Zixi Zhao

Non-destructive Degradation Pattern Decoupling for Ultra-early Battery Prototype Verification Using Physics-informed Machine Learning

Jun 01, 2024

Abstract:Manufacturing complexities and uncertainties have impeded the transition from material prototypes to commercial batteries, making prototype verification critical to quality assessment. A fundamental challenge involves deciphering intertwined chemical processes to characterize degradation patterns and their quantitative relationship with battery performance. Here we show that a physics-informed machine learning approach can quantify and visualize temporally resolved losses concerning thermodynamics and kinetics only using electric signals. Our method enables non-destructive degradation pattern characterization, expediting temperature-adaptable predictions of entire lifetime trajectories, rather than end-of-life points. The verification speed is 25 times faster yet maintaining 95.1% accuracy across temperatures. Such advances facilitate more sustainable management of defective prototypes before massive production, establishing a 19.76 billion USD scrap material recycling market by 2060 in China. By incorporating stepwise charge acceptance as a measure of the initial manufacturing variability of normally identical batteries, we can immediately identify long-term degradation variations. We attribute the predictive power to interpreting machine learning insights using material-agnostic featurization taxonomy for degradation pattern decoupling. Our findings offer new possibilities for dynamic system analysis, such as battery prototype degradation, demonstrating that complex pattern evolutions can be accurately predicted in a non-destructive and data-driven fashion by integrating physics-informed machine learning.

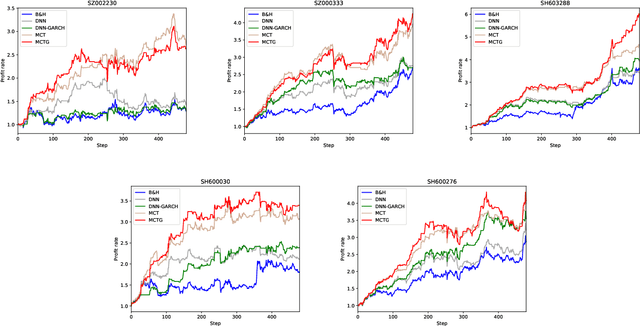

A parallel-network continuous quantitative trading model with GARCH and PPO

May 21, 2021

Abstract:It is a difficult task for both professional investors and individual traders continuously making profit in stock market. With the development of computer science and deep reinforcement learning, Buy\&Hold (B\&H) has been oversteped by many artificial intelligence trading algorithms. However, the information and process are not enough, which limit the performance of reinforcement learning algorithms. Thus, we propose a parallel-network continuous quantitative trading model with GARCH and PPO to enrich the basical deep reinforcement learning model, where the deep learning parallel network layers deal with 3 different frequencies data (including GARCH information) and proximal policy optimization (PPO) algorithm interacts actions and rewards with stock trading environment. Experiments in 5 stocks from Chinese stock market show our method achieves more extra profit comparing with basical reinforcement learning methods and bench models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge