Jesus Lago

The Energy Prediction Smart-Meter Dataset: Analysis of Previous Competitions and Beyond

Nov 07, 2023

Abstract:This paper presents the real-world smart-meter dataset and offers an analysis of solutions derived from the Energy Prediction Technical Challenges, focusing primarily on two key competitions: the IEEE Computational Intelligence Society (IEEE-CIS) Technical Challenge on Energy Prediction from Smart Meter data in 2020 (named EP) and its follow-up challenge at the IEEE International Conference on Fuzzy Systems (FUZZ-IEEE) in 2021 (named as XEP). These competitions focus on accurate energy consumption forecasting and the importance of interpretability in understanding the underlying factors. The challenge aims to predict monthly and yearly estimated consumption for households, addressing the accurate billing problem with limited historical smart meter data. The dataset comprises 3,248 smart meters, with varying data availability ranging from a minimum of one month to a year. This paper delves into the challenges, solutions and analysing issues related to the provided real-world smart meter data, developing accurate predictions at the household level, and introducing evaluation criteria for assessing interpretability. Additionally, this paper discusses aspects beyond the competitions: opportunities for energy disaggregation and pattern detection applications at the household level, significance of communicating energy-driven factors for optimised billing, and emphasising the importance of responsible AI and data privacy considerations. These aspects provide insights into the broader implications and potential advancements in energy consumption prediction. Overall, these competitions provide a dataset for residential energy research and serve as a catalyst for exploring accurate forecasting, enhancing interpretability, and driving progress towards the discussion of various aspects such as energy disaggregation, demand response programs or behavioural interventions.

Electricity Price Forecasting: The Dawn of Machine Learning

Apr 02, 2022

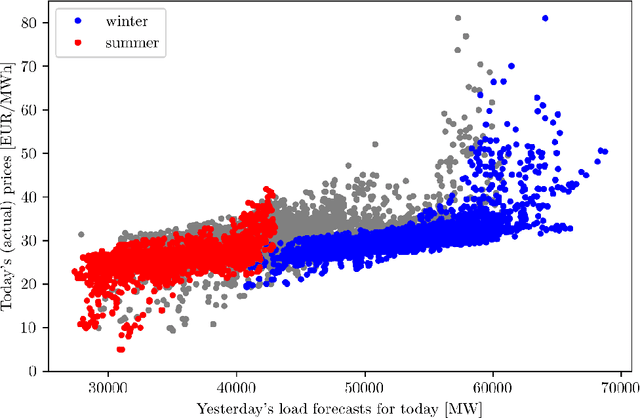

Abstract:Electricity price forecasting (EPF) is a branch of forecasting on the interface of electrical engineering, statistics, computer science, and finance, which focuses on predicting prices in wholesale electricity markets for a whole spectrum of horizons. These range from a few minutes (real-time/intraday auctions and continuous trading), through days (day-ahead auctions), to weeks, months or even years (exchange and over-the-counter traded futures and forward contracts). Over the last 25 years, various methods and computational tools have been applied to intraday and day-ahead EPF. Until the early 2010s, the field was dominated by relatively small linear regression models and (artificial) neural networks, typically with no more than two dozen inputs. As time passed, more data and more computational power became available. The models grew larger to the extent where expert knowledge was no longer enough to manage the complex structures. This, in turn, led to the introduction of machine learning (ML) techniques in this rapidly developing and fascinating area. Here, we provide an overview of the main trends and EPF models as of 2022.

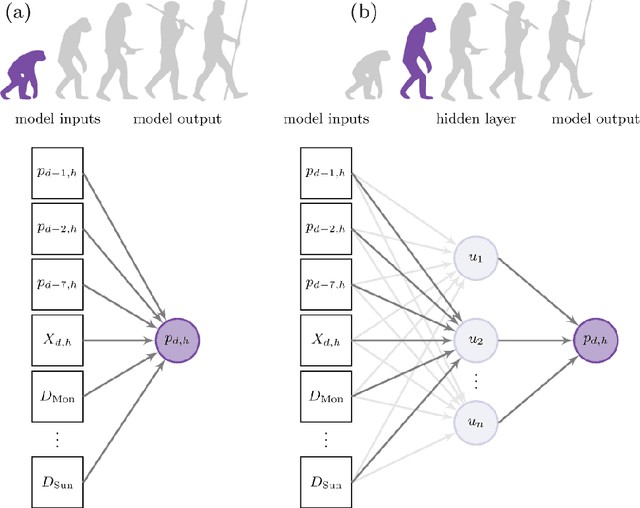

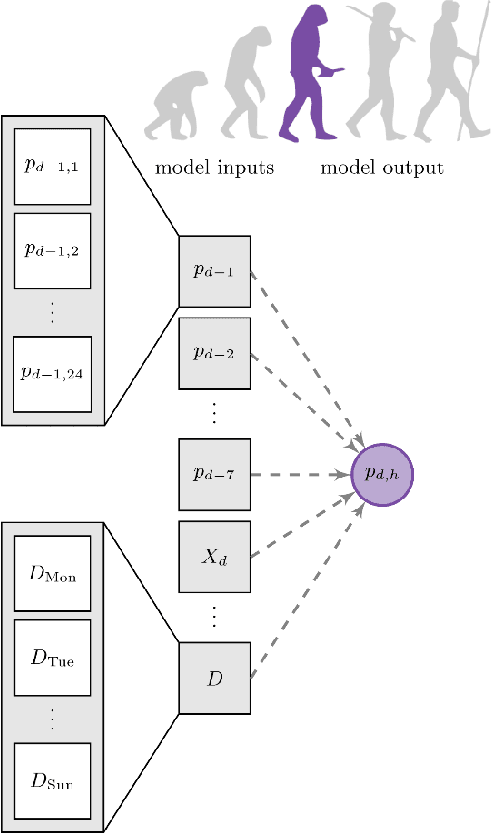

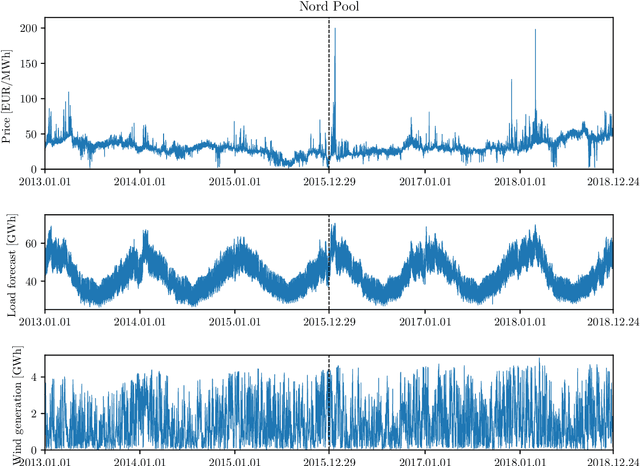

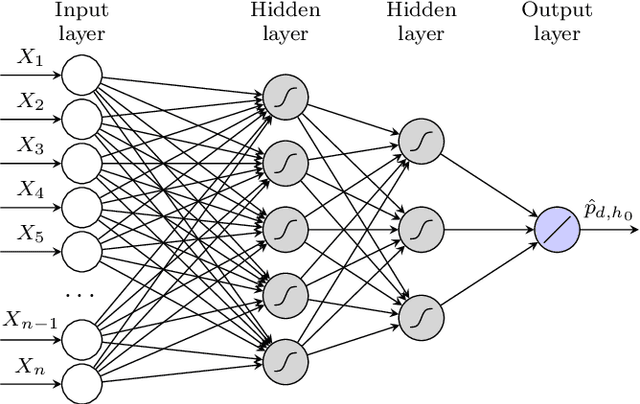

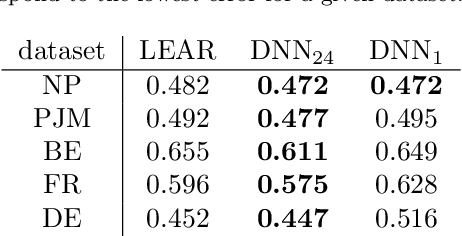

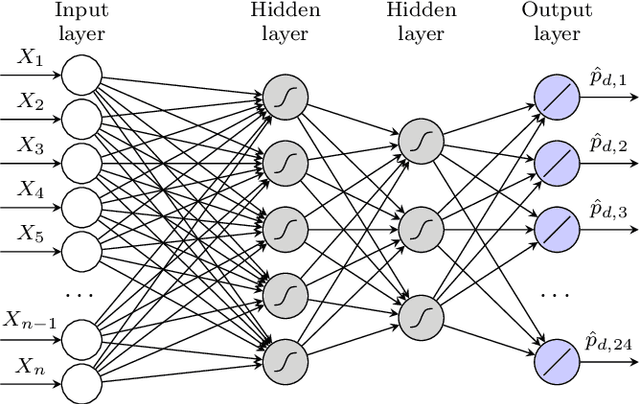

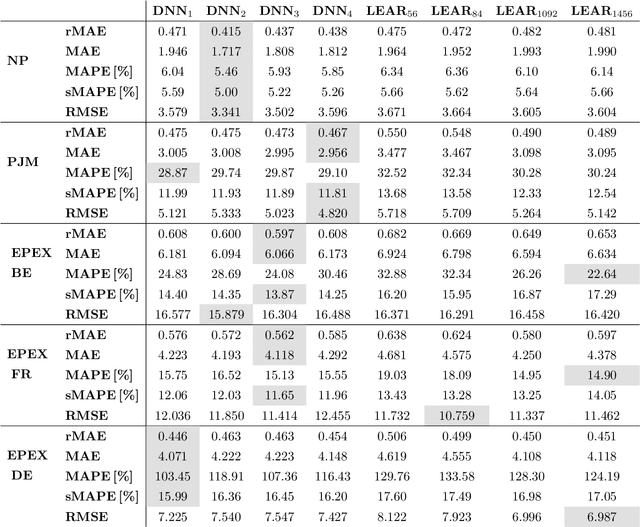

Neural networks in day-ahead electricity price forecasting: Single vs. multiple outputs

Aug 18, 2020

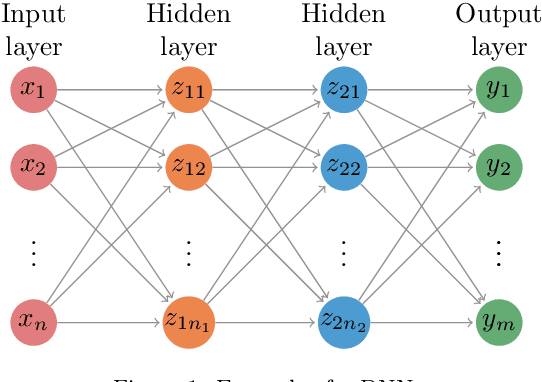

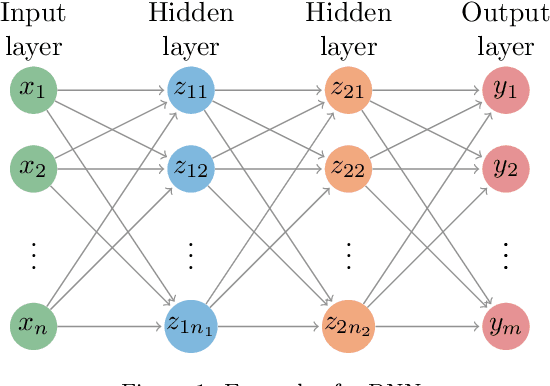

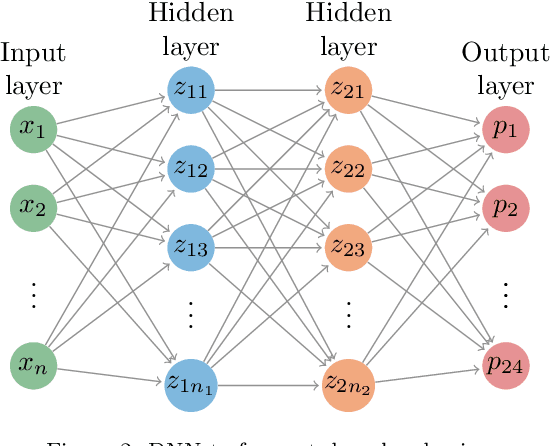

Abstract:Recent advancements in the fields of artificial intelligence and machine learning methods resulted in a significant increase of their popularity in the literature, including electricity price forecasting. Said methods cover a very broad spectrum, from decision trees, through random forests to various artificial neural network models and hybrid approaches. In electricity price forecasting, neural networks are the most popular machine learning method as they provide a non-linear counterpart for well-tested linear regression models. Their application, however, is not straightforward, with multiple implementation factors to consider. One of such factors is the network's structure. This paper provides a comprehensive comparison of two most common structures when using the deep neural networks -- one that focuses on each hour of the day separately, and one that reflects the daily auction structure and models vectors of the prices. The results show a significant accuracy advantage of using the latter, confirmed on data from five distinct power exchanges.

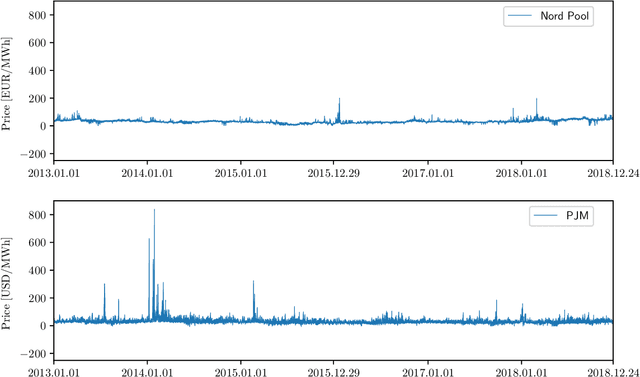

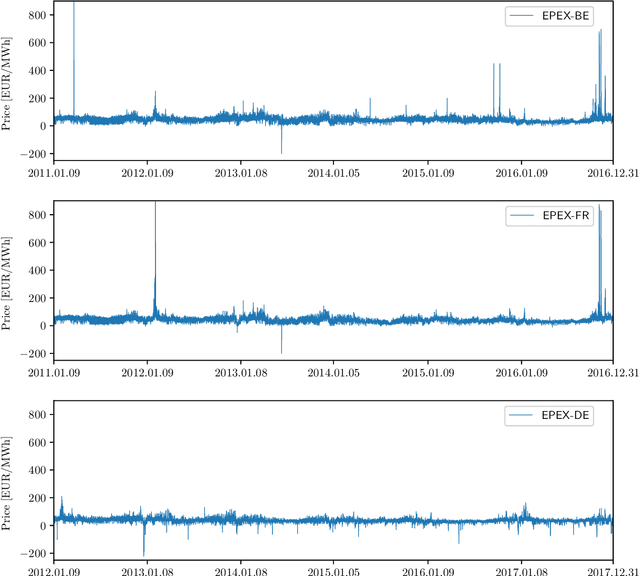

Forecasting day-ahead electricity prices: A review of state-of-the-art algorithms, best practices and an open-access benchmark

Aug 18, 2020

Abstract:While the field of electricity price forecasting has benefited from plenty of contributions in the last two decades, it arguably lacks a rigorous approach to evaluating new predictive algorithms. The latter are often compared using unique, not publicly available datasets and across too short and limited to one market test samples. The proposed new methods are rarely benchmarked against well established and well performing simpler models, the accuracy metrics are sometimes inadequate and testing the significance of differences in predictive performance is seldom conducted. Consequently, it is not clear which methods perform well nor what are the best practices when forecasting electricity prices. In this paper, we tackle these issues by performing a literature survey of state-of-the-art models, comparing state-of-the-art statistical and deep learning methods across multiple years and markets, and by putting forward a set of best practices. In addition, we make available the considered datasets, forecasts of the state-of-the-art models, and a specifically designed python toolbox, so that new algorithms can be rigorously evaluated in future studies.

Short-term forecasting of solar irradiance without local telemetry: a generalized model using satellite data

Nov 12, 2019

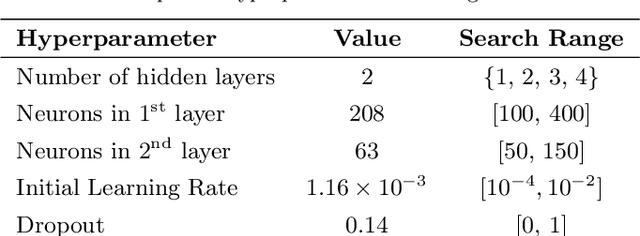

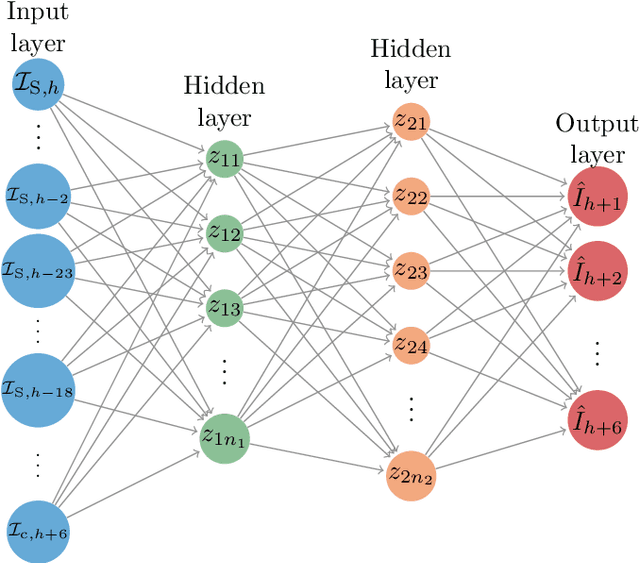

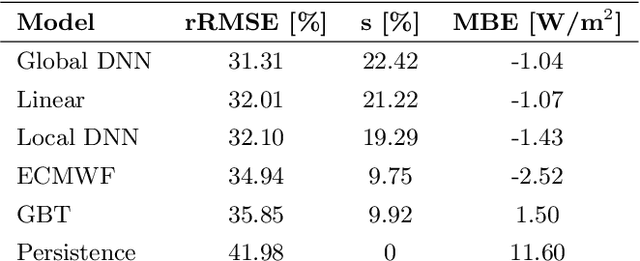

Abstract:Due to the increasing integration of solar power into the electrical grid, forecasting short-term solar irradiance has become key for many applications, e.g.~operational planning, power purchases, reserve activation, etc. In this context, as solar generators are geographically dispersed and ground measurements are not always easy to obtain, it is very important to have general models that can predict solar irradiance without the need of local data. In this paper, a model that can perform short-term forecasting of solar irradiance in any general location without the need of ground measurements is proposed. To do so, the model considers satellite-based measurements and weather-based forecasts, and employs a deep neural network structure that is able to generalize across locations; particularly, the network is trained only using a small subset of sites where ground data is available, and the model is able to generalize to a much larger number of locations where ground data does not exist. As a case study, 25 locations in The Netherlands are considered and the proposed model is compared against four local models that are individually trained for each location using ground measurements. Despite the general nature of the model, it is shown show that the proposed model is equal or better than the local models: when comparing the average performance across all the locations and prediction horizons, the proposed model obtains a 31.31% rRMSE (relative root mean square error) while the best local model achieves a 32.01% rRMSE.

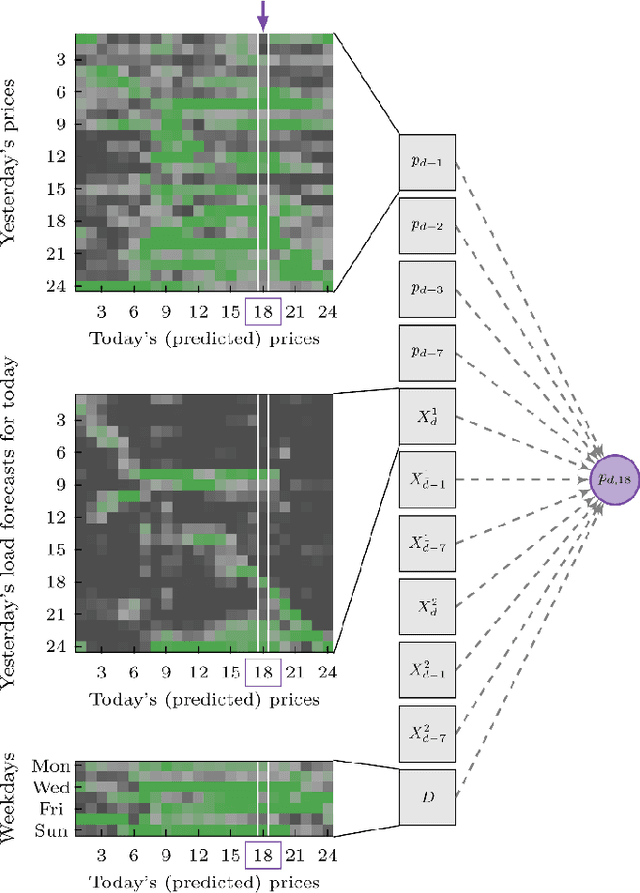

Forecasting day-ahead electricity prices in Europe: the importance of considering market integration

Dec 07, 2017

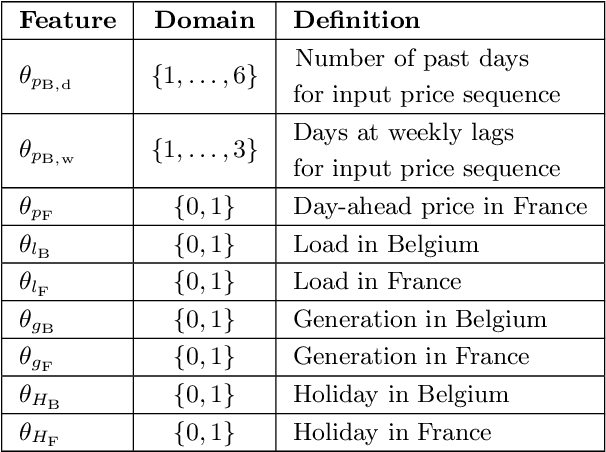

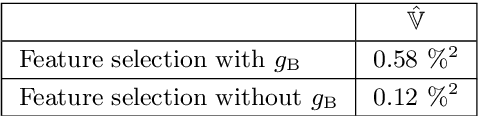

Abstract:Motivated by the increasing integration among electricity markets, in this paper we propose two different methods to incorporate market integration in electricity price forecasting and to improve the predictive performance. First, we propose a deep neural network that considers features from connected markets to improve the predictive accuracy in a local market. To measure the importance of these features, we propose a novel feature selection algorithm that, by using Bayesian optimization and functional analysis of variance, evaluates the effect of the features on the algorithm performance. In addition, using market integration, we propose a second model that, by simultaneously predicting prices from two markets, improves the forecasting accuracy even further. As a case study, we consider the electricity market in Belgium and the improvements in forecasting accuracy when using various French electricity features. We show that the two proposed models lead to improvements that are statistically significant. Particularly, due to market integration, the predictive accuracy is improved from 15.7% to 12.5% sMAPE (symmetric mean absolute percentage error). In addition, we show that the proposed feature selection algorithm is able to perform a correct assessment, i.e. to discard the irrelevant features.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge