Huanming Zhang

RecGURU: Adversarial Learning of Generalized User Representations for Cross-Domain Recommendation

Nov 19, 2021

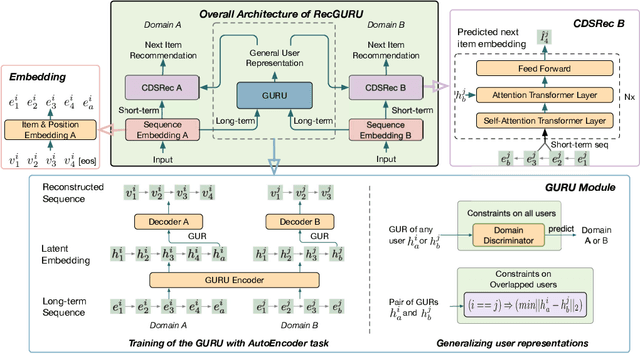

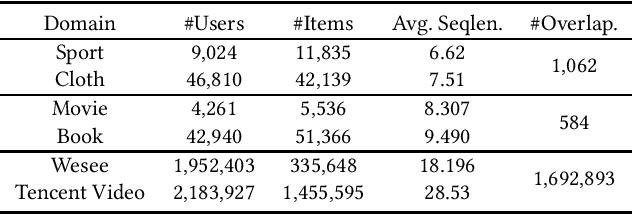

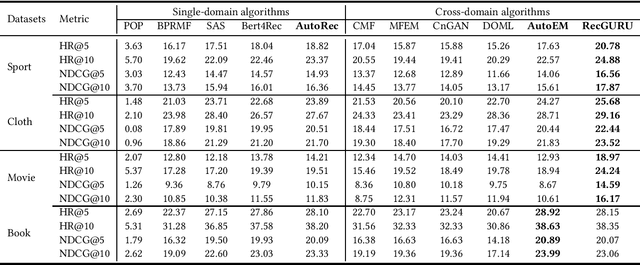

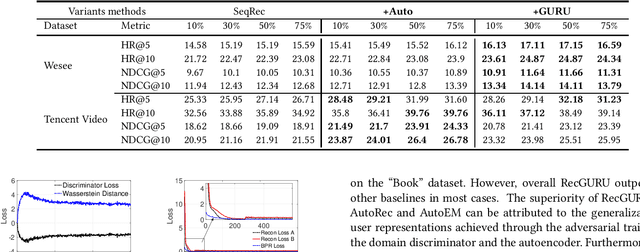

Abstract:Cross-domain recommendation can help alleviate the data sparsity issue in traditional sequential recommender systems. In this paper, we propose the RecGURU algorithm framework to generate a Generalized User Representation (GUR) incorporating user information across domains in sequential recommendation, even when there is minimum or no common users in the two domains. We propose a self-attentive autoencoder to derive latent user representations, and a domain discriminator, which aims to predict the origin domain of a generated latent representation. We propose a novel adversarial learning method to train the two modules to unify user embeddings generated from different domains into a single global GUR for each user. The learned GUR captures the overall preferences and characteristics of a user and thus can be used to augment the behavior data and improve recommendations in any single domain in which the user is involved. Extensive experiments have been conducted on two public cross-domain recommendation datasets as well as a large dataset collected from real-world applications. The results demonstrate that RecGURU boosts performance and outperforms various state-of-the-art sequential recommendation and cross-domain recommendation methods. The collected data will be released to facilitate future research.

A Deep Deterministic Policy Gradient-based Strategy for Stocks Portfolio Management

Mar 21, 2021Abstract:With the improvement of computer performance and the development of GPU-accelerated technology, trading with machine learning algorithms has attracted the attention of many researchers and practitioners. In this research, we propose a novel portfolio management strategy based on the framework of Deep Deterministic Policy Gradient, a policy-based reinforcement learning framework, and compare its performance to that of other trading strategies. In our framework, two Long Short-Term Memory neural networks and two fully connected neural networks are constructed. We also investigate the performance of our strategy with and without transaction costs. Experimentally, we choose eight US stocks consisting of four low-volatility stocks and four high-volatility stocks. We compare the compound annual return rate of our strategy against seven other strategies, e.g., Uniform Buy and Hold, Exponential Gradient and Universal Portfolios. In our case, the compound annual return rate is 14.12%, outperforming all other strategies. Furthermore, in terms of Sharpe Ratio (0.5988), our strategy is nearly 33% higher than that of the second-best performing strategy.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge