Zijian Shi

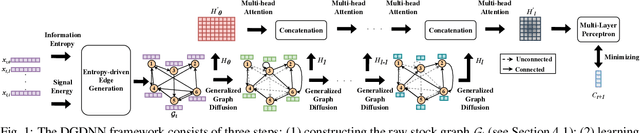

DGDNN: Decoupled Graph Diffusion Neural Network for Stock Movement Prediction

Jan 03, 2024

Abstract:Forecasting future stock trends remains challenging for academia and industry due to stochastic inter-stock dynamics and hierarchical intra-stock dynamics influencing stock prices. In recent years, graph neural networks have achieved remarkable performance in this problem by formulating multiple stocks as graph-structured data. However, most of these approaches rely on artificially defined factors to construct static stock graphs, which fail to capture the intrinsic interdependencies between stocks that rapidly evolve. In addition, these methods often ignore the hierarchical features of the stocks and lose distinctive information within. In this work, we propose a novel graph learning approach implemented without expert knowledge to address these issues. First, our approach automatically constructs dynamic stock graphs by entropy-driven edge generation from a signal processing perspective. Then, we further learn task-optimal dependencies between stocks via a generalized graph diffusion process on constructed stock graphs. Last, a decoupled representation learning scheme is adopted to capture distinctive hierarchical intra-stock features. Experimental results demonstrate substantial improvements over state-of-the-art baselines on real-world datasets. Moreover, the ablation study and sensitivity study further illustrate the effectiveness of the proposed method in modeling the time-evolving inter-stock and intra-stock dynamics.

Neural Stochastic Agent-Based Limit Order Book Simulation: A Hybrid Methodology

Feb 28, 2023Abstract:Modern financial exchanges use an electronic limit order book (LOB) to store bid and ask orders for a specific financial asset. As the most fine-grained information depicting the demand and supply of an asset, LOB data is essential in understanding market dynamics. Therefore, realistic LOB simulations offer a valuable methodology for explaining empirical properties of markets. Mainstream simulation models include agent-based models (ABMs) and stochastic models (SMs). However, ABMs tend not to be grounded on real historical data, while SMs tend not to enable dynamic agent-interaction. To overcome these limitations, we propose a novel hybrid LOB simulation paradigm characterised by: (1) representing the aggregation of market events' logic by a neural stochastic background trader that is pre-trained on historical LOB data through a neural point process model; and (2) embedding the background trader in a multi-agent simulation with other trading agents. We instantiate this hybrid NS-ABM model using the ABIDES platform. We first run the background trader in isolation and show that the simulated LOB can recreate a comprehensive list of stylised facts that demonstrate realistic market behaviour. We then introduce a population of `trend' and `value' trading agents, which interact with the background trader. We show that the stylised facts remain and we demonstrate order flow impact and financial herding behaviours that are in accordance with empirical observations of real markets.

Divergence-degenerated spatial multiplexing towards ultrahigh capacity, low bit-error-rate optical communications

Oct 17, 2021

Abstract:Spatial mode (de)multiplexing of orbital angular momentum (OAM) beams is a promising solution to address future bandwidth issues, but the rapidly increasing divergence with the mode order severely limits the practically addressable number of OAM modes. Here we present a set of multi-vortex geometric beams (MVGBs) as high-dimensional information carriers, by virtue of three independent degrees of freedom (DoFs) including central OAM, sub-beam OAM, and coherent-state phase. The novel modal basis set has high divergence degeneracy, and highly consistent propagation behaviors among all spatial modes, capable of increasing the addressable spatial channels by two orders of magnitude than OAM basis as predicted. We experimentally realize the tri-DoF MVGB mode (de)multiplexing and shift keying encoding/decoding by the conjugated modulation method, demonstrating ultra-low bit error rates (BERs) caused by center offset and coherent background noise. Our work provides a useful basis for next generation of large-scale dense data communication.

The Limit Order Book Recreation Model : An Extended Analysis

Jul 01, 2021

Abstract:The limit order book (LOB) depicts the fine-grained demand and supply relationship for financial assets and is widely used in market microstructure studies. Nevertheless, the availability and high cost of LOB data restrict its wider application. The LOB recreation model (LOBRM) was recently proposed to bridge this gap by synthesizing the LOB from trades and quotes (TAQ) data. However, in the original LOBRM study, there were two limitations: (1) experiments were conducted on a relatively small dataset containing only one day of LOB data; and (2) the training and testing were performed in a non-chronological fashion, which essentially re-frames the task as interpolation and potentially introduces lookahead bias. In this study, we extend the research on LOBRM and further validate its use in real-world application scenarios. We first advance the workflow of LOBRM by (1) adding a time-weighted z-score standardization for the LOB and (2) substituting the ordinary differential equation kernel with an exponential decay kernel to lower computation complexity. Experiments are conducted on the extended LOBSTER dataset in a chronological fashion, as it would be used in a real-world application. We find that (1) LOBRM with decay kernel is superior to traditional non-linear models, and module ensembling is effective; (2) prediction accuracy is negatively related to the volatility of order volumes resting in the LOB; (3) the proposed sparse encoding method for TAQ exhibits good generalization ability and can facilitate manifold tasks; and (4) the influence of stochastic drift on prediction accuracy can be alleviated by increasing historical samples.

The LOB Recreation Model: Predicting the Limit Order Book from TAQ History Using an Ordinary Differential Equation Recurrent Neural Network

Mar 02, 2021

Abstract:In an order-driven financial market, the price of a financial asset is discovered through the interaction of orders - requests to buy or sell at a particular price - that are posted to the public limit order book (LOB). Therefore, LOB data is extremely valuable for modelling market dynamics. However, LOB data is not freely accessible, which poses a challenge to market participants and researchers wishing to exploit this information. Fortunately, trades and quotes (TAQ) data - orders arriving at the top of the LOB, and trades executing in the market - are more readily available. In this paper, we present the LOB recreation model, a first attempt from a deep learning perspective to recreate the top five price levels of the LOB for small-tick stocks using only TAQ data. Volumes of orders sitting deep in the LOB are predicted by combining outputs from: (1) a history compiler that uses a Gated Recurrent Unit (GRU) module to selectively compile prediction relevant quote history; (2) a market events simulator, which uses an Ordinary Differential Equation Recurrent Neural Network (ODE-RNN) to simulate the accumulation of net order arrivals; and (3) a weighting scheme to adaptively combine the predictions generated by (1) and (2). By the paradigm of transfer learning, the source model trained on one stock can be fine-tuned to enable application to other financial assets of the same class with much lower demand on additional data. Comprehensive experiments conducted on two real world intraday LOB datasets demonstrate that the proposed model can efficiently recreate the LOB with high accuracy using only TAQ data as input.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge