Boyi Zhang

PhysicsMind: Sim and Real Mechanics Benchmarking for Physical Reasoning and Prediction in Foundational VLMs and World Models

Jan 22, 2026Abstract:Modern foundational Multimodal Large Language Models (MLLMs) and video world models have advanced significantly in mathematical, common-sense, and visual reasoning, but their grasp of the underlying physics remains underexplored. Existing benchmarks attempting to measure this matter rely on synthetic, Visual Question Answer templates or focus on perceptual video quality that is tangential to measuring how well the video abides by physical laws. To address this fragmentation, we introduce PhysicsMind, a unified benchmark with both real and simulation environments that evaluates law-consistent reasoning and generation over three canonical principles: Center of Mass, Lever Equilibrium, and Newton's First Law. PhysicsMind comprises two main tasks: i) VQA tasks, testing whether models can reason and determine physical quantities and values from images or short videos, and ii) Video Generation(VG) tasks, evaluating if predicted motion trajectories obey the same center-of-mass, torque, and inertial constraints as the ground truth. A broad range of recent models and video generation models is evaluated on PhysicsMind and found to rely on appearance heuristics while often violating basic mechanics. These gaps indicate that current scaling and training are still insufficient for robust physical understanding, underscoring PhysicsMind as a focused testbed for physics-aware multimodal models. Our data will be released upon acceptance.

Mastering Pair Trading with Risk-Aware Recurrent Reinforcement Learning

Apr 01, 2023

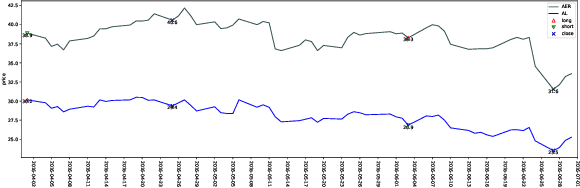

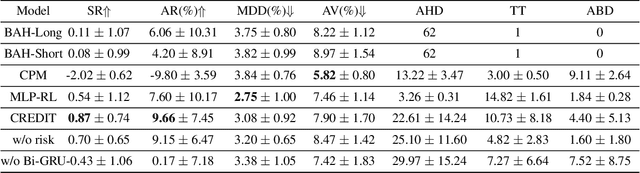

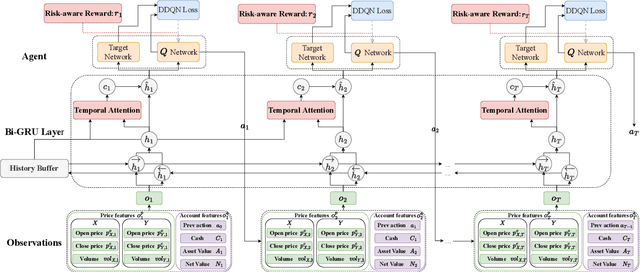

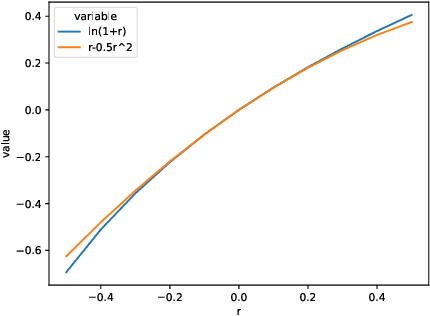

Abstract:Although pair trading is the simplest hedging strategy for an investor to eliminate market risk, it is still a great challenge for reinforcement learning (RL) methods to perform pair trading as human expertise. It requires RL methods to make thousands of correct actions that nevertheless have no obvious relations to the overall trading profit, and to reason over infinite states of the time-varying market most of which have never appeared in history. However, existing RL methods ignore the temporal connections between asset price movements and the risk of the performed trading. These lead to frequent tradings with high transaction costs and potential losses, which barely reach the human expertise level of trading. Therefore, we introduce CREDIT, a risk-aware agent capable of learning to exploit long-term trading opportunities in pair trading similar to a human expert. CREDIT is the first to apply bidirectional GRU along with the temporal attention mechanism to fully consider the temporal correlations embedded in the states, which allows CREDIT to capture long-term patterns of the price movements of two assets to earn higher profit. We also design the risk-aware reward inspired by the economic theory, that models both the profit and risk of the tradings during the trading period. It helps our agent to master pair trading with a robust trading preference that avoids risky trading with possible high returns and losses. Experiments show that it outperforms existing reinforcement learning methods in pair trading and achieves a significant profit over five years of U.S. stock data.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge