Shuheng Wang

EvolvingGS: High-Fidelity Streamable Volumetric Video via Evolving 3D Gaussian Representation

Mar 07, 2025

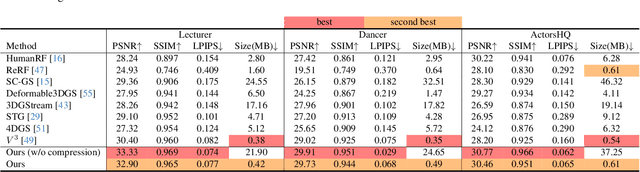

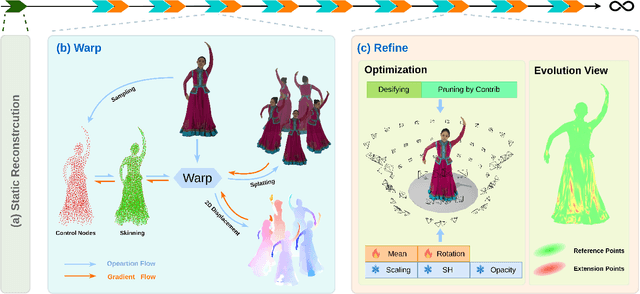

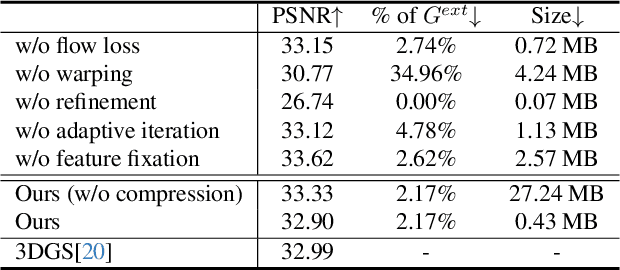

Abstract:We have recently seen great progress in 3D scene reconstruction through explicit point-based 3D Gaussian Splatting (3DGS), notable for its high quality and fast rendering speed. However, reconstructing dynamic scenes such as complex human performances with long durations remains challenging. Prior efforts fall short of modeling a long-term sequence with drastic motions, frequent topology changes or interactions with props, and resort to segmenting the whole sequence into groups of frames that are processed independently, which undermines temporal stability and thereby leads to an unpleasant viewing experience and inefficient storage footprint. In view of this, we introduce EvolvingGS, a two-stage strategy that first deforms the Gaussian model to coarsely align with the target frame, and then refines it with minimal point addition/subtraction, particularly in fast-changing areas. Owing to the flexibility of the incrementally evolving representation, our method outperforms existing approaches in terms of both per-frame and temporal quality metrics while maintaining fast rendering through its purely explicit representation. Moreover, by exploiting temporal coherence between successive frames, we propose a simple yet effective compression algorithm that achieves over 50x compression rate. Extensive experiments on both public benchmarks and challenging custom datasets demonstrate that our method significantly advances the state-of-the-art in dynamic scene reconstruction, particularly for extended sequences with complex human performances.

A novel improved fuzzy support vector machine based stock price trend forecast model

Jan 02, 2018

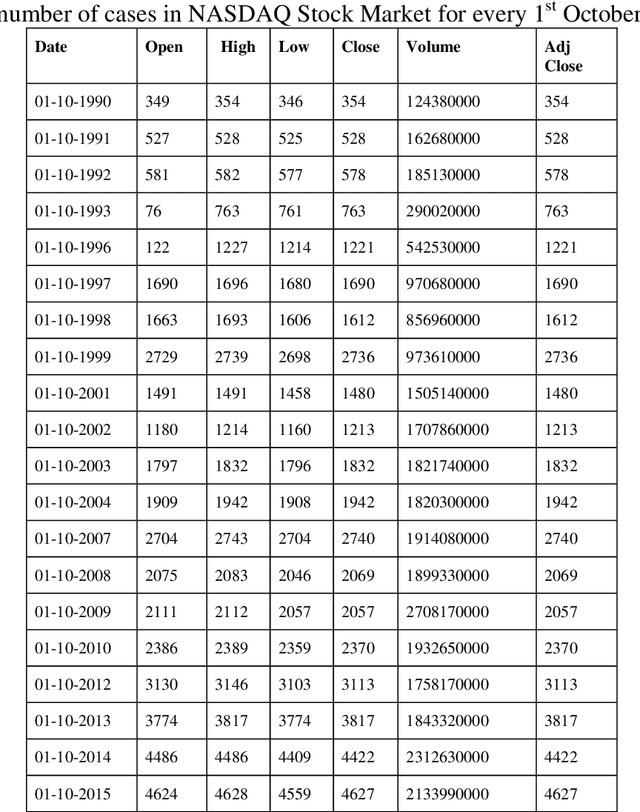

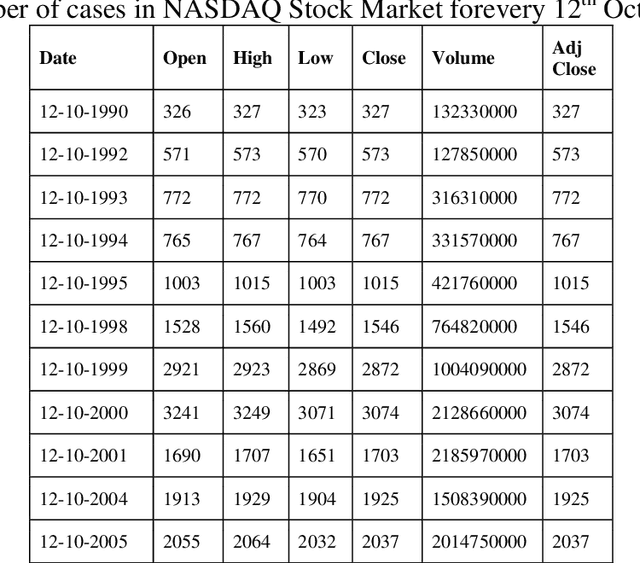

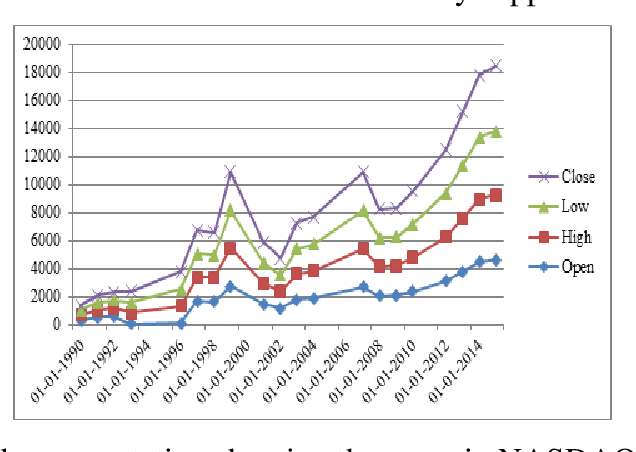

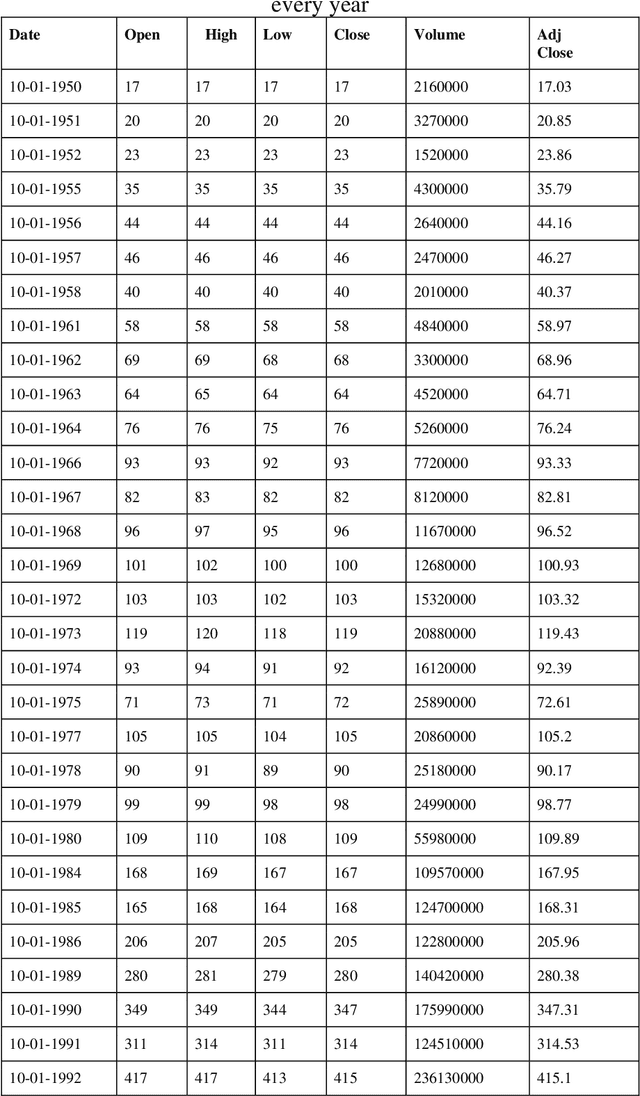

Abstract:Application of fuzzy support vector machine in stock price forecast. Support vector machine is a new type of machine learning method proposed in 1990s. It can deal with classification and regression problems very successfully. Due to the excellent learning performance of support vector machine, the technology has become a hot research topic in the field of machine learning, and it has been successfully applied in many fields. However, as a new technology, there are many limitations to support vector machines. There is a large amount of fuzzy information in the objective world. If the training of support vector machine contains noise and fuzzy information, the performance of the support vector machine will become very weak and powerless. As the complexity of many factors influence the stock price prediction, the prediction results of traditional support vector machine cannot meet people with precision, this study improved the traditional support vector machine fuzzy prediction algorithm is proposed to improve the new model precision. NASDAQ Stock Market, Standard & Poor's (S&P) Stock market are considered. Novel advanced- fuzzy support vector machine (NA-FSVM) is the proposed methodology.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge