production-grade exotic option-pricing problems: swaption pricing in HJM model and the variance swap pricing in a stochastic local volatility model.

A VAE-based Framework for Learning Multi-Level Neural Granger-Causal Connectivity

Feb 25, 2024

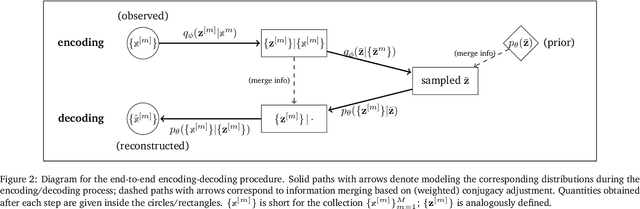

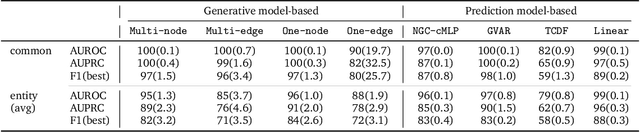

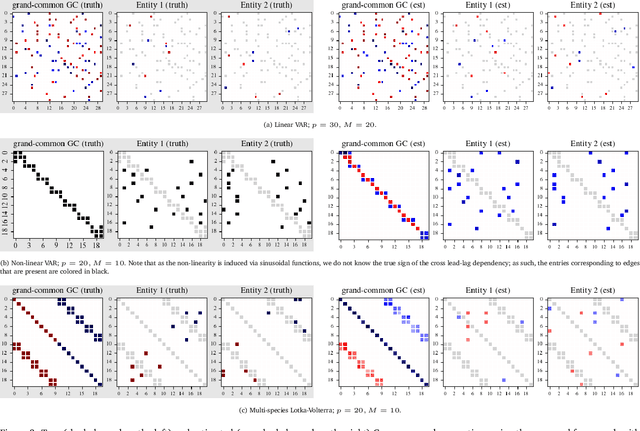

Abstract:Granger causality has been widely used in various application domains to capture lead-lag relationships amongst the components of complex dynamical systems, and the focus in extant literature has been on a single dynamical system. In certain applications in macroeconomics and neuroscience, one has access to data from a collection of related such systems, wherein the modeling task of interest is to extract the shared common structure that is embedded across them, as well as to identify the idiosyncrasies within individual ones. This paper introduces a Variational Autoencoder (VAE) based framework that jointly learns Granger-causal relationships amongst components in a collection of related-yet-heterogeneous dynamical systems, and handles the aforementioned task in a principled way. The performance of the proposed framework is evaluated on several synthetic data settings and benchmarked against existing approaches designed for individual system learning. The method is further illustrated on a real dataset involving time series data from a neurophysiological experiment and produces interpretable results.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge