Asef Nazari

SALSA: Sequential Approximate Leverage-Score Algorithm with Application in Analyzing Big Time Series Data

Dec 30, 2023Abstract:We develop a new efficient sequential approximate leverage score algorithm, SALSA, using methods from randomized numerical linear algebra (RandNLA) for large matrices. We demonstrate that, with high probability, the accuracy of SALSA's approximations is within $(1 + O({\varepsilon}))$ of the true leverage scores. In addition, we show that the theoretical computational complexity and numerical accuracy of SALSA surpass existing approximations. These theoretical results are subsequently utilized to develop an efficient algorithm, named LSARMA, for fitting an appropriate ARMA model to large-scale time series data. Our proposed algorithm is, with high probability, guaranteed to find the maximum likelihood estimates of the parameters for the true underlying ARMA model. Furthermore, it has a worst-case running time that significantly improves those of the state-of-the-art alternatives in big data regimes. Empirical results on large-scale data strongly support these theoretical results and underscore the efficacy of our new approach.

A Framework for Empowering Reinforcement Learning Agents with Causal Analysis: Enhancing Automated Cryptocurrency Trading

Oct 14, 2023Abstract:Despite advances in artificial intelligence-enhanced trading methods, developing a profitable automated trading system remains challenging in the rapidly evolving cryptocurrency market. This study aims to address these challenges by developing a reinforcement learning-based automated trading system for five popular altcoins~(cryptocurrencies other than Bitcoin): Binance Coin, Ethereum, Litecoin, Ripple, and Tether. To this end, we present CausalReinforceNet, a framework framed as a decision support system. Designed as the foundational architecture of the trading system, the CausalReinforceNet framework enhances the capabilities of the reinforcement learning agent through causal analysis. Within this framework, we use Bayesian networks in the feature engineering process to identify the most relevant features with causal relationships that influence cryptocurrency price movements. Additionally, we incorporate probabilistic price direction signals from dynamic Bayesian networks to enhance our reinforcement learning agent's decision-making. Due to the high volatility of the cryptocurrency market, we design our framework to adopt a conservative approach that limits sell and buy position sizes to manage risk. We develop two agents using the CausalReinforceNet framework, each based on distinct reinforcement learning algorithms. The results indicate that our framework substantially surpasses the Buy-and-Hold benchmark strategy in profitability. Additionally, both agents generated notable returns on investment for Binance Coin and Ethereum.

Causal Feature Engineering of Price Directions of Cryptocurrencies using Dynamic Bayesian Networks

Jun 13, 2023

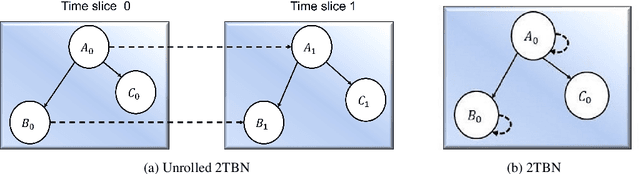

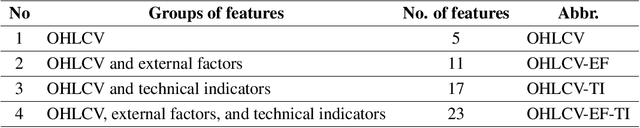

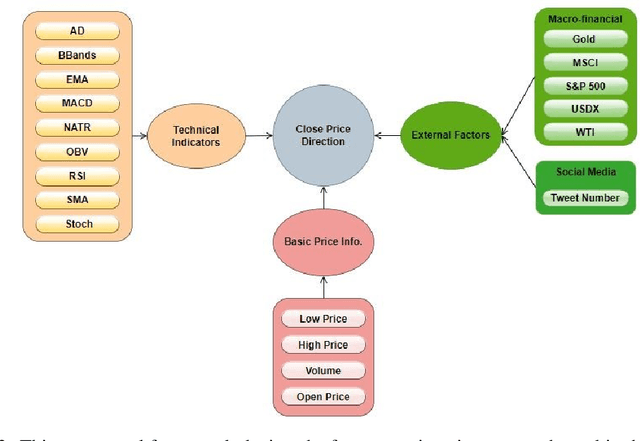

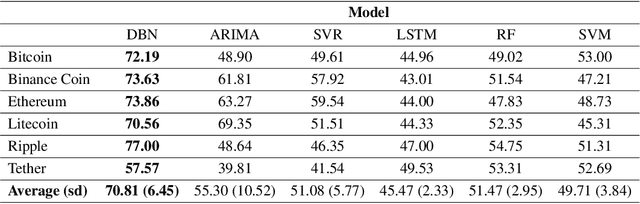

Abstract:Cryptocurrencies have gained popularity across various sectors, especially in finance and investment. The popularity is partly due to their unique specifications originating from blockchain-related characteristics such as privacy, decentralisation, and untraceability. Despite their growing popularity, cryptocurrencies remain a high-risk investment due to their price volatility and uncertainty. The inherent volatility in cryptocurrency prices, coupled with internal cryptocurrency-related factors and external influential global economic factors makes predicting their prices and price movement directions challenging. Nevertheless, the knowledge obtained from predicting the direction of cryptocurrency prices can provide valuable guidance for investors in making informed investment decisions. To address this issue, this paper proposes a dynamic Bayesian network (DBN) approach, which can model complex systems in multivariate settings, to predict the price movement direction of five popular altcoins (cryptocurrencies other than Bitcoin) in the next trading day. The efficacy of the proposed model in predicting cryptocurrency price directions is evaluated from two perspectives. Firstly, our proposed approach is compared to two baseline models, namely an auto-regressive integrated moving average and support vector regression. Secondly, from a feature engineering point of view, the impact of twenty-three different features, grouped into four categories, on the DBN's prediction performance is investigated. The experimental results demonstrate that the DBN significantly outperforms the baseline models. In addition, among the groups of features, technical indicators are found to be the most effective predictors of cryptocurrency price directions.

Modelling Determinants of Cryptocurrency Prices: A Bayesian Network Approach

Mar 26, 2023Abstract:The growth of market capitalisation and the number of altcoins (cryptocurrencies other than Bitcoin) provide investment opportunities and complicate the prediction of their price movements. A significant challenge in this volatile and relatively immature market is the problem of predicting cryptocurrency prices which needs to identify the factors influencing these prices. The focus of this study is to investigate the factors influencing altcoin prices, and these factors have been investigated from a causal analysis perspective using Bayesian networks. In particular, studying the nature of interactions between five leading altcoins, traditional financial assets including gold, oil, and S\&P 500, and social media is the research question. To provide an answer to the question, we create causal networks which are built from the historic price data of five traditional financial assets, social media data, and price data of altcoins. The ensuing networks are used for causal reasoning and diagnosis, and the results indicate that social media (in particular Twitter data in this study) is the most significant influencing factor of the prices of altcoins. Furthermore, it is not possible to generalise the coins' reactions against the changes in the factors. Consequently, the coins need to be studied separately for a particular price movement investigation.

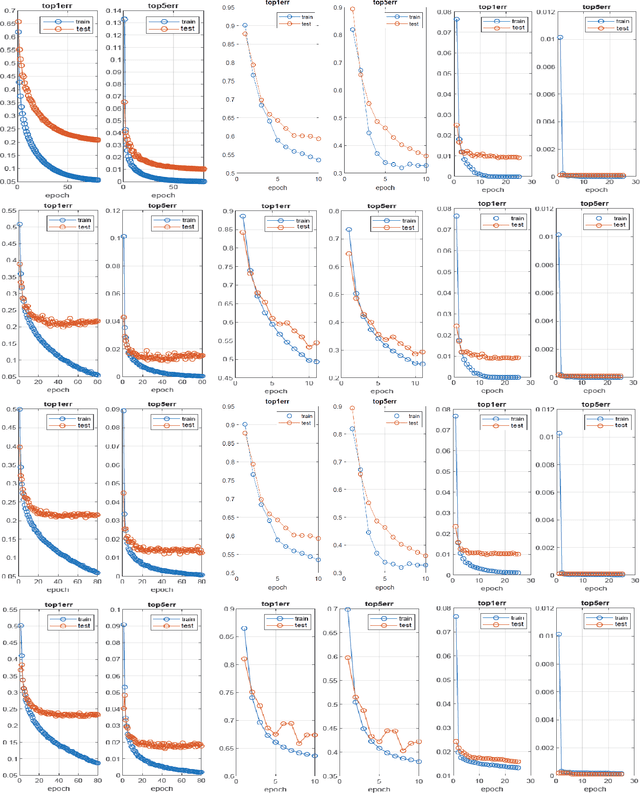

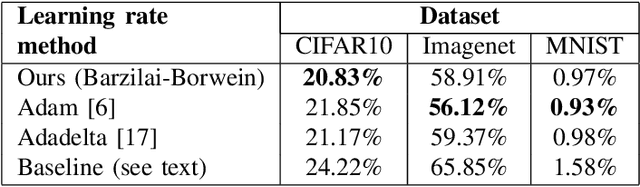

Incorporating the Barzilai-Borwein Adaptive Step Size into Sugradient Methods for Deep Network Training

May 27, 2022

Abstract:In this paper, we incorporate the Barzilai-Borwein step size into gradient descent methods used to train deep networks. This allows us to adapt the learning rate using a two-point approximation to the secant equation which quasi-Newton methods are based upon. Moreover, the adaptive learning rate method presented here is quite general in nature and can be applied to widely used gradient descent approaches such as Adagrad and RMSprop. We evaluate our method using standard example network architectures on widely available datasets and compare against alternatives elsewhere in the literature. In our experiments, our adaptive learning rate shows a smoother and faster convergence than that exhibited by the alternatives, with better or comparable performance.

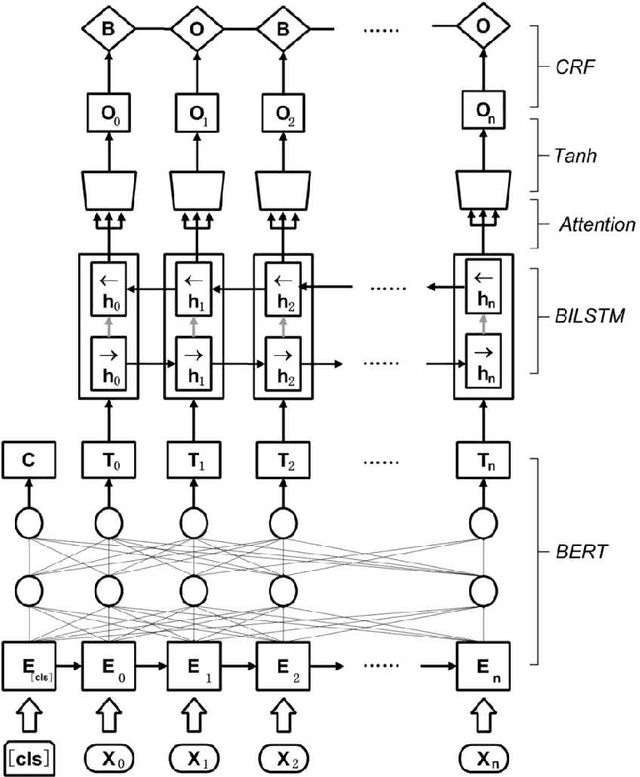

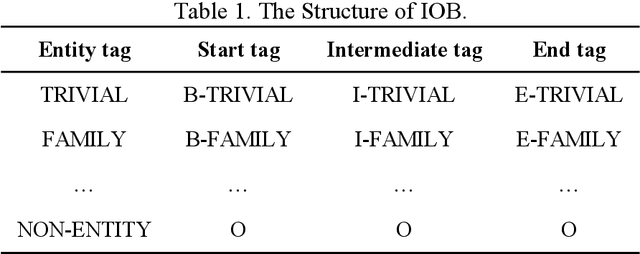

A hybrid deep-learning approach for complex biochemical named entity recognition

Dec 20, 2020

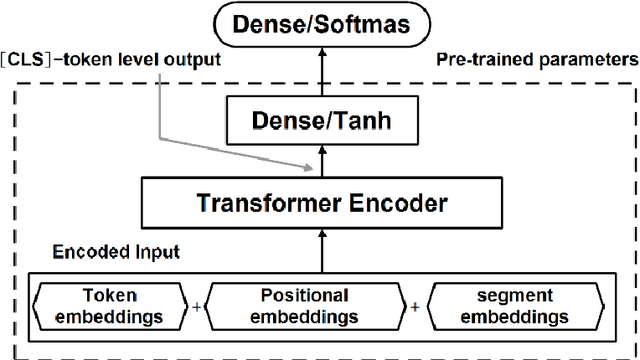

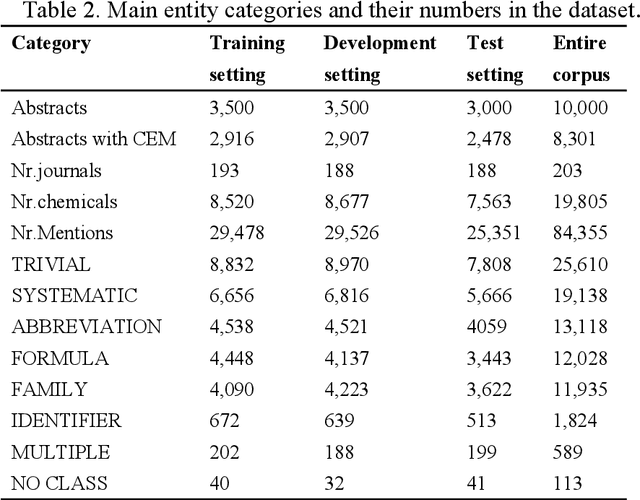

Abstract:Named entity recognition (NER) of chemicals and drugs is a critical domain of information extraction in biochemical research. NER provides support for text mining in biochemical reactions, including entity relation extraction, attribute extraction, and metabolic response relationship extraction. However, the existence of complex naming characteristics in the biomedical field, such as polysemy and special characters, make the NER task very challenging. Here, we propose a hybrid deep learning approach to improve the recognition accuracy of NER. Specifically, our approach applies the Bidirectional Encoder Representations from Transformers (BERT) model to extract the underlying features of the text, learns a representation of the context of the text through Bi-directional Long Short-Term Memory (BILSTM), and incorporates the multi-head attention (MHATT) mechanism to extract chapter-level features. In this approach, the MHATT mechanism aims to improve the recognition accuracy of abbreviations to efficiently deal with the problem of inconsistency in full-text labels. Moreover, conditional random field (CRF) is used to label sequence tags because this probabilistic method does not need strict independence assumptions and can accommodate arbitrary context information. The experimental evaluation on a publicly-available dataset shows that the proposed hybrid approach achieves the best recognition performance; in particular, it substantially improves performance in recognizing abbreviations, polysemes, and low-frequency entities, compared with the state-of-the-art approaches. For instance, compared with the recognition accuracies for low-frequency entities produced by the BILSTM-CRF algorithm, those produced by the hybrid approach on two entity datasets (MULTIPLE and IDENTIFIER) have been increased by 80% and 21.69%, respectively.

LSAR: Efficient Leverage Score Sampling Algorithm for the Analysis of Big Time Series Data

Dec 26, 2019

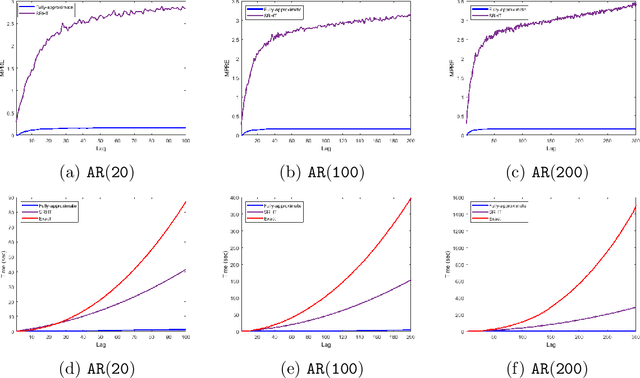

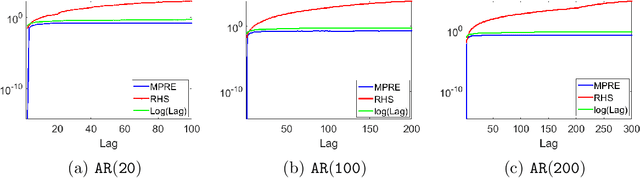

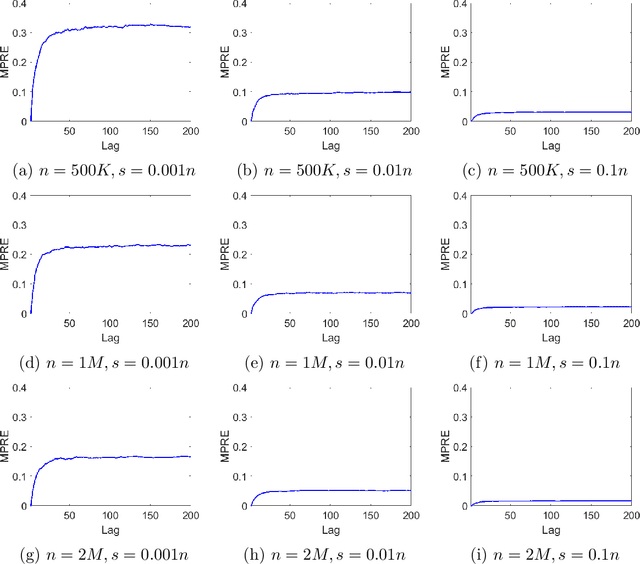

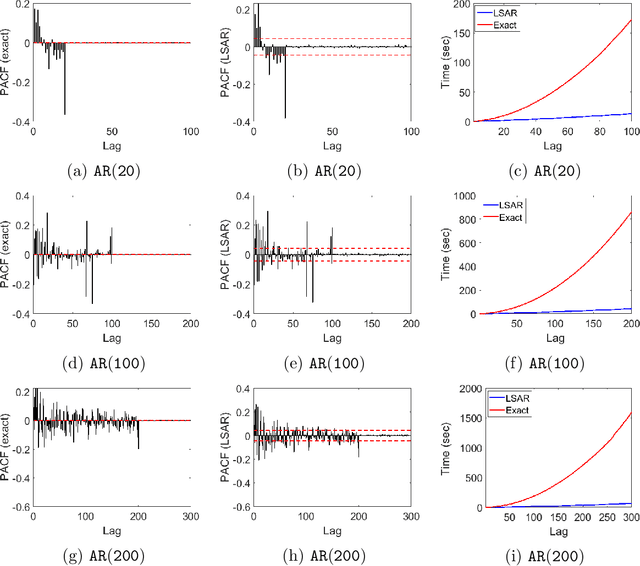

Abstract:We apply methods from randomized numerical linear algebra (RandNLA) to develop improved algorithms for the analysis of large-scale time series data. We first develop a new fast algorithm to estimate the leverage scores of an autoregressive (AR) model in big data regimes. We show that the accuracy of approximations lies within $(1+\mathcal{O}(\varepsilon))$ of the true leverage scores with high probability. These theoretical results are subsequently exploited to develop an efficient algorithm, called LSAR, for fitting an appropriate AR model to big time series data. Our proposed algorithm is guaranteed, with high probability, to find the maximum likelihood estimates of the parameters of the underlying true AR model and has a worst case running time that significantly improves those of the state-of-the-art alternatives in big data regimes. Empirical results on large-scale synthetic as well as real data highly support the theoretical results and reveal the efficacy of this new approach.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge