Xihan Xiong

SoK: Decentralized AI (DeAI)

Nov 26, 2024Abstract:The centralization of Artificial Intelligence (AI) poses significant challenges, including single points of failure, inherent biases, data privacy concerns, and scalability issues. These problems are especially prevalent in closed-source large language models (LLMs), where user data is collected and used without transparency. To mitigate these issues, blockchain-based decentralized AI (DeAI) has emerged as a promising solution. DeAI combines the strengths of both blockchain and AI technologies to enhance the transparency, security, decentralization, and trustworthiness of AI systems. However, a comprehensive understanding of state-of-the-art DeAI development, particularly for active industry solutions, is still lacking. In this work, we present a Systematization of Knowledge (SoK) for blockchain-based DeAI solutions. We propose a taxonomy to classify existing DeAI protocols based on the model lifecycle. Based on this taxonomy, we provide a structured way to clarify the landscape of DeAI protocols and identify their similarities and differences. We analyze the functionalities of blockchain in DeAI, investigating how blockchain features contribute to enhancing the security, transparency, and trustworthiness of AI processes, while also ensuring fair incentives for AI data and model contributors. In addition, we identify key insights and research gaps in developing DeAI protocols, highlighting several critical avenues for future research.

Decoding SEC Actions: Enforcement Trends through Analyzing Blockchain litigation using LLM-based Thematic Factor Mapping

Aug 21, 2024

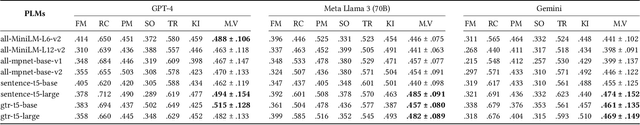

Abstract:The proliferation of blockchain entities (persons or enterprises) exposes them to potential regulatory actions (e.g., being litigated) by regulatory authorities. Regulatory frameworks for crypto assets are actively being developed and refined, increasing the likelihood of such actions. The lack of systematic analysis of the factors driving litigation against blockchain entities leaves companies in need of clarity to navigate compliance risks. This absence of insight also deprives investors of the information for informed decision-making. This study focuses on U.S. litigation against blockchain entities, particularly by the U.S. Securities and Exchange Commission (SEC) given its influence on global crypto regulation. Utilizing frontier pretrained language models and large language models, we systematically map all SEC complaints against blockchain companies from 2012 to 2024 to thematic factors conceptualized by our study to delineate the factors driving SEC actions. We quantify the thematic factors and assess their influence on specific legal Acts cited within the complaints on an annual basis, allowing us to discern the regulatory emphasis, patterns and conduct trend analysis.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge