Greg Zanotti

Automatic Outlier Rectification via Optimal Transport

Mar 21, 2024

Abstract:In this paper, we propose a novel conceptual framework to detect outliers using optimal transport with a concave cost function. Conventional outlier detection approaches typically use a two-stage procedure: first, outliers are detected and removed, and then estimation is performed on the cleaned data. However, this approach does not inform outlier removal with the estimation task, leaving room for improvement. To address this limitation, we propose an automatic outlier rectification mechanism that integrates rectification and estimation within a joint optimization framework. We take the first step to utilize an optimal transport distance with a concave cost function to construct a rectification set in the space of probability distributions. Then, we select the best distribution within the rectification set to perform the estimation task. Notably, the concave cost function we introduced in this paper is the key to making our estimator effectively identify the outlier during the optimization process. We discuss the fundamental differences between our estimator and optimal transport-based distributionally robust optimization estimator. finally, we demonstrate the effectiveness and superiority of our approach over conventional approaches in extensive simulation and empirical analyses for mean estimation, least absolute regression, and the fitting of option implied volatility surfaces.

Deep Learning Statistical Arbitrage

Jun 08, 2021

Abstract:Statistical arbitrage identifies and exploits temporal price differences between similar assets. We propose a unifying conceptual framework for statistical arbitrage and develop a novel deep learning solution, which finds commonality and time-series patterns from large panels in a data-driven and flexible way. First, we construct arbitrage portfolios of similar assets as residual portfolios from conditional latent asset pricing factors. Second, we extract the time series signals of these residual portfolios with one of the most powerful machine learning time-series solutions, a convolutional transformer. Last, we use these signals to form an optimal trading policy, that maximizes risk-adjusted returns under constraints. We conduct a comprehensive empirical comparison study with daily large cap U.S. stocks. Our optimal trading strategy obtains a consistently high out-of-sample Sharpe ratio and substantially outperforms all benchmark approaches. It is orthogonal to common risk factors, and exploits asymmetric local trend and reversion patterns. Our strategies remain profitable after taking into account trading frictions and costs. Our findings suggest a high compensation for arbitrageurs to enforce the law of one price.

Change-point Detection Methods for Body-Worn Video

Oct 20, 2016

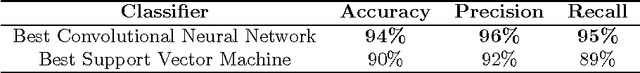

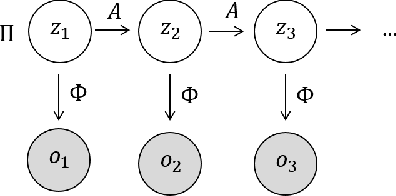

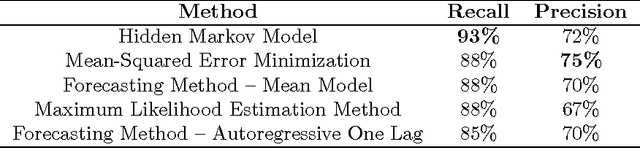

Abstract:Body-worn video (BWV) cameras are increasingly utilized by police departments to provide a record of police-public interactions. However, large-scale BWV deployment produces terabytes of data per week, necessitating the development of effective computational methods to identify salient changes in video. In work carried out at the 2016 RIPS program at IPAM, UCLA, we present a novel two-stage framework for video change-point detection. First, we employ state-of-the-art machine learning methods including convolutional neural networks and support vector machines for scene classification. We then develop and compare change-point detection algorithms utilizing mean squared-error minimization, forecasting methods, hidden Markov models, and maximum likelihood estimation to identify noteworthy changes. We test our framework on detection of vehicle exits and entrances in a BWV data set provided by the Los Angeles Police Department and achieve over 90% recall and nearly 70% precision -- demonstrating robustness to rapid scene changes, extreme luminance differences, and frequent camera occlusions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge