Gregory Epiphaniou

A BERT-based Empirical Study of Privacy Policies' Compliance with GDPR

Jul 09, 2024

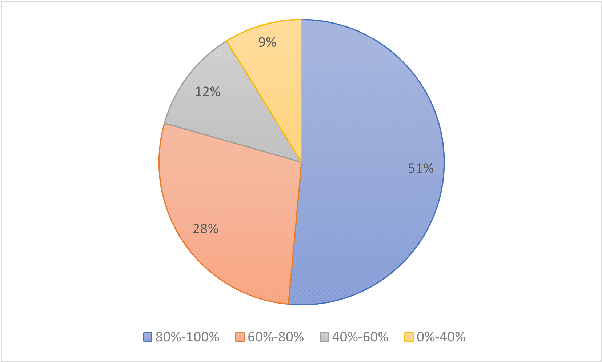

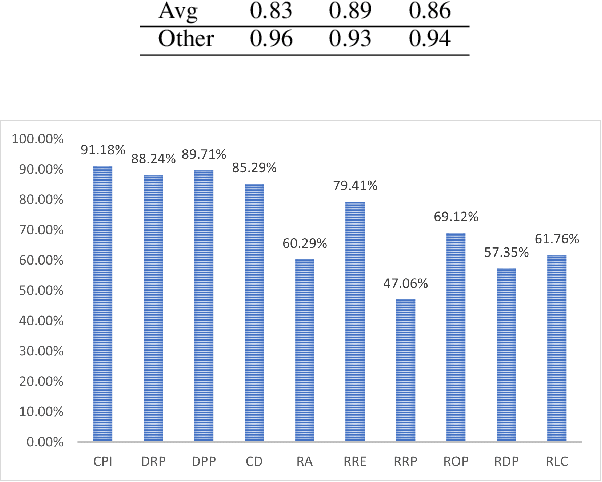

Abstract:Since its implementation in May 2018, the General Data Protection Regulation (GDPR) has prompted businesses to revisit and revise their data handling practices to ensure compliance. The privacy policy, which serves as the primary means of informing users about their privacy rights and the data practices of companies, has been significantly updated by numerous businesses post-GDPR implementation. However, many privacy policies remain packed with technical jargon, lengthy explanations, and vague descriptions of data practices and user rights. This makes it a challenging task for users and regulatory authorities to manually verify the GDPR compliance of these privacy policies. In this study, we aim to address the challenge of compliance analysis between GDPR (Article 13) and privacy policies for 5G networks. We manually collected privacy policies from almost 70 different 5G MNOs, and we utilized an automated BERT-based model for classification. We show that an encouraging 51$\%$ of companies demonstrate a strong adherence to GDPR. In addition, we present the first study that provides current empirical evidence on the readability of privacy policies for 5G network. we adopted readability analysis toolset that incorporates various established readability metrics. The findings empirically show that the readability of the majority of current privacy policies remains a significant challenge. Hence, 5G providers need to invest considerable effort into revising these documents to enhance both their utility and the overall user experience.

Data-Agnostic Face Image Synthesis Detection Using Bayesian CNNs

Jan 08, 2024Abstract:Face image synthesis detection is considerably gaining attention because of the potential negative impact on society that this type of synthetic data brings. In this paper, we propose a data-agnostic solution to detect the face image synthesis process. Specifically, our solution is based on an anomaly detection framework that requires only real data to learn the inference process. It is therefore data-agnostic in the sense that it requires no synthetic face images. The solution uses the posterior probability with respect to the reference data to determine if new samples are synthetic or not. Our evaluation results using different synthesizers show that our solution is very competitive against the state-of-the-art, which requires synthetic data for training.

Detecting Face Synthesis Using a Concealed Fusion Model

Jan 08, 2024Abstract:Face image synthesis is gaining more attention in computer security due to concerns about its potential negative impacts, including those related to fake biometrics. Hence, building models that can detect the synthesized face images is an important challenge to tackle. In this paper, we propose a fusion-based strategy to detect face image synthesis while providing resiliency to several attacks. The proposed strategy uses a late fusion of the outputs computed by several undisclosed models by relying on random polynomial coefficients and exponents to conceal a new feature space. Unlike existing concealing solutions, our strategy requires no quantization, which helps to preserve the feature space. Our experiments reveal that our strategy achieves state-of-the-art performance while providing protection against poisoning, perturbation, backdoor, and reverse model attacks.

The AI Revolution: Opportunities and Challenges for the Finance Sector

Aug 31, 2023Abstract:This report examines Artificial Intelligence (AI) in the financial sector, outlining its potential to revolutionise the industry and identify its challenges. It underscores the criticality of a well-rounded understanding of AI, its capabilities, and its implications to effectively leverage its potential while mitigating associated risks. The potential of AI potential extends from augmenting existing operations to paving the way for novel applications in the finance sector. The application of AI in the financial sector is transforming the industry. Its use spans areas from customer service enhancements, fraud detection, and risk management to credit assessments and high-frequency trading. However, along with these benefits, AI also presents several challenges. These include issues related to transparency, interpretability, fairness, accountability, and trustworthiness. The use of AI in the financial sector further raises critical questions about data privacy and security. A further issue identified in this report is the systemic risk that AI can introduce to the financial sector. Being prone to errors, AI can exacerbate existing systemic risks, potentially leading to financial crises. Regulation is crucial to harnessing the benefits of AI while mitigating its potential risks. Despite the global recognition of this need, there remains a lack of clear guidelines or legislation for AI use in finance. This report discusses key principles that could guide the formation of effective AI regulation in the financial sector, including the need for a risk-based approach, the inclusion of ethical considerations, and the importance of maintaining a balance between innovation and consumer protection. The report provides recommendations for academia, the finance industry, and regulators.

Leveraging Semantic Relationships to Prioritise Indicators of Compromise in Additive Manufacturing Systems

May 06, 2023Abstract:Additive manufacturing (AM) offers numerous benefits, such as manufacturing complex and customised designs quickly and cost-effectively, reducing material waste, and enabling on-demand production. However, several security challenges are associated with AM, making it increasingly attractive to attackers ranging from individual hackers to organised criminal gangs and nation-state actors. This paper addresses the cyber risk in AM to attackers by proposing a novel semantic-based threat prioritisation system for identifying, extracting and ranking indicators of compromise (IOC). The system leverages the heterogeneous information networks (HINs) that automatically extract high-level IOCs from multi-source threat text and identifies semantic relations among the IOCs. It models IOCs with a HIN comprising different meta-paths and meta-graphs to depict semantic relations among diverse IOCs. We introduce a domain-specific recogniser that identifies IOCs in three domains: organisation-specific, regional source-specific, and regional target-specific. A threat assessment uses similarity measures based on meta-paths and meta-graphs to assess semantic relations among IOCs. It prioritises IOCs by measuring their severity based on the frequency of attacks, IOC lifetime, and exploited vulnerabilities in each domain.

CyRes -- Avoiding Catastrophic Failure in Connected and Autonomous Vehicles (Extended Abstract)

Jul 03, 2020

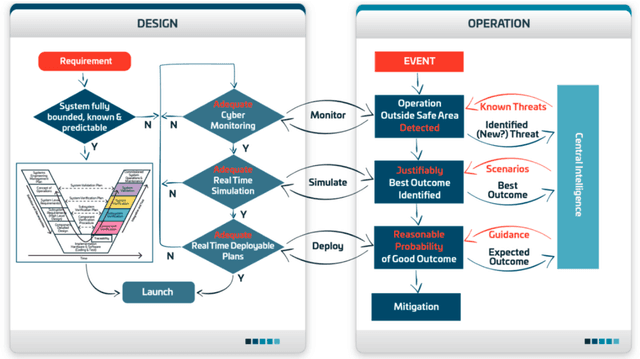

Abstract:Existing approaches to cyber security and regulation in the automotive sector cannot achieve the quality of outcome necessary to ensure the safe mass deployment of advanced vehicle technologies and smart mobility systems. Without sustainable resilience hard-fought public trust will evaporate, derailing emerging global initiatives to improve the efficiency, safety and environmental impact of future transport. This paper introduces an operational cyber resilience methodology, CyRes, that is suitable for standardisation. The CyRes methodology itself is capable of being tested in court or by publicly appointed regulators. It is designed so that operators understand what evidence should be produced by it and are able to measure the quality of that evidence. The evidence produced is capable of being tested in court or by publicly appointed regulators. Thus, the real-world system to which the CyRes methodology has been applied is capable of operating at all times and in all places with a legally and socially acceptable value of negative consequence.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge