Biased or Limited: Modeling Sub-Rational Human Investors in Financial Markets

Paper and Code

Oct 16, 2022

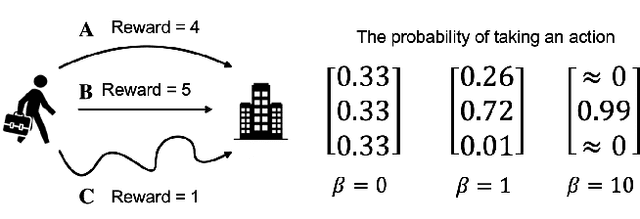

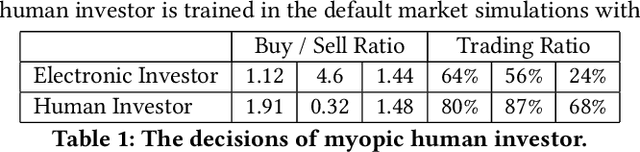

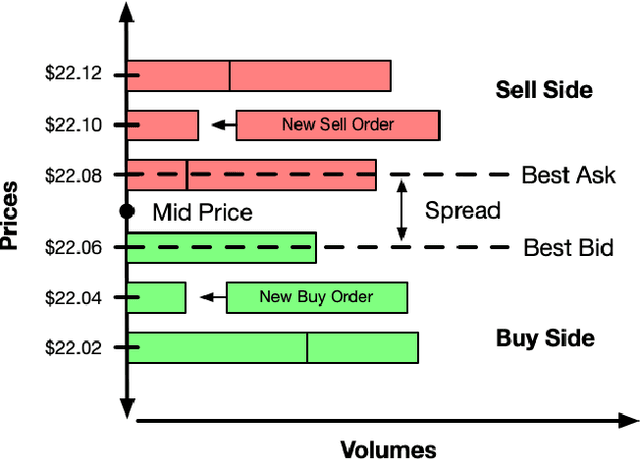

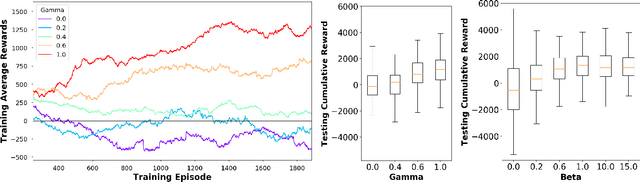

Multi-agent market simulation is an effective tool to investigate the impact of various trading strategies in financial markets. One way of designing a trading agent in simulated markets is through reinforcement learning where the agent is trained to optimize its cumulative rewards (e.g., maximizing profits, minimizing risk, improving equitability). While the agent learns a rational policy that optimizes the reward function, in reality, human investors are sub-rational with their decisions often differing from the optimal. In this work, we model human sub-rationality as resulting from two possible causes: psychological bias and computational limitation. We first examine the relationship between investor profits and their degree of sub-rationality, and create hand-crafted market scenarios to intuitively explain the sub-rational human behaviors. Through experiments, we show that our models successfully capture human sub-rationality as observed in the behavioral finance literature. We also examine the impact of sub-rational human investors on market observables such as traded volumes, spread and volatility. We believe our work will benefit research in behavioral finance and provide a better understanding of human trading behavior.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge