Michail Basios

Evolving Excellence: Automated Optimization of LLM-based Agents

Dec 09, 2025Abstract:Agentic AI systems built on large language models (LLMs) offer significant potential for automating complex workflows, from software development to customer support. However, LLM agents often underperform due to suboptimal configurations; poorly tuned prompts, tool descriptions, and parameters that typically require weeks of manual refinement. Existing optimization methods either are too complex for general use or treat components in isolation, missing critical interdependencies. We present ARTEMIS, a no-code evolutionary optimization platform that jointly optimizes agent configurations through semantically-aware genetic operators. Given only a benchmark script and natural language goals, ARTEMIS automatically discovers configurable components, extracts performance signals from execution logs, and evolves configurations without requiring architectural modifications. We evaluate ARTEMIS on four representative agent systems: the \emph{ALE Agent} for competitive programming on AtCoder Heuristic Contest, achieving a \textbf{$13.6\%$ improvement} in acceptance rate; the \emph{Mini-SWE Agent} for code optimization on SWE-Perf, with a statistically significant \textbf{10.1\% performance gain}; and the \emph{CrewAI Agent} for cost and mathematical reasoning on Math Odyssey, achieving a statistically significant \textbf{$36.9\%$ reduction} in the number of tokens required for evaluation. We also evaluate the \emph{MathTales-Teacher Agent} powered by a smaller open-source model (Qwen2.5-7B) on GSM8K primary-level mathematics problems, achieving a \textbf{22\% accuracy improvement} and demonstrating that ARTEMIS can optimize agents based on both commercial and local models.

evoML Yellow Paper: Evolutionary AI and Optimisation Studio

Dec 20, 2022

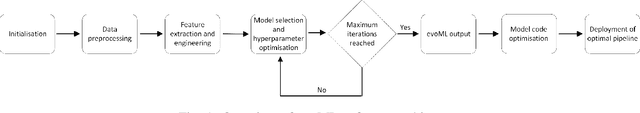

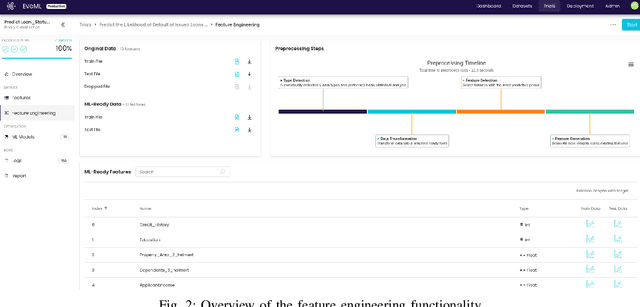

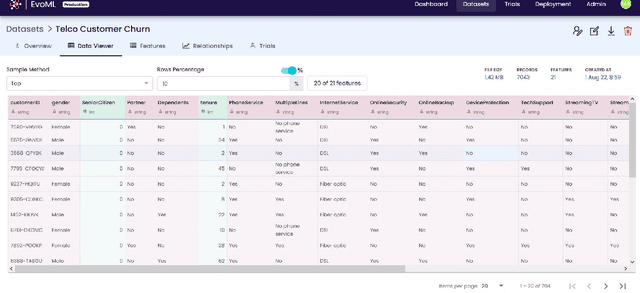

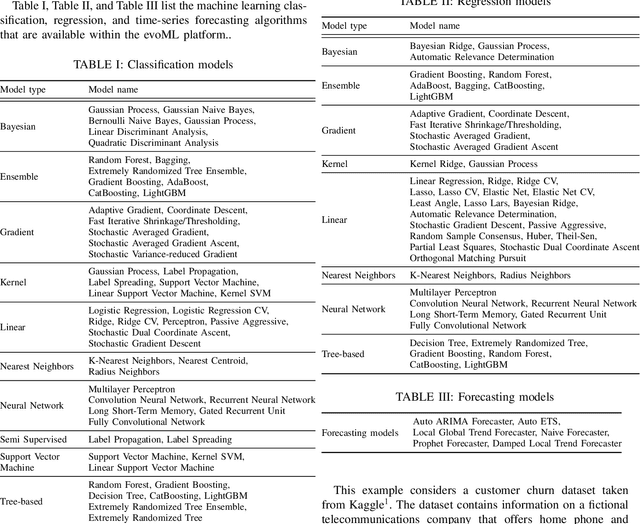

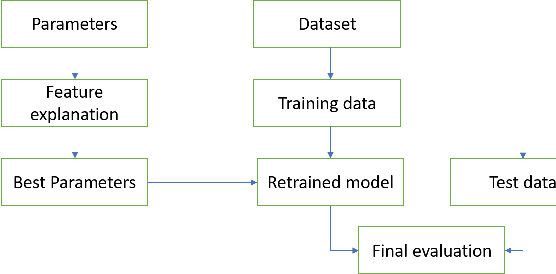

Abstract:Machine learning model development and optimisation can be a rather cumbersome and resource-intensive process. Custom models are often more difficult to build and deploy, and they require infrastructure and expertise which are often costly to acquire and maintain. Machine learning product development lifecycle must take into account the need to navigate the difficulties of developing and deploying machine learning models. evoML is an AI-powered tool that provides automated functionalities in machine learning model development, optimisation, and model code optimisation. Core functionalities of evoML include data cleaning, exploratory analysis, feature analysis and generation, model optimisation, model evaluation, model code optimisation, and model deployment. Additionally, a key feature of evoML is that it embeds code and model optimisation into the model development process, and includes multi-objective optimisation capabilities.

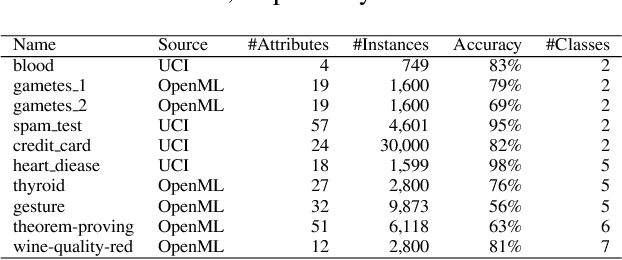

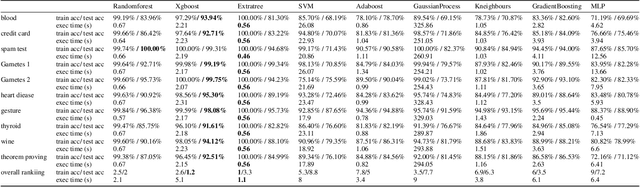

Better Model Selection with a new Definition of Feature Importance

Sep 16, 2020

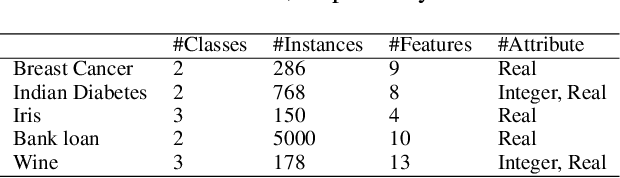

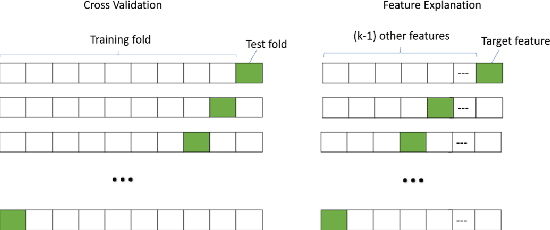

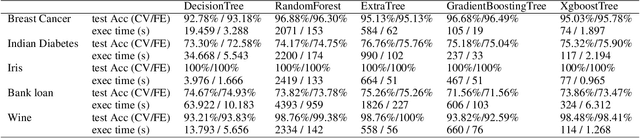

Abstract:Feature importance aims at measuring how crucial each input feature is for model prediction. It is widely used in feature engineering, model selection and explainable artificial intelligence (XAI). In this paper, we propose a new tree-model explanation approach for model selection. Our novel concept leverages the Coefficient of Variation of a feature weight (measured in terms of the contribution of the feature to the prediction) to capture the dispersion of importance over samples. Extensive experimental results show that our novel feature explanation performs better than general cross validation method in model selection both in terms of time efficiency and accuracy performance.

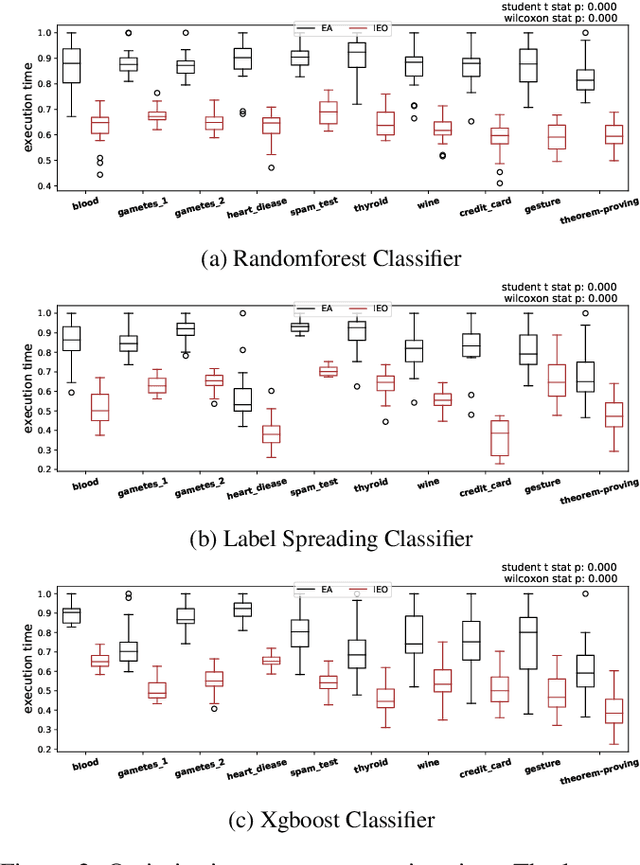

IEO: Intelligent Evolutionary Optimisation for Hyperparameter Tuning

Sep 10, 2020

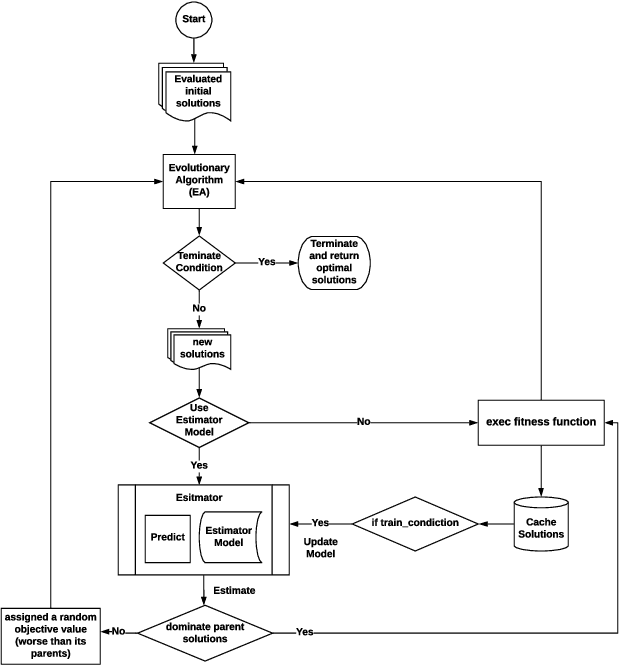

Abstract:Hyperparameter optimisation is a crucial process in searching the optimal machine learning model. The efficiency of finding the optimal hyperparameter settings has been a big concern in recent researches since the optimisation process could be time-consuming, especially when the objective functions are highly expensive to evaluate. In this paper, we introduce an intelligent evolutionary optimisation algorithm which applies machine learning technique to the traditional evolutionary algorithm to accelerate the overall optimisation process of tuning machine learning models in classification problems. We demonstrate our Intelligent Evolutionary Optimisation (IEO)in a series of controlled experiments, comparing with traditional evolutionary optimisation in hyperparameter tuning. The empirical study shows that our approach accelerates the optimisation speed by 30.40% on average and up to 77.06% in the best scenarios.

Genetic Improvement @ ICSE 2020

Jul 31, 2020

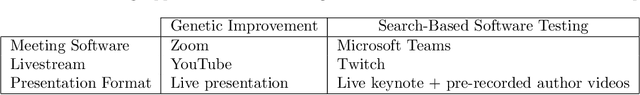

Abstract:Following Prof. Mark Harman of Facebook's keynote and formal presentations (which are recorded in the proceedings) there was a wide ranging discussion at the eighth international Genetic Improvement workshop, GI-2020 @ ICSE (held as part of the 42nd ACM/IEEE International Conference on Software Engineering on Friday 3rd July 2020). Topics included industry take up, human factors, explainabiloity (explainability, justifyability, exploitability) and GI benchmarks. We also contrast various recent online approaches (e.g. SBST 2020) to holding virtual computer science conferences and workshops via the WWW on the Internet without face-2-face interaction. Finally we speculate on how the Coronavirus Covid-19 Pandemic will affect research next year and into the future.

Ascertaining price formation in cryptocurrency markets with DeepLearning

Feb 09, 2020

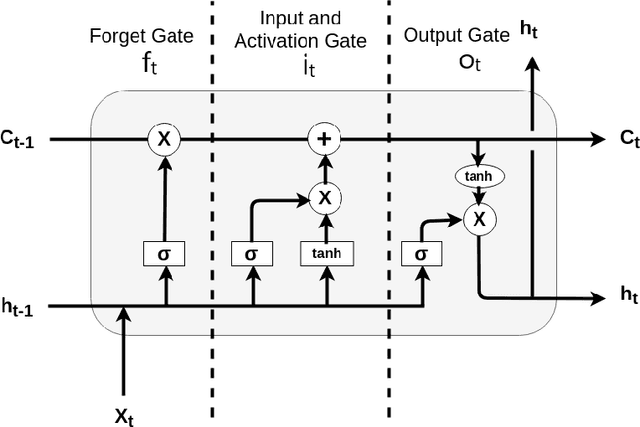

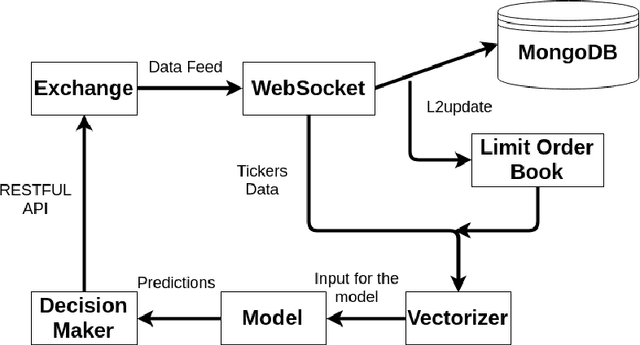

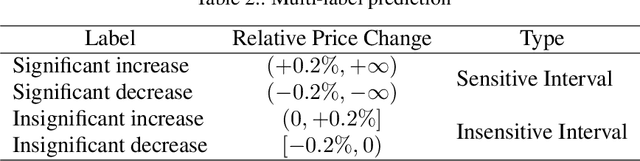

Abstract:The cryptocurrency market is amongst the fastest-growing of all the financial markets in the world. Unlike traditional markets, such as equities, foreign exchange and commodities, cryptocurrency market is considered to have larger volatility and illiquidity. This paper is inspired by the recent success of using deep learning for stock market prediction. In this work, we analyze and present the characteristics of the cryptocurrency market in a high-frequency setting. In particular, we applied a deep learning approach to predict the direction of the mid-price changes on the upcoming tick. We monitored live tick-level data from $8$ cryptocurrency pairs and applied both statistical and machine learning techniques to provide a live prediction. We reveal that promising results are possible for cryptocurrencies, and in particular, we achieve a consistent $78\%$ accuracy on the prediction of the mid-price movement on live exchange rate of Bitcoins vs US dollars.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge