Rafał Weron

Postprocessing of point predictions for probabilistic forecasting of electricity prices: Diversity matters

Apr 02, 2024

Abstract:Operational decisions relying on predictive distributions of electricity prices can result in significantly higher profits compared to those based solely on point forecasts. However, the majority of models developed in both academic and industrial settings provide only point predictions. To address this, we examine three postprocessing methods for converting point forecasts into probabilistic ones: Quantile Regression Averaging, Conformal Prediction, and the recently introduced Isotonic Distributional Regression. We find that while IDR demonstrates the most varied performance, combining its predictive distributions with those of the other two methods results in an improvement of ca. 7.5% compared to a benchmark model with normally distributed errors, over a 4.5-year test period in the German power market spanning the COVID pandemic and the war in Ukraine. Remarkably, the performance of this combination is at par with state-of-the-art Distributional Deep Neural Networks.

Combining predictive distributions of electricity prices: Does minimizing the CRPS lead to optimal decisions in day-ahead bidding?

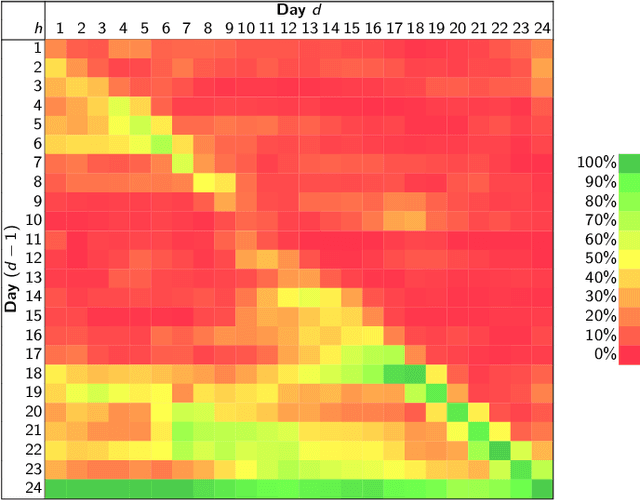

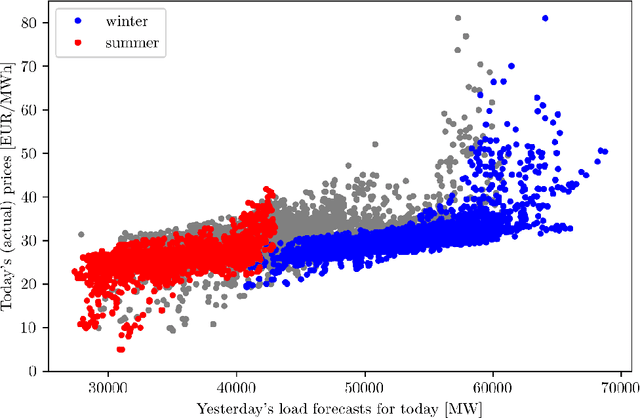

Aug 29, 2023Abstract:Probabilistic price forecasting has recently gained attention in power trading because decisions based on such predictions can yield significantly higher profits than those made with point forecasts alone. At the same time, methods are being developed to combine predictive distributions, since no model is perfect and averaging generally improves forecasting performance. In this article we address the question of whether using CRPS learning, a novel weighting technique minimizing the continuous ranked probability score (CRPS), leads to optimal decisions in day-ahead bidding. To this end, we conduct an empirical study using hourly day-ahead electricity prices from the German EPEX market. We find that increasing the diversity of an ensemble can have a positive impact on accuracy. At the same time, the higher computational cost of using CRPS learning compared to an equal-weighted aggregation of distributions is not offset by higher profits, despite significantly more accurate predictions.

Distributional neural networks for electricity price forecasting

Jul 06, 2022

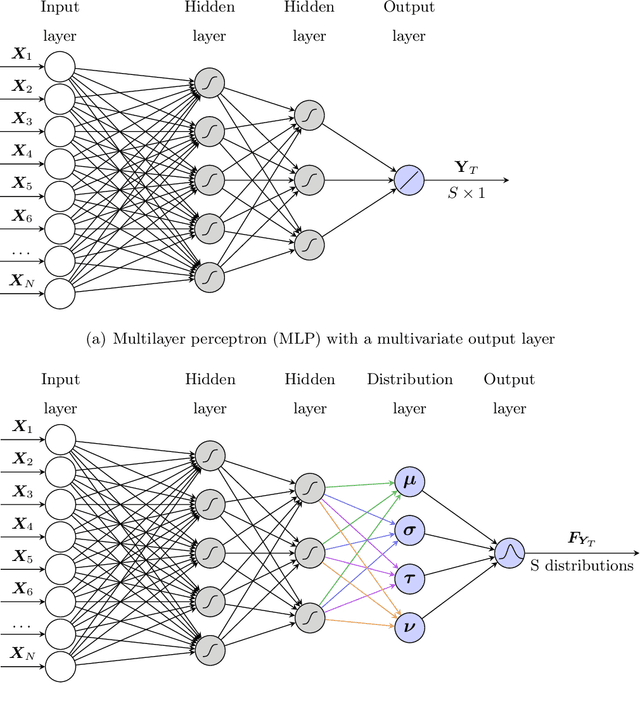

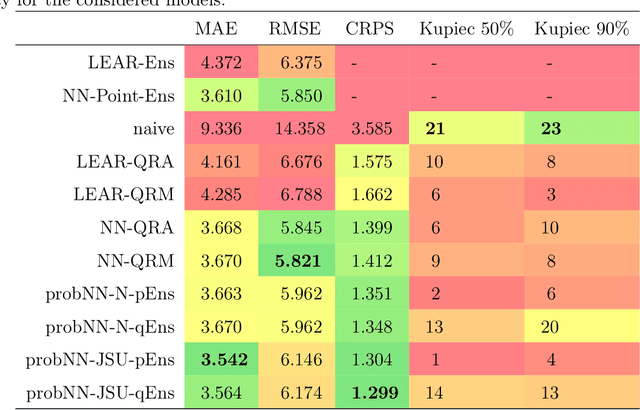

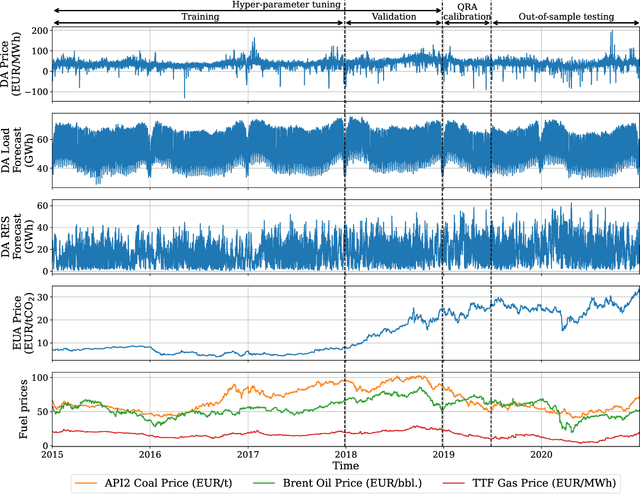

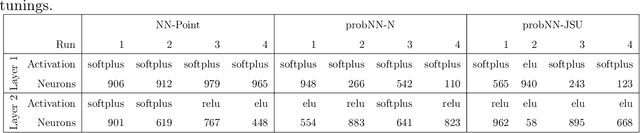

Abstract:We present a novel approach to probabilistic electricity price forecasting (EPF) which utilizes distributional artificial neural networks. The novel network structure for EPF is based on a regularized distributional multilayer perceptron (DMLP) which contains a probability layer. Using the TensorFlow Probability framework, the neural network's output is defined to be a distribution, either normal or potentially skewed and heavy-tailed Johnson's SU (JSU). The method is compared against state-of-the-art benchmarks in a forecasting study. The study comprises forecasting involving day-ahead electricity prices in the German market. The results show evidence of the importance of higher moments when modeling electricity prices.

Forecasting Electricity Prices

Apr 25, 2022

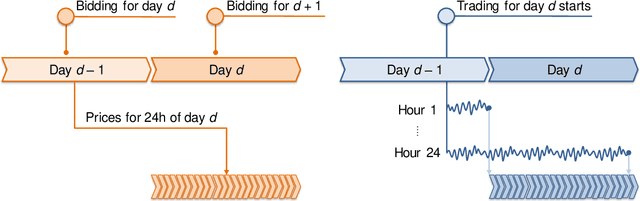

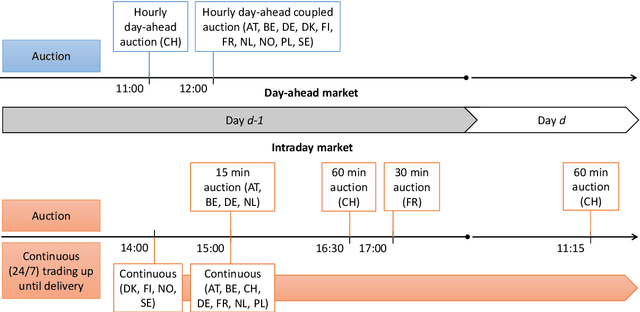

Abstract:Forecasting electricity prices is a challenging task and an active area of research since the 1990s and the deregulation of the traditionally monopolistic and government-controlled power sectors. Although it aims at predicting both spot and forward prices, the vast majority of research is focused on short-term horizons which exhibit dynamics unlike in any other market. The reason is that power system stability calls for a constant balance between production and consumption, while being weather (both demand and supply) and business activity (demand only) dependent. The recent market innovations do not help in this respect. The rapid expansion of intermittent renewable energy sources is not offset by the costly increase of electricity storage capacities and modernization of the grid infrastructure. On the methodological side, this leads to three visible trends in electricity price forecasting research as of 2022. Firstly, there is a slow, but more noticeable with every year, tendency to consider not only point but also probabilistic (interval, density) or even path (also called ensemble) forecasts. Secondly, there is a clear shift from the relatively parsimonious econometric (or statistical) models towards more complex and harder to comprehend, but more versatile and eventually more accurate statistical/machine learning approaches. Thirdly, statistical error measures are nowadays regarded as only the first evaluation step. Since they may not necessarily reflect the economic value of reducing prediction errors, more and more often, they are complemented by case studies comparing profits from scheduling or trading strategies based on price forecasts obtained from different models.

Electricity Price Forecasting: The Dawn of Machine Learning

Apr 02, 2022

Abstract:Electricity price forecasting (EPF) is a branch of forecasting on the interface of electrical engineering, statistics, computer science, and finance, which focuses on predicting prices in wholesale electricity markets for a whole spectrum of horizons. These range from a few minutes (real-time/intraday auctions and continuous trading), through days (day-ahead auctions), to weeks, months or even years (exchange and over-the-counter traded futures and forward contracts). Over the last 25 years, various methods and computational tools have been applied to intraday and day-ahead EPF. Until the early 2010s, the field was dominated by relatively small linear regression models and (artificial) neural networks, typically with no more than two dozen inputs. As time passed, more data and more computational power became available. The models grew larger to the extent where expert knowledge was no longer enough to manage the complex structures. This, in turn, led to the introduction of machine learning (ML) techniques in this rapidly developing and fascinating area. Here, we provide an overview of the main trends and EPF models as of 2022.

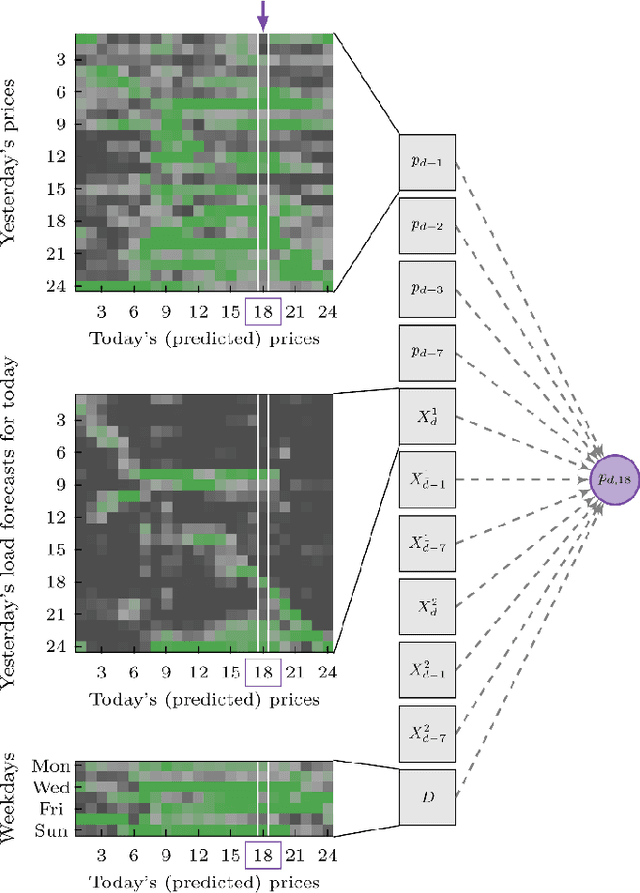

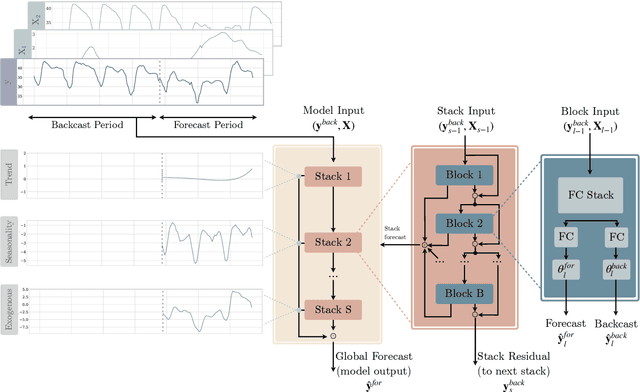

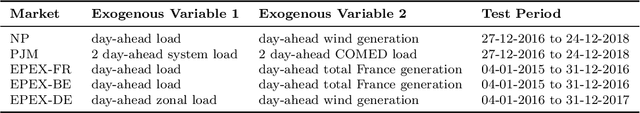

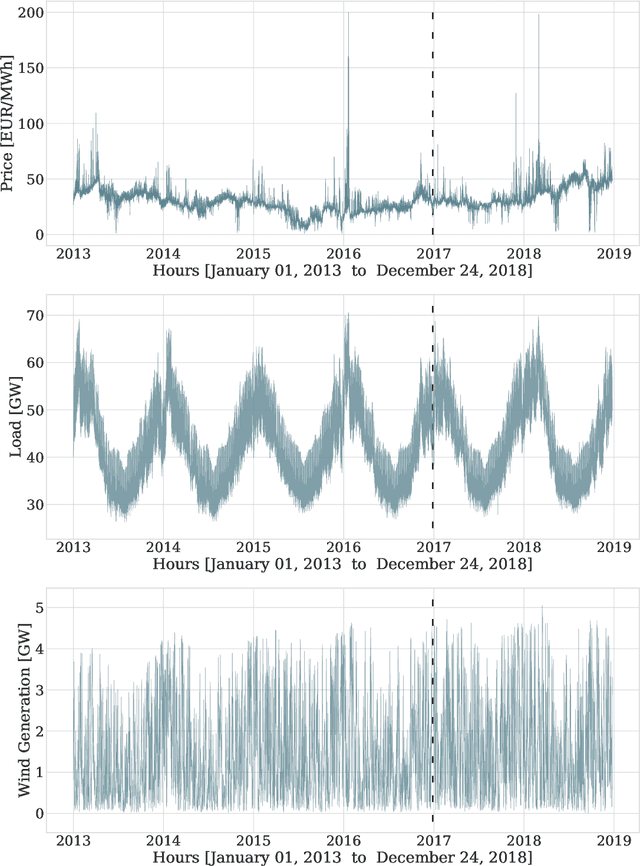

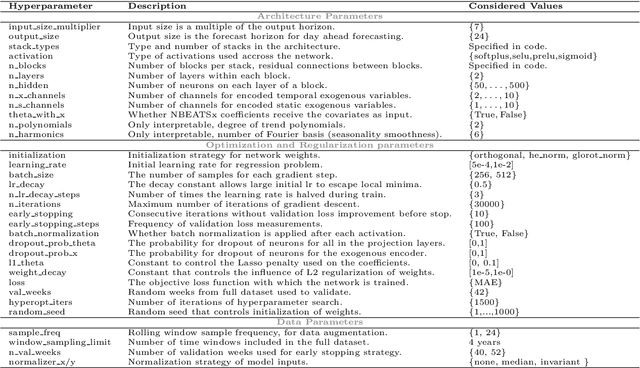

Neural basis expansion analysis with exogenous variables: Forecasting electricity prices with NBEATSx

Apr 23, 2021

Abstract:We extend the neural basis expansion analysis (NBEATS) to incorporate exogenous factors. The resulting method, called NBEATSx, improves on a well performing deep learning model, extending its capabilities by including exogenous variables and allowing it to integrate multiple sources of useful information. To showcase the utility of the NBEATSx model, we conduct a comprehensive study of its application to electricity price forecasting (EPF) tasks across a broad range of years and markets. We observe state-of-the-art performance, significantly improving the forecast accuracy by nearly 20% over the original NBEATS model, and by up to 5% over other well established statistical and machine learning methods specialized for these tasks. Additionally, the proposed neural network has an interpretable configuration that can structurally decompose time series, visualizing the relative impact of trend and seasonal components and revealing the modeled processes' interactions with exogenous factors. To assist related work we made the code available in https://github.com/cchallu/nbeatsx.

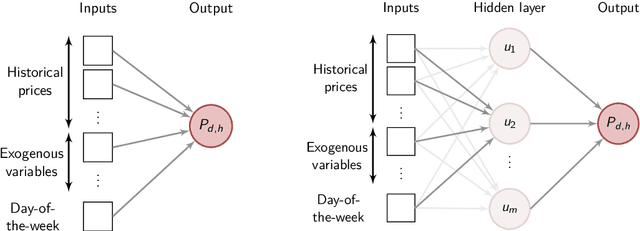

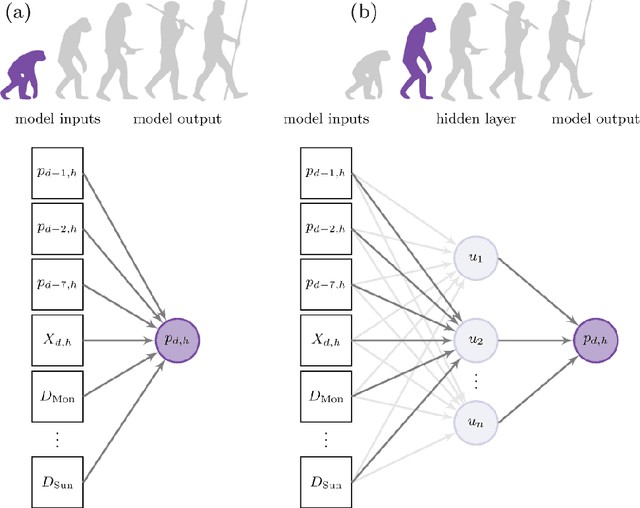

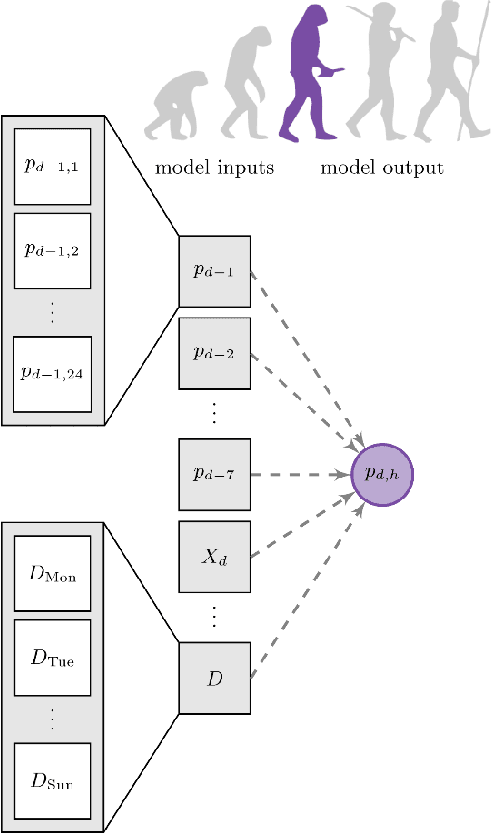

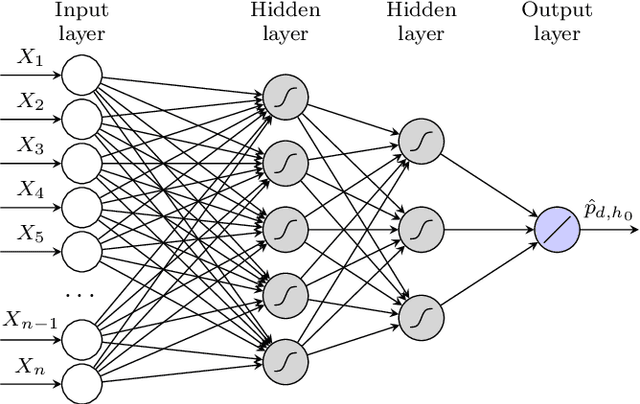

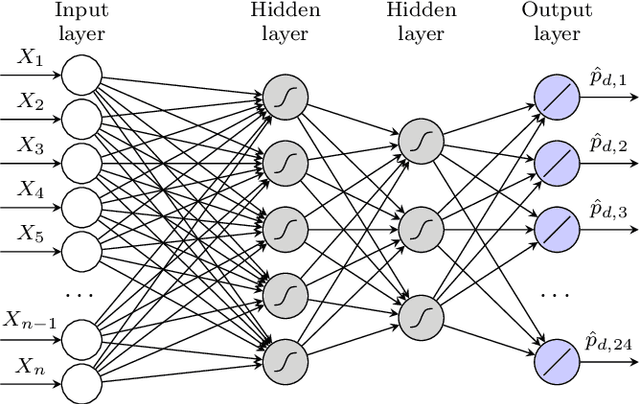

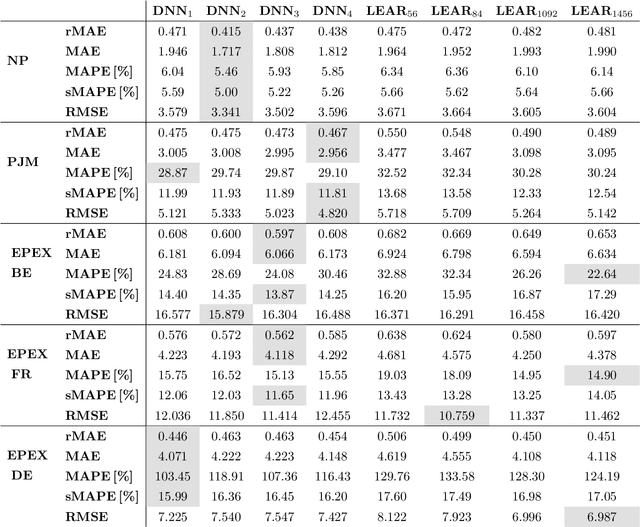

Neural networks in day-ahead electricity price forecasting: Single vs. multiple outputs

Aug 18, 2020

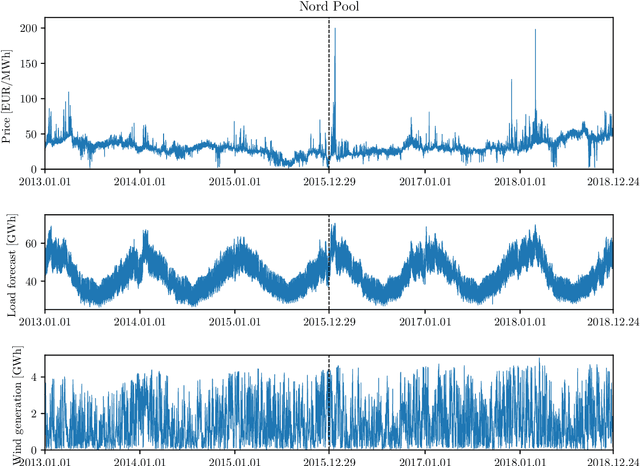

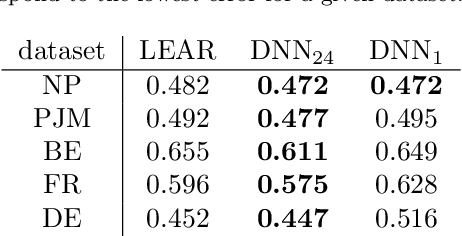

Abstract:Recent advancements in the fields of artificial intelligence and machine learning methods resulted in a significant increase of their popularity in the literature, including electricity price forecasting. Said methods cover a very broad spectrum, from decision trees, through random forests to various artificial neural network models and hybrid approaches. In electricity price forecasting, neural networks are the most popular machine learning method as they provide a non-linear counterpart for well-tested linear regression models. Their application, however, is not straightforward, with multiple implementation factors to consider. One of such factors is the network's structure. This paper provides a comprehensive comparison of two most common structures when using the deep neural networks -- one that focuses on each hour of the day separately, and one that reflects the daily auction structure and models vectors of the prices. The results show a significant accuracy advantage of using the latter, confirmed on data from five distinct power exchanges.

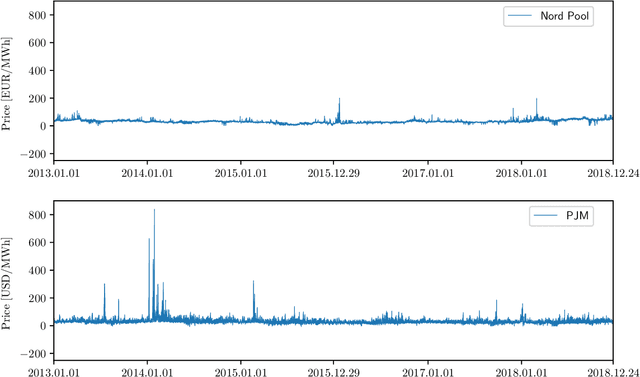

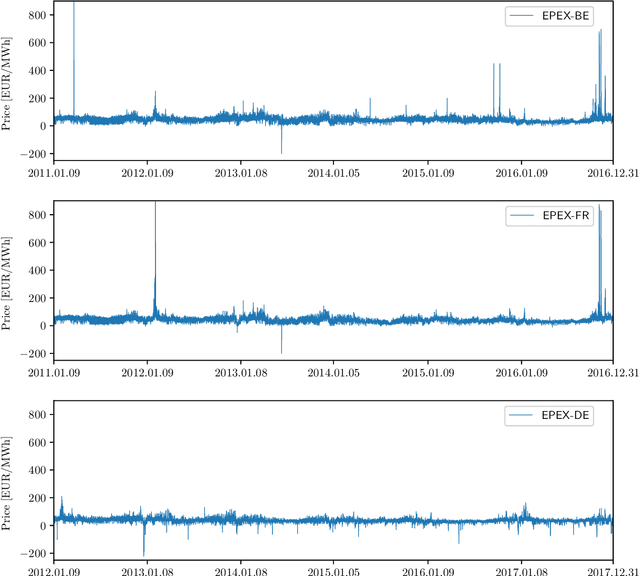

Forecasting day-ahead electricity prices: A review of state-of-the-art algorithms, best practices and an open-access benchmark

Aug 18, 2020

Abstract:While the field of electricity price forecasting has benefited from plenty of contributions in the last two decades, it arguably lacks a rigorous approach to evaluating new predictive algorithms. The latter are often compared using unique, not publicly available datasets and across too short and limited to one market test samples. The proposed new methods are rarely benchmarked against well established and well performing simpler models, the accuracy metrics are sometimes inadequate and testing the significance of differences in predictive performance is seldom conducted. Consequently, it is not clear which methods perform well nor what are the best practices when forecasting electricity prices. In this paper, we tackle these issues by performing a literature survey of state-of-the-art models, comparing state-of-the-art statistical and deep learning methods across multiple years and markets, and by putting forward a set of best practices. In addition, we make available the considered datasets, forecasts of the state-of-the-art models, and a specifically designed python toolbox, so that new algorithms can be rigorously evaluated in future studies.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge