Decoding SEC Actions: Enforcement Trends through Analyzing Blockchain litigation using LLM-based Thematic Factor Mapping

Paper and Code

Aug 21, 2024

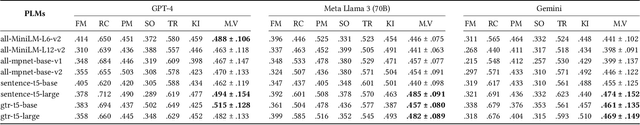

The proliferation of blockchain entities (persons or enterprises) exposes them to potential regulatory actions (e.g., being litigated) by regulatory authorities. Regulatory frameworks for crypto assets are actively being developed and refined, increasing the likelihood of such actions. The lack of systematic analysis of the factors driving litigation against blockchain entities leaves companies in need of clarity to navigate compliance risks. This absence of insight also deprives investors of the information for informed decision-making. This study focuses on U.S. litigation against blockchain entities, particularly by the U.S. Securities and Exchange Commission (SEC) given its influence on global crypto regulation. Utilizing frontier pretrained language models and large language models, we systematically map all SEC complaints against blockchain companies from 2012 to 2024 to thematic factors conceptualized by our study to delineate the factors driving SEC actions. We quantify the thematic factors and assess their influence on specific legal Acts cited within the complaints on an annual basis, allowing us to discern the regulatory emphasis, patterns and conduct trend analysis.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge