Nikhil Devanur

Blink: Fast and Generic Collectives for Distributed ML

Oct 11, 2019

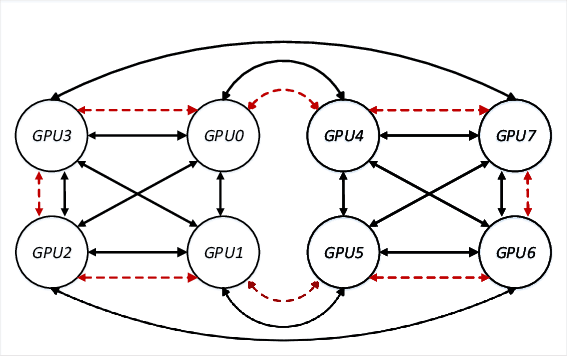

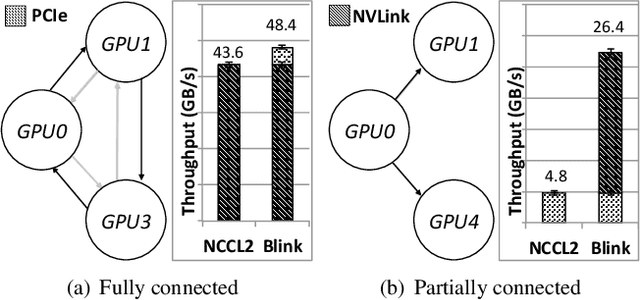

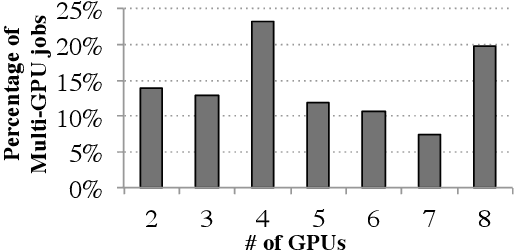

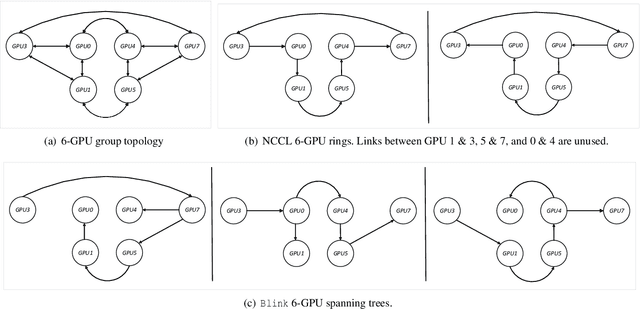

Abstract:Model parameter synchronization across GPUs introduces high overheads for data-parallel training at scale. Existing parameter synchronization protocols cannot effectively leverage available network resources in the face of ever increasing hardware heterogeneity. To address this, we propose Blink, a collective communication library that dynamically generates optimal communication primitives by packing spanning trees. We propose techniques to minimize the number of trees generated and extend Blink to leverage heterogeneous communication channels for faster data transfers. Evaluations show that compared to the state-of-the-art (NCCL), Blink can achieve up to 8x faster model synchronization, and reduce end-to-end training time for image classification tasks by up to 40%.

Truth and Regret in Online Scheduling

Mar 01, 2017

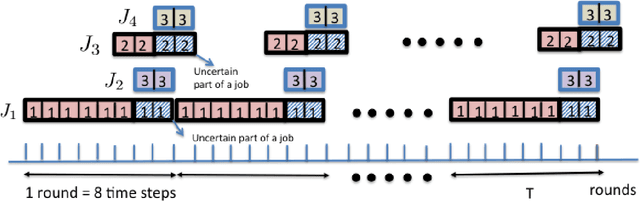

Abstract:We consider a scheduling problem where a cloud service provider has multiple units of a resource available over time. Selfish clients submit jobs, each with an arrival time, deadline, length, and value. The service provider's goal is to implement a truthful online mechanism for scheduling jobs so as to maximize the social welfare of the schedule. Recent work shows that under a stochastic assumption on job arrivals, there is a single-parameter family of mechanisms that achieves near-optimal social welfare. We show that given any such family of near-optimal online mechanisms, there exists an online mechanism that in the worst case performs nearly as well as the best of the given mechanisms. Our mechanism is truthful whenever the mechanisms in the given family are truthful and prompt, and achieves optimal (within constant factors) regret. We model the problem of competing against a family of online scheduling mechanisms as one of learning from expert advice. A primary challenge is that any scheduling decisions we make affect not only the payoff at the current step, but also the resource availability and payoffs in future steps. Furthermore, switching from one algorithm (a.k.a. expert) to another in an online fashion is challenging both because it requires synchronization with the state of the latter algorithm as well as because it affects the incentive structure of the algorithms. We further show how to adapt our algorithm to a non-clairvoyant setting where job lengths are unknown until jobs are run to completion. Once again, in this setting, we obtain truthfulness along with asymptotically optimal regret (within poly-logarithmic factors).

Budget Constraints in Prediction Markets

Oct 07, 2015

Abstract:We give a detailed characterization of optimal trades under budget constraints in a prediction market with a cost-function-based automated market maker. We study how the budget constraints of individual traders affect their ability to impact the market price. As a concrete application of our characterization, we give sufficient conditions for a property we call budget additivity: two traders with budgets B and B' and the same beliefs would have a combined impact equal to a single trader with budget B+B'. That way, even if a single trader cannot move the market much, a crowd of like-minded traders can have the same desired effect. When the set of payoff vectors associated with outcomes, with coordinates corresponding to securities, is affinely independent, we obtain that a generalization of the heavily-used logarithmic market scoring rule is budget additive, but the quadratic market scoring rule is not. Our results may be used both descriptively, to understand if a particular market maker is affected by budget constraints or not, and prescriptively, as a recipe to construct markets.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge