Degang Wang

EvolvingGS: High-Fidelity Streamable Volumetric Video via Evolving 3D Gaussian Representation

Mar 07, 2025

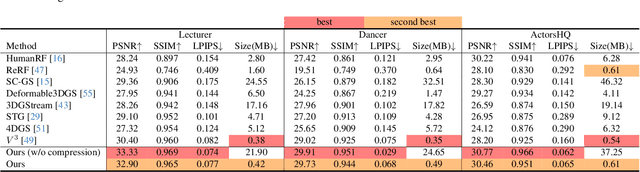

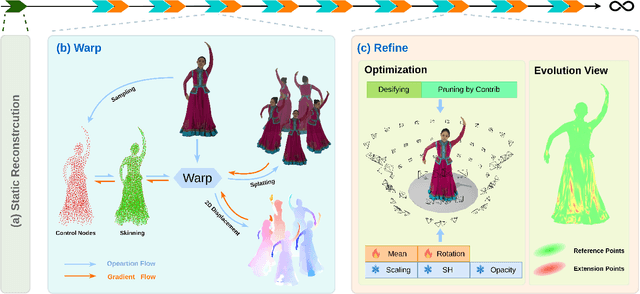

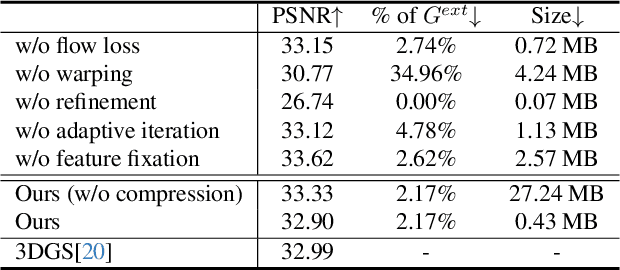

Abstract:We have recently seen great progress in 3D scene reconstruction through explicit point-based 3D Gaussian Splatting (3DGS), notable for its high quality and fast rendering speed. However, reconstructing dynamic scenes such as complex human performances with long durations remains challenging. Prior efforts fall short of modeling a long-term sequence with drastic motions, frequent topology changes or interactions with props, and resort to segmenting the whole sequence into groups of frames that are processed independently, which undermines temporal stability and thereby leads to an unpleasant viewing experience and inefficient storage footprint. In view of this, we introduce EvolvingGS, a two-stage strategy that first deforms the Gaussian model to coarsely align with the target frame, and then refines it with minimal point addition/subtraction, particularly in fast-changing areas. Owing to the flexibility of the incrementally evolving representation, our method outperforms existing approaches in terms of both per-frame and temporal quality metrics while maintaining fast rendering through its purely explicit representation. Moreover, by exploiting temporal coherence between successive frames, we propose a simple yet effective compression algorithm that achieves over 50x compression rate. Extensive experiments on both public benchmarks and challenging custom datasets demonstrate that our method significantly advances the state-of-the-art in dynamic scene reconstruction, particularly for extended sequences with complex human performances.

Financial Markets Prediction with Deep Learning

Apr 05, 2021

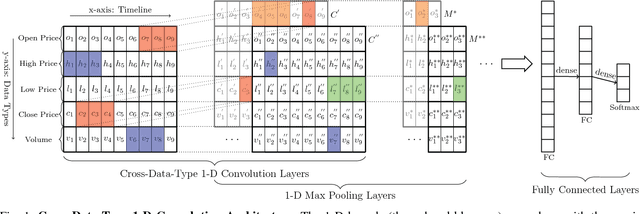

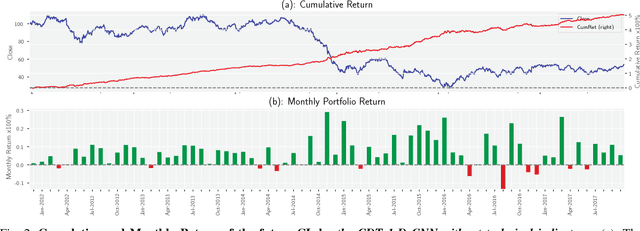

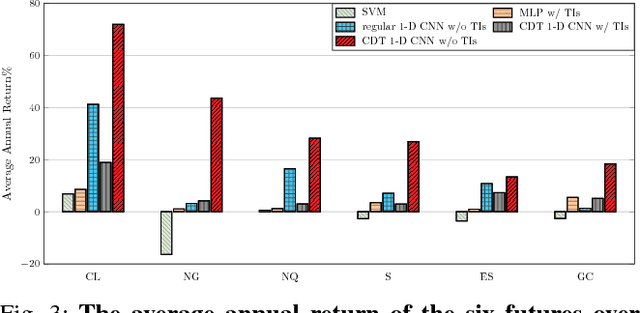

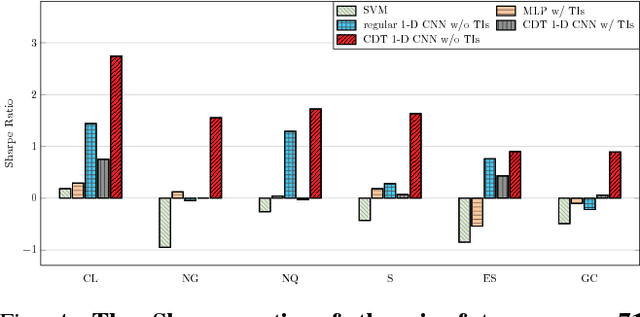

Abstract:Financial markets are difficult to predict due to its complex systems dynamics. Although there have been some recent studies that use machine learning techniques for financial markets prediction, they do not offer satisfactory performance on financial returns. We propose a novel one-dimensional convolutional neural networks (CNN) model to predict financial market movement. The customized one-dimensional convolutional layers scan financial trading data through time, while different types of data, such as prices and volume, share parameters (kernels) with each other. Our model automatically extracts features instead of using traditional technical indicators and thus can avoid biases caused by selection of technical indicators and pre-defined coefficients in technical indicators. We evaluate the performance of our prediction model with strictly backtesting on historical trading data of six futures from January 2010 to October 2017. The experiment results show that our CNN model can effectively extract more generalized and informative features than traditional technical indicators, and achieves more robust and profitable financial performance than previous machine learning approaches.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge