Kshama Dwarakanath

LLM-driven Imitation of Subrational Behavior : Illusion or Reality?

Feb 13, 2024

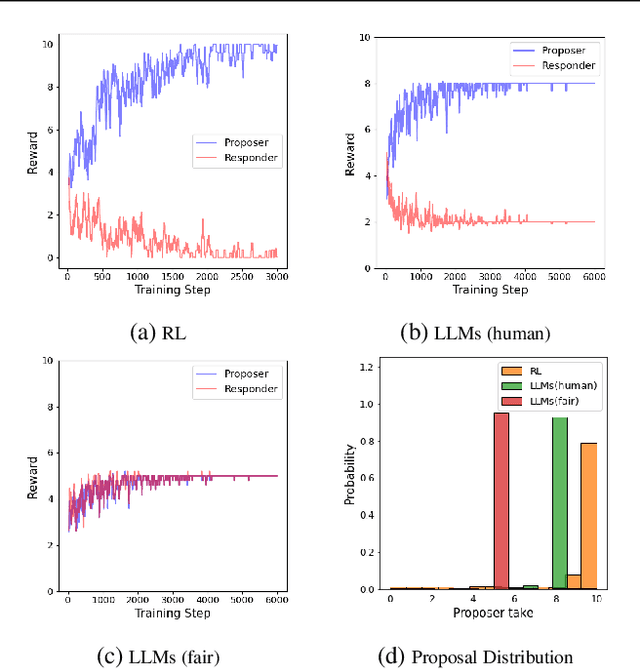

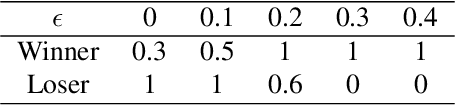

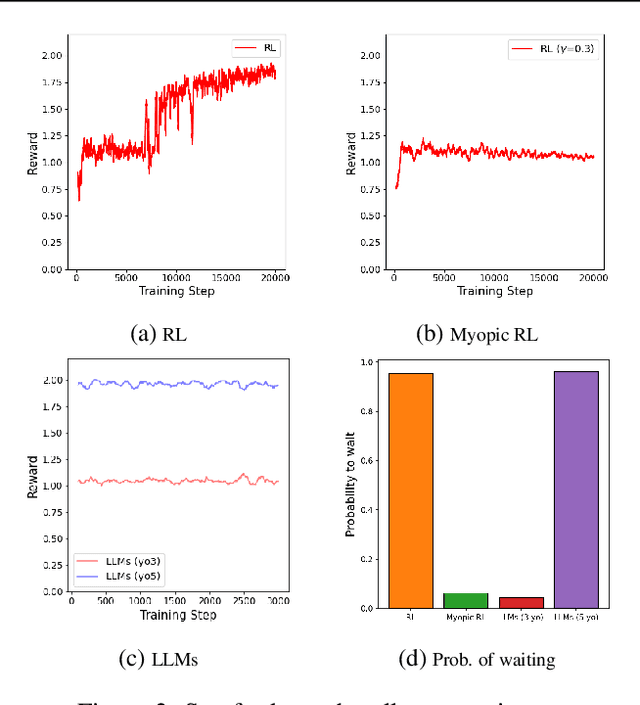

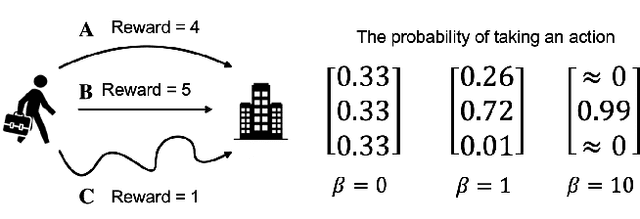

Abstract:Modeling subrational agents, such as humans or economic households, is inherently challenging due to the difficulty in calibrating reinforcement learning models or collecting data that involves human subjects. Existing work highlights the ability of Large Language Models (LLMs) to address complex reasoning tasks and mimic human communication, while simulation using LLMs as agents shows emergent social behaviors, potentially improving our comprehension of human conduct. In this paper, we propose to investigate the use of LLMs to generate synthetic human demonstrations, which are then used to learn subrational agent policies though Imitation Learning. We make an assumption that LLMs can be used as implicit computational models of humans, and propose a framework to use synthetic demonstrations derived from LLMs to model subrational behaviors that are characteristic of humans (e.g., myopic behavior or preference for risk aversion). We experimentally evaluate the ability of our framework to model sub-rationality through four simple scenarios, including the well-researched ultimatum game and marshmallow experiment. To gain confidence in our framework, we are able to replicate well-established findings from prior human studies associated with the above scenarios. We conclude by discussing the potential benefits, challenges and limitations of our framework.

Biased or Limited: Modeling Sub-Rational Human Investors in Financial Markets

Oct 16, 2022

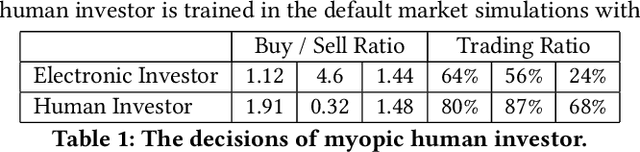

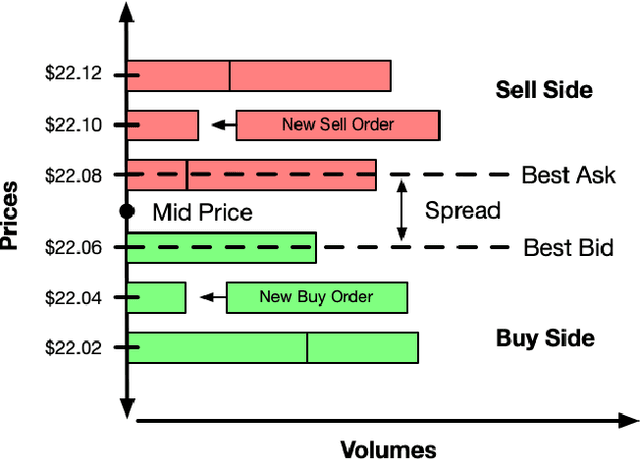

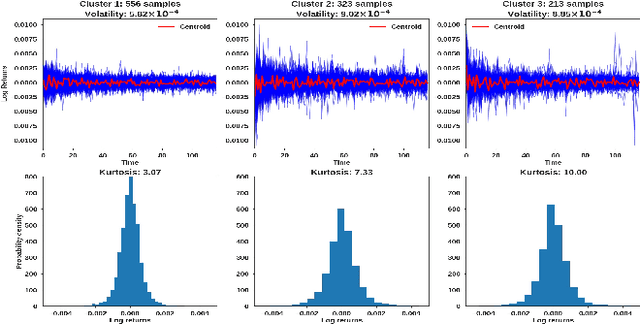

Abstract:Multi-agent market simulation is an effective tool to investigate the impact of various trading strategies in financial markets. One way of designing a trading agent in simulated markets is through reinforcement learning where the agent is trained to optimize its cumulative rewards (e.g., maximizing profits, minimizing risk, improving equitability). While the agent learns a rational policy that optimizes the reward function, in reality, human investors are sub-rational with their decisions often differing from the optimal. In this work, we model human sub-rationality as resulting from two possible causes: psychological bias and computational limitation. We first examine the relationship between investor profits and their degree of sub-rationality, and create hand-crafted market scenarios to intuitively explain the sub-rational human behaviors. Through experiments, we show that our models successfully capture human sub-rationality as observed in the behavioral finance literature. We also examine the impact of sub-rational human investors on market observables such as traded volumes, spread and volatility. We believe our work will benefit research in behavioral finance and provide a better understanding of human trading behavior.

Optimal Stopping with Gaussian Processes

Oct 07, 2022

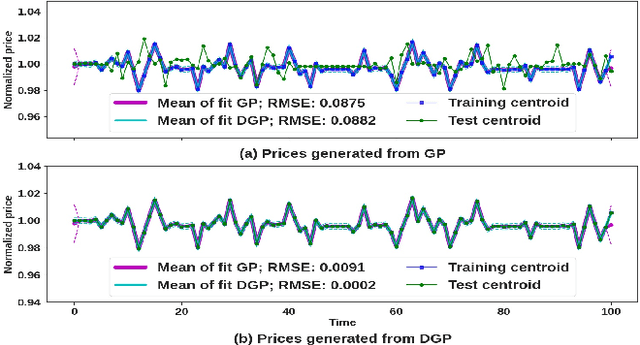

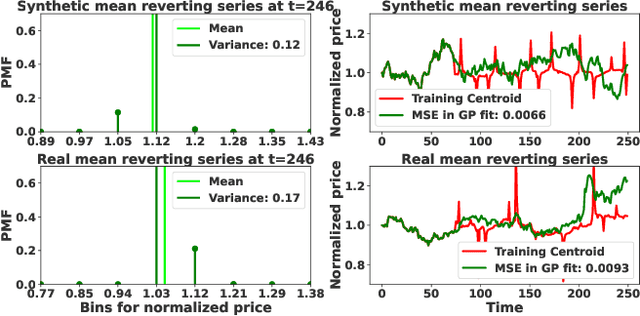

Abstract:We propose a novel group of Gaussian Process based algorithms for fast approximate optimal stopping of time series with specific applications to financial markets. We show that structural properties commonly exhibited by financial time series (e.g., the tendency to mean-revert) allow the use of Gaussian and Deep Gaussian Process models that further enable us to analytically evaluate optimal stopping value functions and policies. We additionally quantify uncertainty in the value function by propagating the price model through the optimal stopping analysis. We compare and contrast our proposed methods against a sampling-based method, as well as a deep learning based benchmark that is currently considered the state-of-the-art in the literature. We show that our family of algorithms outperforms benchmarks on three historical time series datasets that include intra-day and end-of-day equity stock prices as well as the daily US treasury yield curve rates.

Equitable Marketplace Mechanism Design

Sep 22, 2022

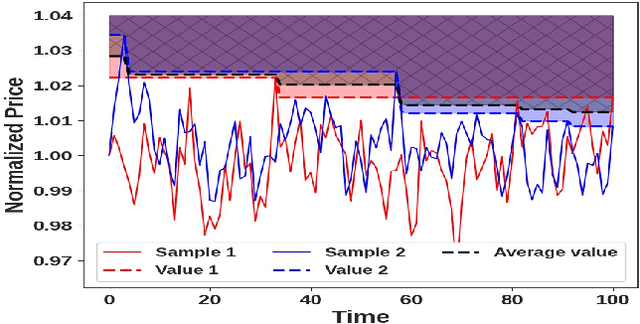

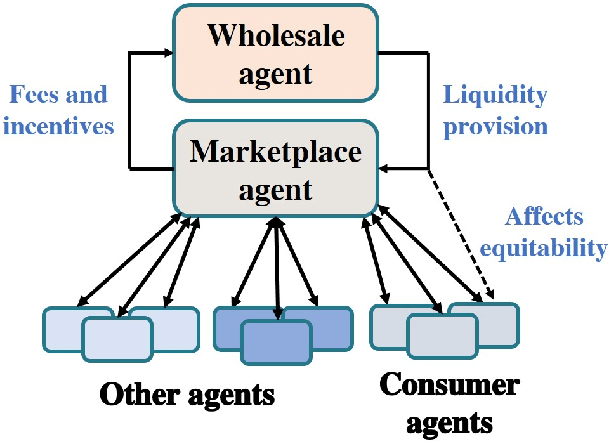

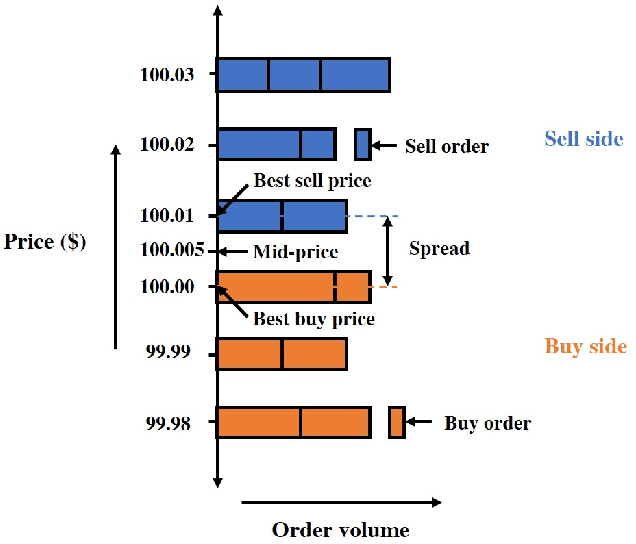

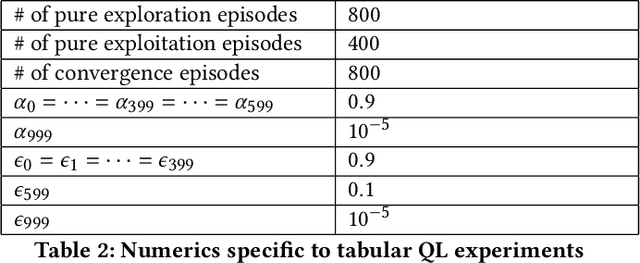

Abstract:We consider a trading marketplace that is populated by traders with diverse trading strategies and objectives. The marketplace allows the suppliers to list their goods and facilitates matching between buyers and sellers. In return, such a marketplace typically charges fees for facilitating trade. The goal of this work is to design a dynamic fee schedule for the marketplace that is equitable and profitable to all traders while being profitable to the marketplace at the same time (from charging fees). Since the traders adapt their strategies to the fee schedule, we present a reinforcement learning framework for simultaneously learning a marketplace fee schedule and trading strategies that adapt to this fee schedule using a weighted optimization objective of profits and equitability. We illustrate the use of the proposed approach in detail on a simulated stock exchange with different types of investors, specifically market makers and consumer investors. As we vary the equitability weights across different investor classes, we see that the learnt exchange fee schedule starts favoring the class of investors with the highest weight. We further discuss the observed insights from the simulated stock exchange in light of the general framework of equitable marketplace mechanism design.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge