Wihan van der Heever

A Comprehensive Review on Financial Explainable AI

Sep 21, 2023

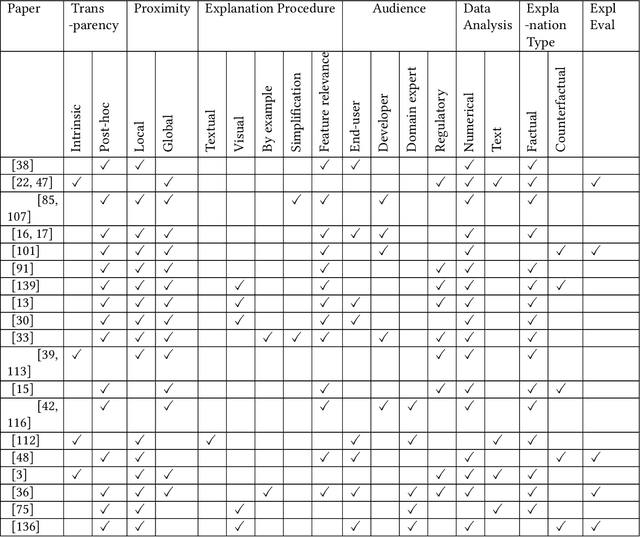

Abstract:The success of artificial intelligence (AI), and deep learning models in particular, has led to their widespread adoption across various industries due to their ability to process huge amounts of data and learn complex patterns. However, due to their lack of explainability, there are significant concerns regarding their use in critical sectors, such as finance and healthcare, where decision-making transparency is of paramount importance. In this paper, we provide a comparative survey of methods that aim to improve the explainability of deep learning models within the context of finance. We categorize the collection of explainable AI methods according to their corresponding characteristics, and we review the concerns and challenges of adopting explainable AI methods, together with future directions we deemed appropriate and important.

FinXABSA: Explainable Finance through Aspect-Based Sentiment Analysis

Mar 16, 2023

Abstract:This paper presents a novel approach for explainability in financial analysis by utilizing the Pearson correlation coefficient to establish a relationship between aspect-based sentiment analysis and stock prices. The proposed methodology involves constructing an aspect list from financial news articles and analyzing sentiment intensity scores for each aspect. These scores are then compared to the stock prices for the relevant companies using the Pearson coefficient to determine any significant correlations. The results indicate that the proposed approach provides a more detailed and accurate understanding of the relationship between sentiment analysis and stock prices, which can be useful for investors and financial analysts in making informed decisions. Additionally, this methodology offers a transparent and interpretable way to explain the sentiment analysis results and their impact on stock prices. Overall, the findings of this paper demonstrate the importance of explainability in financial analysis and highlight the potential benefits of utilizing the Pearson coefficient for analyzing aspect-based sentiment analysis and stock prices. The proposed approach offers a valuable tool for understanding the complex relationships between financial news sentiment and stock prices, providing a new perspective on the financial market and aiding in making informed investment decisions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge