Yuxia Zhu

Guided Verifier: Collaborative Multimodal Reasoning via Dynamic Process Supervision

Feb 04, 2026Abstract:Reinforcement Learning (RL) has emerged as a pivotal mechanism for enhancing the complex reasoning capabilities of Multimodal Large Language Models (MLLMs). However, prevailing paradigms typically rely on solitary rollout strategies where the model works alone. This lack of intermediate oversight renders the reasoning process susceptible to error propagation, where early logical deviations cascade into irreversible failures, resulting in noisy optimization signals. In this paper, we propose the \textbf{Guided Verifier} framework to address these structural limitations. Moving beyond passive terminal rewards, we introduce a dynamic verifier that actively co-solves tasks alongside the policy. During the rollout phase, this verifier interacts with the policy model in real-time, detecting inconsistencies and providing directional signals to steer the model toward valid trajectories. To facilitate this, we develop a specialized data synthesis pipeline targeting multimodal hallucinations, constructing \textbf{CoRe} dataset of process-level negatives and \textbf{Co}rrect-guide \textbf{Re}asoning trajectories to train the guided verifier. Extensive experiments on MathVista, MathVerse and MMMU indicate that by allocating compute to collaborative inference and dynamic verification, an 8B-parameter model can achieve strong performance.

FinTSB: A Comprehensive and Practical Benchmark for Financial Time Series Forecasting

Feb 26, 2025

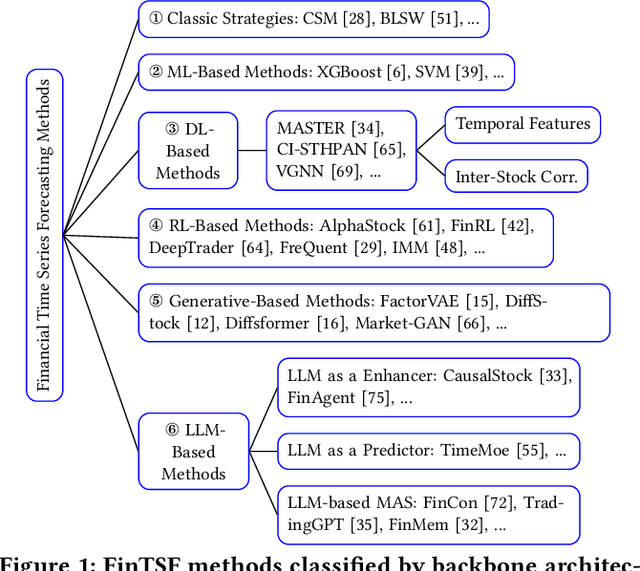

Abstract:Financial time series (FinTS) record the behavior of human-brain-augmented decision-making, capturing valuable historical information that can be leveraged for profitable investment strategies. Not surprisingly, this area has attracted considerable attention from researchers, who have proposed a wide range of methods based on various backbones. However, the evaluation of the area often exhibits three systemic limitations: 1. Failure to account for the full spectrum of stock movement patterns observed in dynamic financial markets. (Diversity Gap), 2. The absence of unified assessment protocols undermines the validity of cross-study performance comparisons. (Standardization Deficit), and 3. Neglect of critical market structure factors, resulting in inflated performance metrics that lack practical applicability. (Real-World Mismatch). Addressing these limitations, we propose FinTSB, a comprehensive and practical benchmark for financial time series forecasting (FinTSF). To increase the variety, we categorize movement patterns into four specific parts, tokenize and pre-process the data, and assess the data quality based on some sequence characteristics. To eliminate biases due to different evaluation settings, we standardize the metrics across three dimensions and build a user-friendly, lightweight pipeline incorporating methods from various backbones. To accurately simulate real-world trading scenarios and facilitate practical implementation, we extensively model various regulatory constraints, including transaction fees, among others. Finally, we conduct extensive experiments on FinTSB, highlighting key insights to guide model selection under varying market conditions. Overall, FinTSB provides researchers with a novel and comprehensive platform for improving and evaluating FinTSF methods. The code is available at https://github.com/TongjiFinLab/FinTSBenchmark.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge