Mong Shan Ee

A Framework for Empowering Reinforcement Learning Agents with Causal Analysis: Enhancing Automated Cryptocurrency Trading

Oct 14, 2023Abstract:Despite advances in artificial intelligence-enhanced trading methods, developing a profitable automated trading system remains challenging in the rapidly evolving cryptocurrency market. This study aims to address these challenges by developing a reinforcement learning-based automated trading system for five popular altcoins~(cryptocurrencies other than Bitcoin): Binance Coin, Ethereum, Litecoin, Ripple, and Tether. To this end, we present CausalReinforceNet, a framework framed as a decision support system. Designed as the foundational architecture of the trading system, the CausalReinforceNet framework enhances the capabilities of the reinforcement learning agent through causal analysis. Within this framework, we use Bayesian networks in the feature engineering process to identify the most relevant features with causal relationships that influence cryptocurrency price movements. Additionally, we incorporate probabilistic price direction signals from dynamic Bayesian networks to enhance our reinforcement learning agent's decision-making. Due to the high volatility of the cryptocurrency market, we design our framework to adopt a conservative approach that limits sell and buy position sizes to manage risk. We develop two agents using the CausalReinforceNet framework, each based on distinct reinforcement learning algorithms. The results indicate that our framework substantially surpasses the Buy-and-Hold benchmark strategy in profitability. Additionally, both agents generated notable returns on investment for Binance Coin and Ethereum.

Causal Feature Engineering of Price Directions of Cryptocurrencies using Dynamic Bayesian Networks

Jun 13, 2023

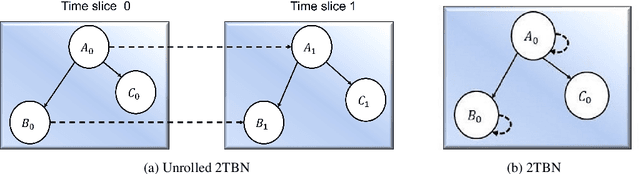

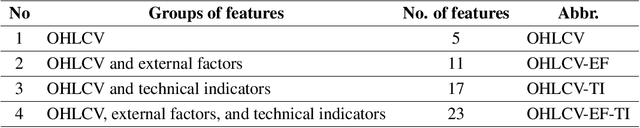

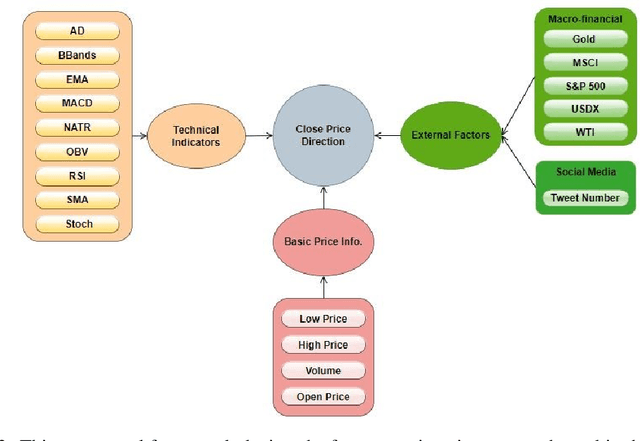

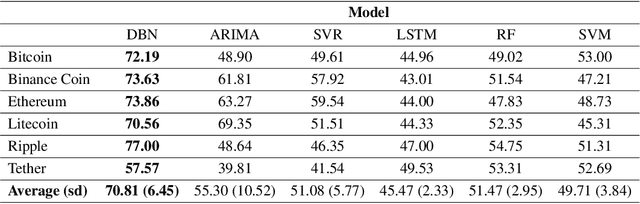

Abstract:Cryptocurrencies have gained popularity across various sectors, especially in finance and investment. The popularity is partly due to their unique specifications originating from blockchain-related characteristics such as privacy, decentralisation, and untraceability. Despite their growing popularity, cryptocurrencies remain a high-risk investment due to their price volatility and uncertainty. The inherent volatility in cryptocurrency prices, coupled with internal cryptocurrency-related factors and external influential global economic factors makes predicting their prices and price movement directions challenging. Nevertheless, the knowledge obtained from predicting the direction of cryptocurrency prices can provide valuable guidance for investors in making informed investment decisions. To address this issue, this paper proposes a dynamic Bayesian network (DBN) approach, which can model complex systems in multivariate settings, to predict the price movement direction of five popular altcoins (cryptocurrencies other than Bitcoin) in the next trading day. The efficacy of the proposed model in predicting cryptocurrency price directions is evaluated from two perspectives. Firstly, our proposed approach is compared to two baseline models, namely an auto-regressive integrated moving average and support vector regression. Secondly, from a feature engineering point of view, the impact of twenty-three different features, grouped into four categories, on the DBN's prediction performance is investigated. The experimental results demonstrate that the DBN significantly outperforms the baseline models. In addition, among the groups of features, technical indicators are found to be the most effective predictors of cryptocurrency price directions.

Modelling Determinants of Cryptocurrency Prices: A Bayesian Network Approach

Mar 26, 2023Abstract:The growth of market capitalisation and the number of altcoins (cryptocurrencies other than Bitcoin) provide investment opportunities and complicate the prediction of their price movements. A significant challenge in this volatile and relatively immature market is the problem of predicting cryptocurrency prices which needs to identify the factors influencing these prices. The focus of this study is to investigate the factors influencing altcoin prices, and these factors have been investigated from a causal analysis perspective using Bayesian networks. In particular, studying the nature of interactions between five leading altcoins, traditional financial assets including gold, oil, and S\&P 500, and social media is the research question. To provide an answer to the question, we create causal networks which are built from the historic price data of five traditional financial assets, social media data, and price data of altcoins. The ensuing networks are used for causal reasoning and diagnosis, and the results indicate that social media (in particular Twitter data in this study) is the most significant influencing factor of the prices of altcoins. Furthermore, it is not possible to generalise the coins' reactions against the changes in the factors. Consequently, the coins need to be studied separately for a particular price movement investigation.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge