Shangkun Wang

Asset Bundling for Wind Power Forecasting

Sep 28, 2023

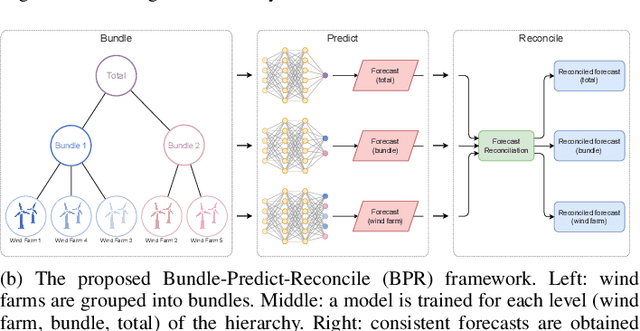

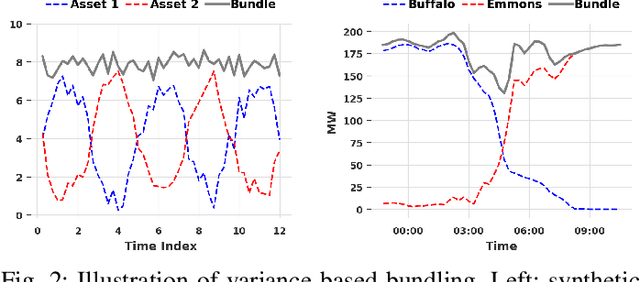

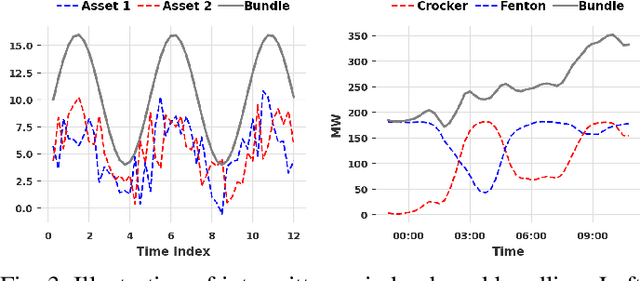

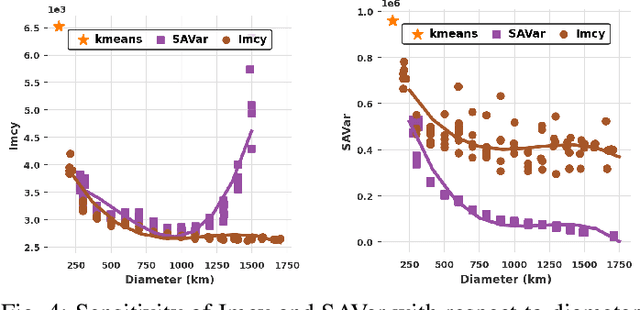

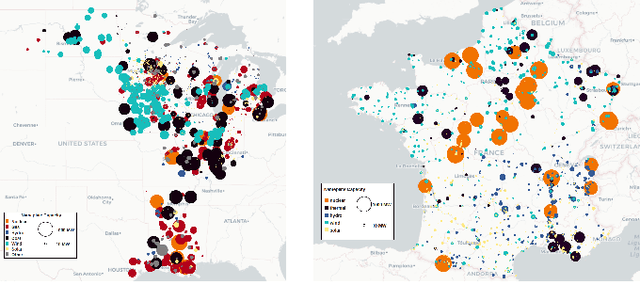

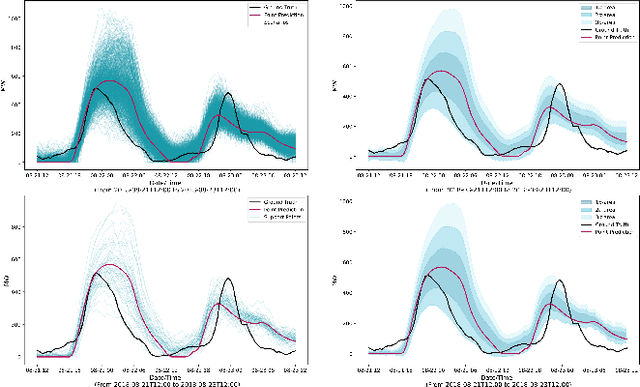

Abstract:The growing penetration of intermittent, renewable generation in US power grids, especially wind and solar generation, results in increased operational uncertainty. In that context, accurate forecasts are critical, especially for wind generation, which exhibits large variability and is historically harder to predict. To overcome this challenge, this work proposes a novel Bundle-Predict-Reconcile (BPR) framework that integrates asset bundling, machine learning, and forecast reconciliation techniques. The BPR framework first learns an intermediate hierarchy level (the bundles), then predicts wind power at the asset, bundle, and fleet level, and finally reconciles all forecasts to ensure consistency. This approach effectively introduces an auxiliary learning task (predicting the bundle-level time series) to help the main learning tasks. The paper also introduces new asset-bundling criteria that capture the spatio-temporal dynamics of wind power time series. Extensive numerical experiments are conducted on an industry-size dataset of 283 wind farms in the MISO footprint. The experiments consider short-term and day-ahead forecasts, and evaluates a large variety of forecasting models that include weather predictions as covariates. The results demonstrate the benefits of BPR, which consistently and significantly improves forecast accuracy over baselines, especially at the fleet level.

Risk-Aware Control and Optimization for High-Renewable Power Grids

Apr 02, 2022

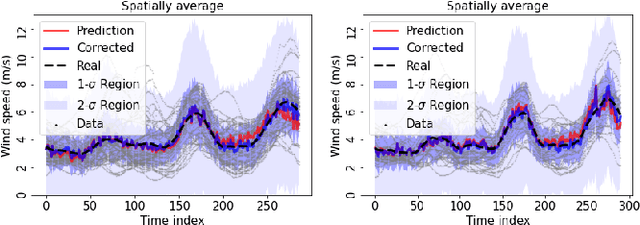

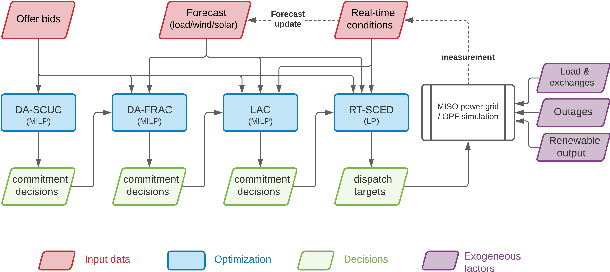

Abstract:The transition of the electrical power grid from fossil fuels to renewable sources of energy raises fundamental challenges to the market-clearing algorithms that drive its operations. Indeed, the increased stochasticity in load and the volatility of renewable energy sources have led to significant increases in prediction errors, affecting the reliability and efficiency of existing deterministic optimization models. The RAMC project was initiated to investigate how to move from this deterministic setting into a risk-aware framework where uncertainty is quantified explicitly and incorporated in the market-clearing optimizations. Risk-aware market-clearing raises challenges on its own, primarily from a computational standpoint. This paper reviews how RAMC approaches risk-aware market clearing and presents some of its innovations in uncertainty quantification, optimization, and machine learning. Experimental results on real networks are presented.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge