Nanbo Peng

Memory-Gated Recurrent Networks

Dec 30, 2020

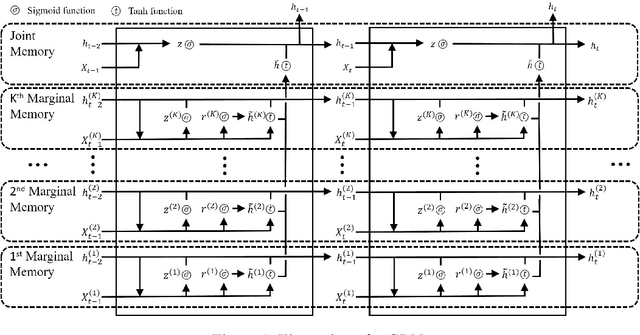

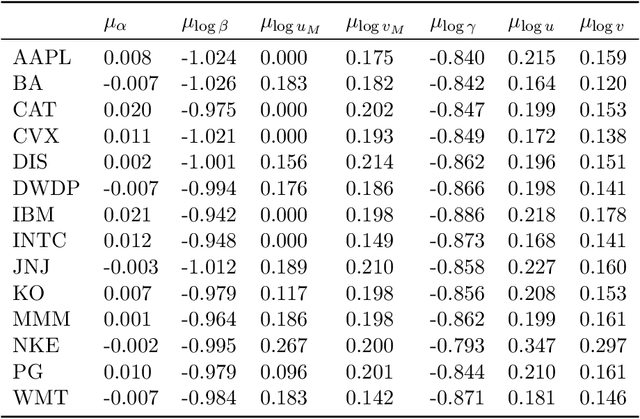

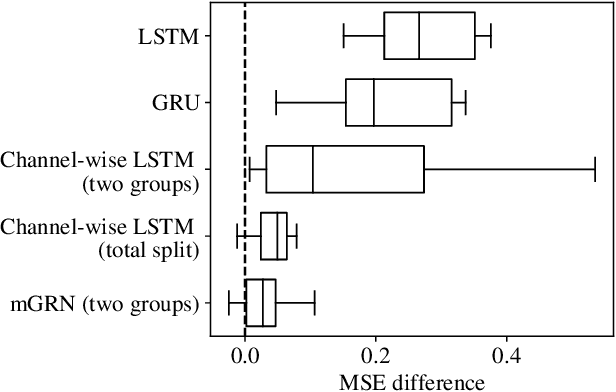

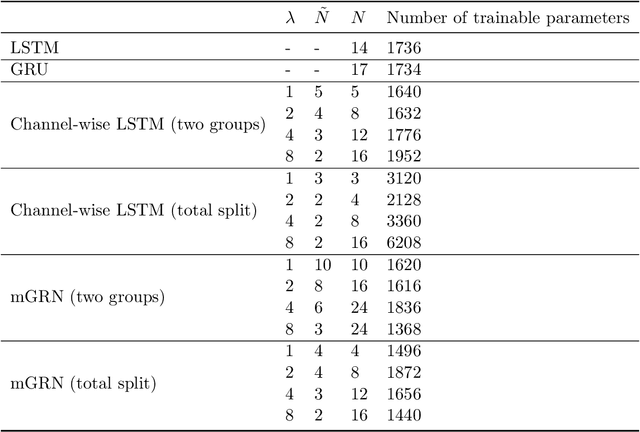

Abstract:The essence of multivariate sequential learning is all about how to extract dependencies in data. These data sets, such as hourly medical records in intensive care units and multi-frequency phonetic time series, often time exhibit not only strong serial dependencies in the individual components (the "marginal" memory) but also non-negligible memories in the cross-sectional dependencies (the "joint" memory). Because of the multivariate complexity in the evolution of the joint distribution that underlies the data generating process, we take a data-driven approach and construct a novel recurrent network architecture, termed Memory-Gated Recurrent Networks (mGRN), with gates explicitly regulating two distinct types of memories: the marginal memory and the joint memory. Through a combination of comprehensive simulation studies and empirical experiments on a range of public datasets, we show that our proposed mGRN architecture consistently outperforms state-of-the-art architectures targeting multivariate time series.

The Causal Learning of Retail Delinquency

Dec 17, 2020

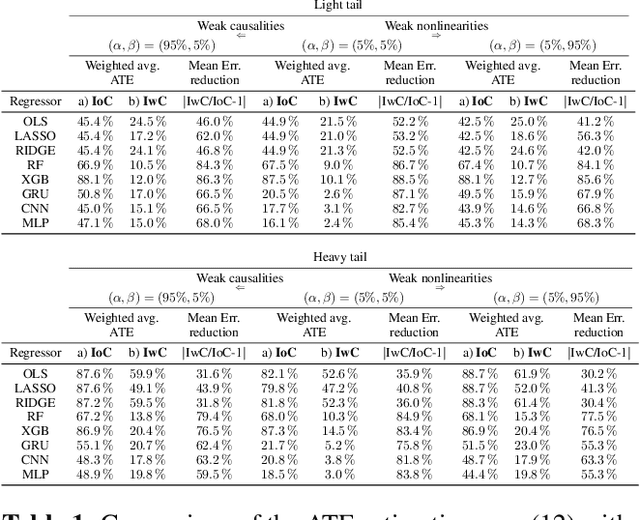

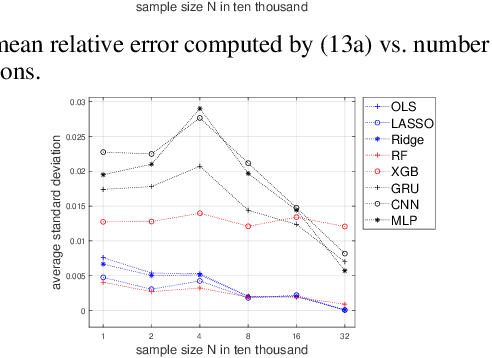

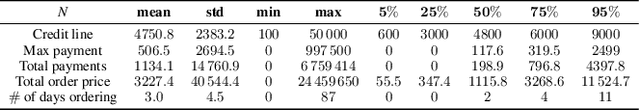

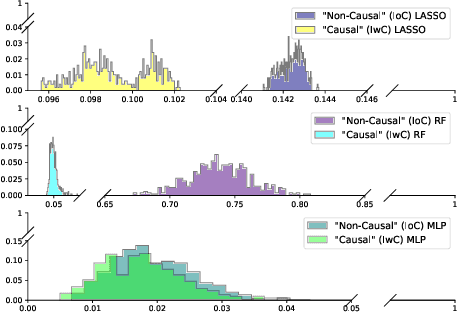

Abstract:This paper focuses on the expected difference in borrower's repayment when there is a change in the lender's credit decisions. Classical estimators overlook the confounding effects and hence the estimation error can be magnificent. As such, we propose another approach to construct the estimators such that the error can be greatly reduced. The proposed estimators are shown to be unbiased, consistent, and robust through a combination of theoretical analysis and numerical testing. Moreover, we compare the power of estimating the causal quantities between the classical estimators and the proposed estimators. The comparison is tested across a wide range of models, including linear regression models, tree-based models, and neural network-based models, under different simulated datasets that exhibit different levels of causality, different degrees of nonlinearity, and different distributional properties. Most importantly, we apply our approaches to a large observational dataset provided by a global technology firm that operates in both the e-commerce and the lending business. We find that the relative reduction of estimation error is strikingly substantial if the causal effects are accounted for correctly.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge