Keane Ong

Enhancing Language Models for Robust Greenwashing Detection

Jan 29, 2026Abstract:Sustainability reports are critical for ESG assessment, yet greenwashing and vague claims often undermine their reliability. Existing NLP models lack robustness to these practices, typically relying on surface-level patterns that generalize poorly. We propose a parameter-efficient framework that structures LLM latent spaces by combining contrastive learning with an ordinal ranking objective to capture graded distinctions between concrete actions and ambiguous claims. Our approach incorporates gated feature modulation to filter disclosure noise and utilizes MetaGradNorm to stabilize multi-objective optimization. Experiments in cross-category settings demonstrate superior robustness over standard baselines while revealing a trade-off between representational rigidity and generalization.

Human Behavior Atlas: Benchmarking Unified Psychological and Social Behavior Understanding

Oct 06, 2025Abstract:Using intelligent systems to perceive psychological and social behaviors, that is, the underlying affective, cognitive, and pathological states that are manifested through observable behaviors and social interactions, remains a challenge due to their complex, multifaceted, and personalized nature. Existing work tackling these dimensions through specialized datasets and single-task systems often miss opportunities for scalability, cross-task transfer, and broader generalization. To address this gap, we curate Human Behavior Atlas, a unified benchmark of diverse behavioral tasks designed to support the development of unified models for understanding psychological and social behaviors. Human Behavior Atlas comprises over 100,000 samples spanning text, audio, and visual modalities, covering tasks on affective states, cognitive states, pathologies, and social processes. Our unification efforts can reduce redundancy and cost, enable training to scale efficiently across tasks, and enhance generalization of behavioral features across domains. On Human Behavior Atlas, we train three models: OmniSapiens-7B SFT, OmniSapiens-7B BAM, and OmniSapiens-7B RL. We show that training on Human Behavior Atlas enables models to consistently outperform existing multimodal LLMs across diverse behavioral tasks. Pretraining on Human Behavior Atlas also improves transfer to novel behavioral datasets; with the targeted use of behavioral descriptors yielding meaningful performance gains.

Deriving Strategic Market Insights with Large Language Models: A Benchmark for Forward Counterfactual Generation

May 26, 2025

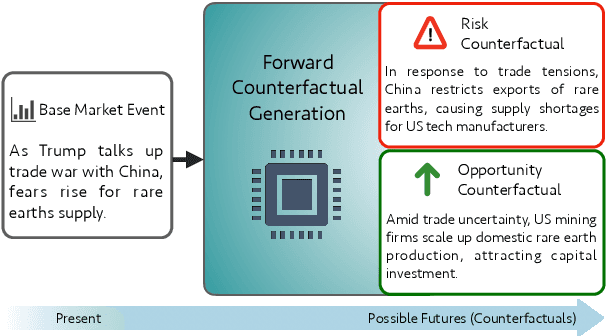

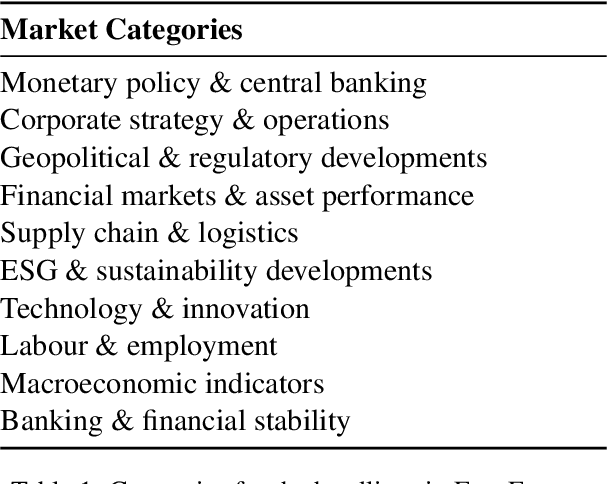

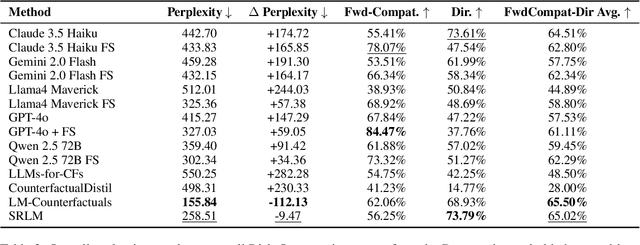

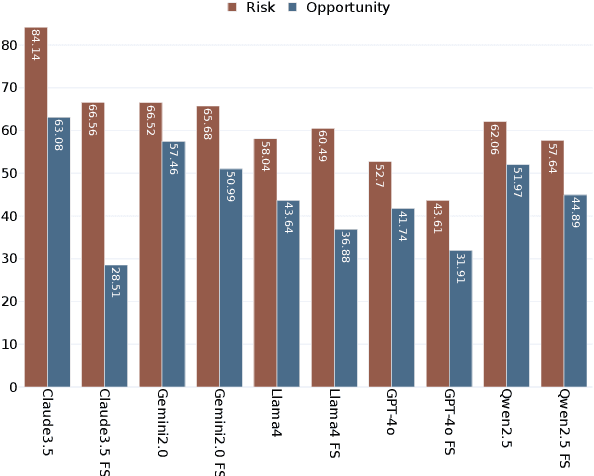

Abstract:Counterfactual reasoning typically involves considering alternatives to actual events. While often applied to understand past events, a distinct form-forward counterfactual reasoning-focuses on anticipating plausible future developments. This type of reasoning is invaluable in dynamic financial markets, where anticipating market developments can powerfully unveil potential risks and opportunities for stakeholders, guiding their decision-making. However, performing this at scale is challenging due to the cognitive demands involved, underscoring the need for automated solutions. Large Language Models (LLMs) offer promise, but remain unexplored for this application. To address this gap, we introduce a novel benchmark, Fin-Force-FINancial FORward Counterfactual Evaluation. By curating financial news headlines and providing structured evaluation, Fin-Force supports LLM based forward counterfactual generation. This paves the way for scalable and automated solutions for exploring and anticipating future market developments, thereby providing structured insights for decision-making. Through experiments on Fin-Force, we evaluate state-of-the-art LLMs and counterfactual generation methods, analyzing their limitations and proposing insights for future research.

ClimaEmpact: Domain-Aligned Small Language Models and Datasets for Extreme Weather Analytics

Apr 27, 2025Abstract:Accurate assessments of extreme weather events are vital for research and policy, yet localized and granular data remain scarce in many parts of the world. This data gap limits our ability to analyze potential outcomes and implications of extreme weather events, hindering effective decision-making. Large Language Models (LLMs) can process vast amounts of unstructured text data, extract meaningful insights, and generate detailed assessments by synthesizing information from multiple sources. Furthermore, LLMs can seamlessly transfer their general language understanding to smaller models, enabling these models to retain key knowledge while being fine-tuned for specific tasks. In this paper, we propose Extreme Weather Reasoning-Aware Alignment (EWRA), a method that enhances small language models (SLMs) by incorporating structured reasoning paths derived from LLMs, and ExtremeWeatherNews, a large dataset of extreme weather event-related news articles. EWRA and ExtremeWeatherNews together form the overall framework, ClimaEmpact, that focuses on addressing three critical extreme-weather tasks: categorization of tangible vulnerabilities/impacts, topic labeling, and emotion analysis. By aligning SLMs with advanced reasoning strategies on ExtremeWeatherNews (and its derived dataset ExtremeAlign used specifically for SLM alignment), EWRA improves the SLMs' ability to generate well-grounded and domain-specific responses for extreme weather analytics. Our results show that the approach proposed guides SLMs to output domain-aligned responses, surpassing the performance of task-specific models and offering enhanced real-world applicability for extreme weather analytics.

Towards Robust ESG Analysis Against Greenwashing Risks: Aspect-Action Analysis with Cross-Category Generalization

Feb 20, 2025

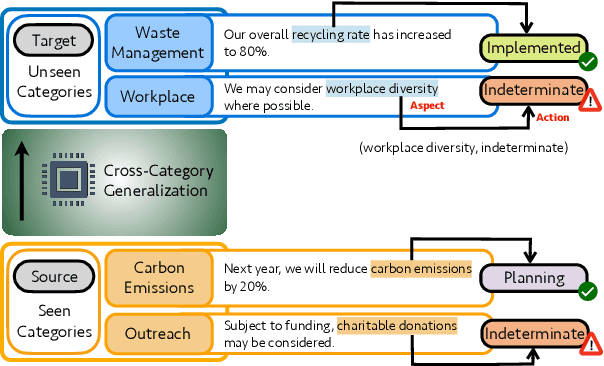

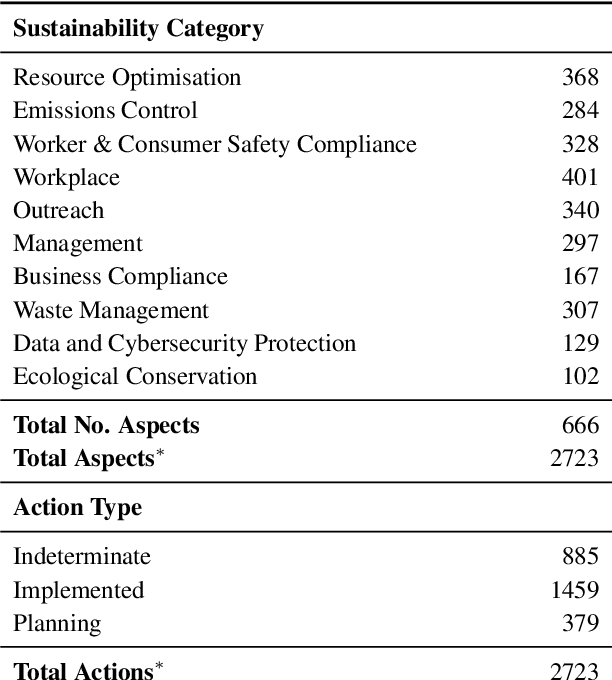

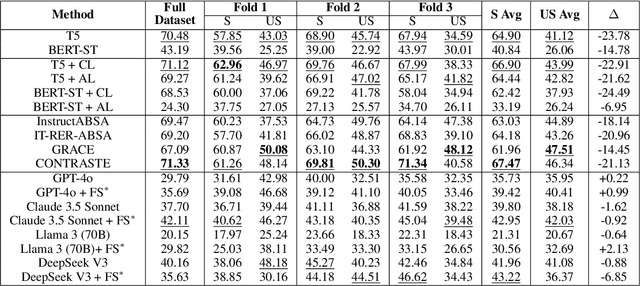

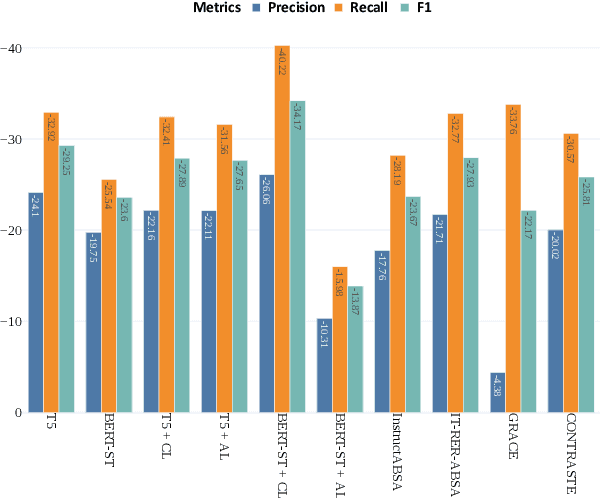

Abstract:Sustainability reports are key for evaluating companies' environmental, social and governance, ESG performance, but their content is increasingly obscured by greenwashing - sustainability claims that are misleading, exaggerated, and fabricated. Yet, existing NLP approaches for ESG analysis lack robustness against greenwashing risks, often extracting insights that reflect misleading or exaggerated sustainability claims rather than objective ESG performance. To bridge this gap, we introduce A3CG - Aspect-Action Analysis with Cross-Category Generalization, as a novel dataset to improve the robustness of ESG analysis amid the prevalence of greenwashing. By explicitly linking sustainability aspects with their associated actions, A3CG facilitates a more fine-grained and transparent evaluation of sustainability claims, ensuring that insights are grounded in verifiable actions rather than vague or misleading rhetoric. Additionally, A3CG emphasizes cross-category generalization. This ensures robust model performance in aspect-action analysis even when companies change their reports to selectively favor certain sustainability areas. Through experiments on A3CG, we analyze state-of-the-art supervised models and LLMs, uncovering their limitations and outlining key directions for future research.

ESGSenticNet: A Neurosymbolic Knowledge Base for Corporate Sustainability Analysis

Jan 27, 2025

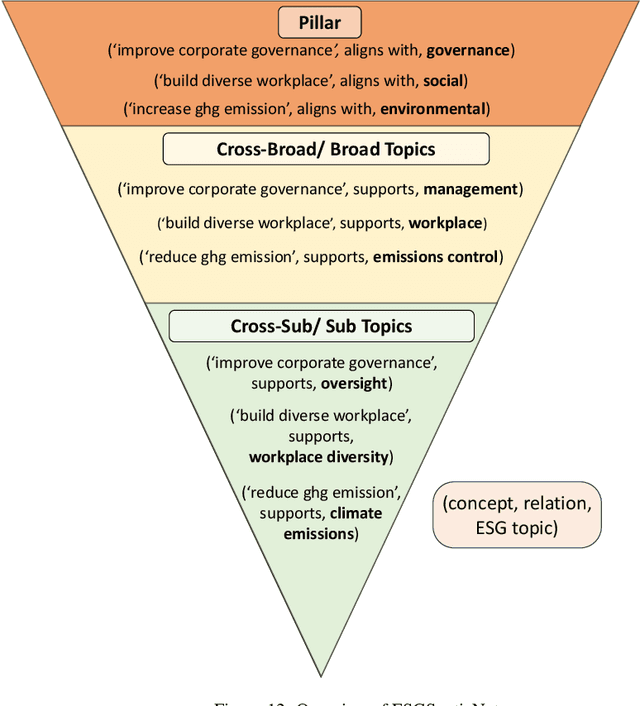

Abstract:Evaluating corporate sustainability performance is essential to drive sustainable business practices, amid the need for a more sustainable economy. However, this is hindered by the complexity and volume of corporate sustainability data (i.e. sustainability disclosures), not least by the effectiveness of the NLP tools used to analyse them. To this end, we identify three primary challenges - immateriality, complexity, and subjectivity, that exacerbate the difficulty of extracting insights from sustainability disclosures. To address these issues, we introduce ESGSenticNet, a publicly available knowledge base for sustainability analysis. ESGSenticNet is constructed from a neurosymbolic framework that integrates specialised concept parsing, GPT-4o inference, and semi-supervised label propagation, together with a hierarchical taxonomy. This approach culminates in a structured knowledge base of 44k knowledge triplets - ('halve carbon emission', supports, 'emissions control'), for effective sustainability analysis. Experiments indicate that ESGSenticNet, when deployed as a lexical method, more effectively captures relevant and actionable sustainability information from sustainability disclosures compared to state of the art baselines. Besides capturing a high number of unique ESG topic terms, ESGSenticNet outperforms baselines on the ESG relatedness and ESG action orientation of these terms by 26% and 31% respectively. These metrics describe the extent to which topic terms are related to ESG, and depict an action toward ESG. Moreover, when deployed as a lexical method, ESGSenticNet does not require any training, possessing a key advantage in its simplicity for non-technical stakeholders.

FinXABSA: Explainable Finance through Aspect-Based Sentiment Analysis

Mar 16, 2023

Abstract:This paper presents a novel approach for explainability in financial analysis by utilizing the Pearson correlation coefficient to establish a relationship between aspect-based sentiment analysis and stock prices. The proposed methodology involves constructing an aspect list from financial news articles and analyzing sentiment intensity scores for each aspect. These scores are then compared to the stock prices for the relevant companies using the Pearson coefficient to determine any significant correlations. The results indicate that the proposed approach provides a more detailed and accurate understanding of the relationship between sentiment analysis and stock prices, which can be useful for investors and financial analysts in making informed decisions. Additionally, this methodology offers a transparent and interpretable way to explain the sentiment analysis results and their impact on stock prices. Overall, the findings of this paper demonstrate the importance of explainability in financial analysis and highlight the potential benefits of utilizing the Pearson coefficient for analyzing aspect-based sentiment analysis and stock prices. The proposed approach offers a valuable tool for understanding the complex relationships between financial news sentiment and stock prices, providing a new perspective on the financial market and aiding in making informed investment decisions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge