Dirk Witthaut

Multivariate Scenario Generation of Day-Ahead Electricity Prices using Normalizing Flows

Nov 23, 2023

Abstract:Trading on electricity markets requires accurate information about the realization of electricity prices and the uncertainty attached to the predictions. We present a probabilistic forecasting approach for day-ahead electricity prices using the fully data-driven deep generative model called normalizing flows. Our modeling approach generates full-day scenarios of day-ahead electricity prices based on conditional features such as residual load forecasts. Furthermore, we propose extended feature sets of prior realizations and a periodic retraining scheme that allows the normalizing flow to adapt to the changing conditions of modern electricity markets. In particular, we investigate the impact of the energy crisis ensuing from the Russian invasion of Ukraine. Our results highlight that the normalizing flow generates high-quality scenarios that reproduce the true price distribution and yield highly accurate forecasts. Additionally, our analysis highlights how our improvements towards adaptations in changing regimes allow the normalizing flow to adapt to changing market conditions and enables continued sampling of high-quality day-ahead price scenarios.

Probabilistic Forecasting of Day-Ahead Electricity Prices and their Volatility with LSTMs

Oct 05, 2023Abstract:Accurate forecasts of electricity prices are crucial for the management of electric power systems and the development of smart applications. European electricity prices have risen substantially and became highly volatile after the Russian invasion of Ukraine, challenging established forecasting methods. Here, we present a Long Short-Term Memory (LSTM) model for the German-Luxembourg day-ahead electricity prices addressing these challenges. The recurrent structure of the LSTM allows the model to adapt to trends, while the joint prediction of both mean and standard deviation enables a probabilistic prediction. Using a physics-inspired approach - superstatistics - to derive an explanation for the statistics of prices, we show that the LSTM model faithfully reproduces both prices and their volatility.

Identifying drivers and mitigators for congestion and redispatch in the German electric power system with explainable AI

Jul 24, 2023

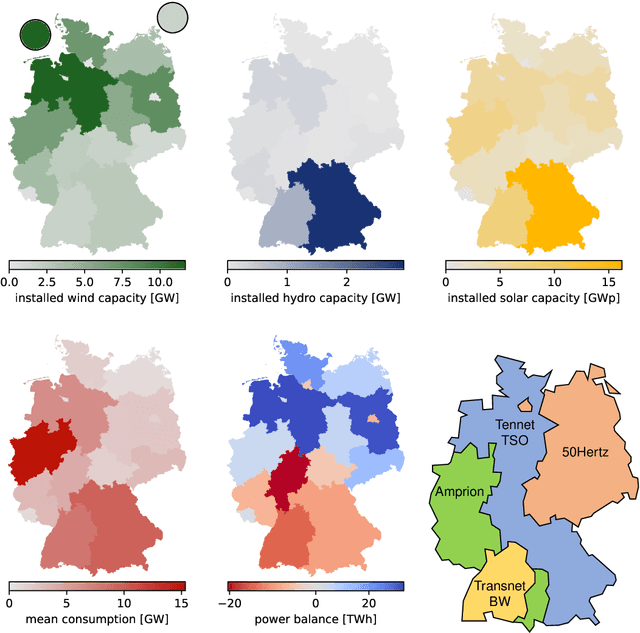

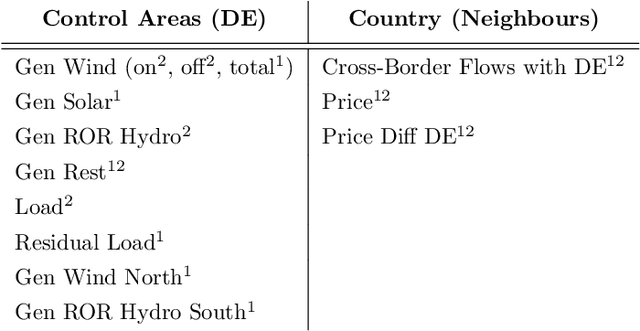

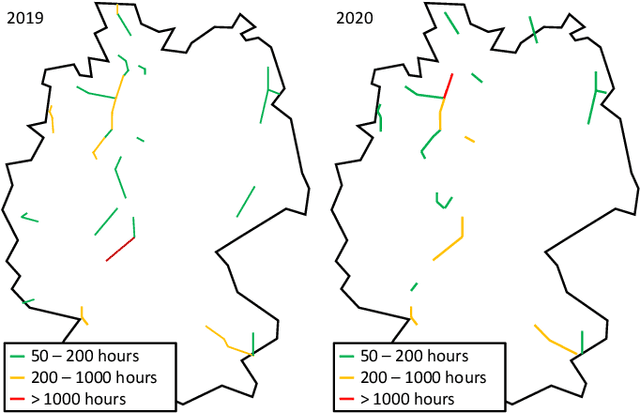

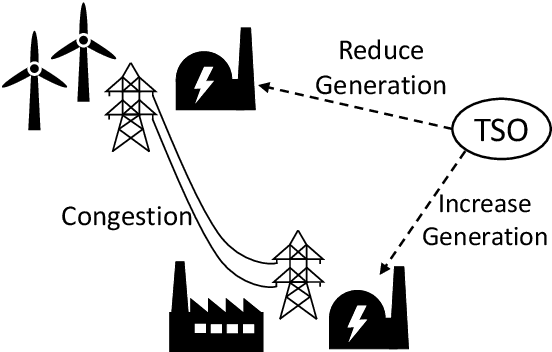

Abstract:The transition to a sustainable energy supply challenges the operation of electric power systems in manifold ways. Transmission grid loads increase as wind and solar power are often installed far away from the consumers. In extreme cases, system operators must intervene via countertrading or redispatch to ensure grid stability. In this article, we provide a data-driven analysis of congestion in the German transmission grid. We develop an explainable machine learning model to predict the volume of redispatch and countertrade on an hourly basis. The model reveals factors that drive or mitigate grid congestion and quantifies their impact. We show that, as expected, wind power generation is the main driver, but hydropower and cross-border electricity trading also play an essential role. Solar power, on the other hand, has no mitigating effect. Our results suggest that a change to the market design would alleviate congestion.

Understanding electricity prices beyond the merit order principle using explainable AI

Dec 09, 2022

Abstract:Electricity prices in liberalized markets are determined by the supply and demand for electric power, which are in turn driven by various external influences that vary strongly in time. In perfect competition, the merit order principle describes that dispatchable power plants enter the market in the order of their marginal costs to meet the residual load, i.e. the difference of load and renewable generation. Many market models implement this principle to predict electricity prices but typically require certain assumptions and simplifications. In this article, we present an explainable machine learning model for the prices on the German day-ahead market, which substantially outperforms a benchmark model based on the merit order principle. Our model is designed for the ex-post analysis of prices and thus builds on various external features. Using Shapley Additive exPlanation (SHAP) values, we can disentangle the role of the different features and quantify their importance from empiric data. Load, wind and solar generation are most important, as expected, but wind power appears to affect prices stronger than solar power does. Fuel prices also rank highly and show nontrivial dependencies, including strong interactions with other features revealed by a SHAP interaction analysis. Large generation ramps are correlated with high prices, again with strong feature interactions, due to the limited flexibility of nuclear and lignite plants. Our results further contribute to model development by providing quantitative insights directly from data.

Predicting Dynamic Stability from Static Features in Power Grid Models using Machine Learning

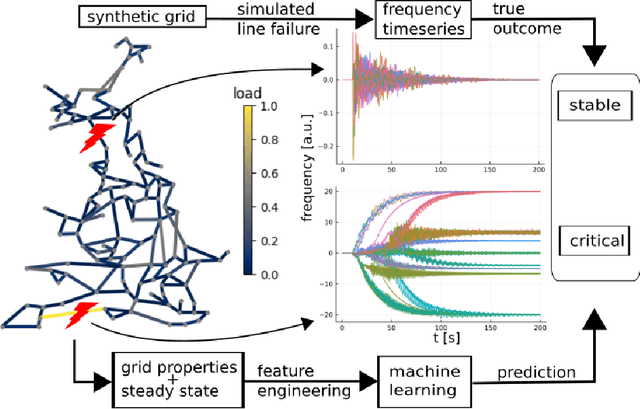

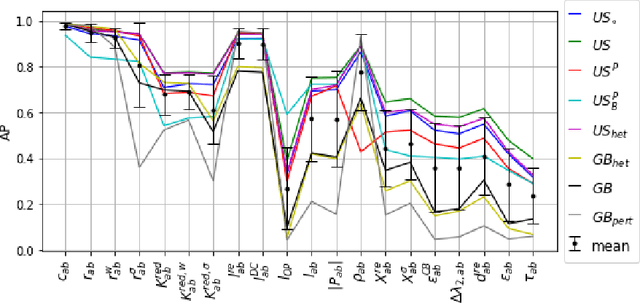

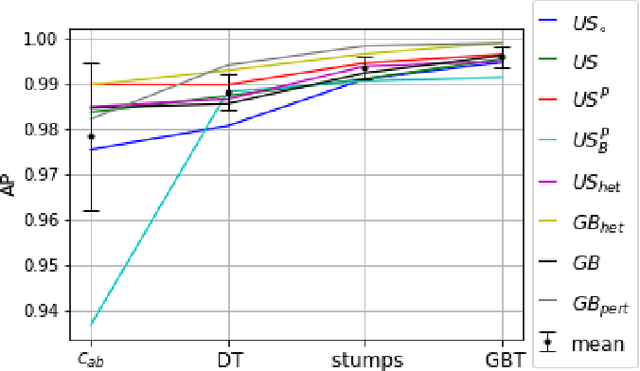

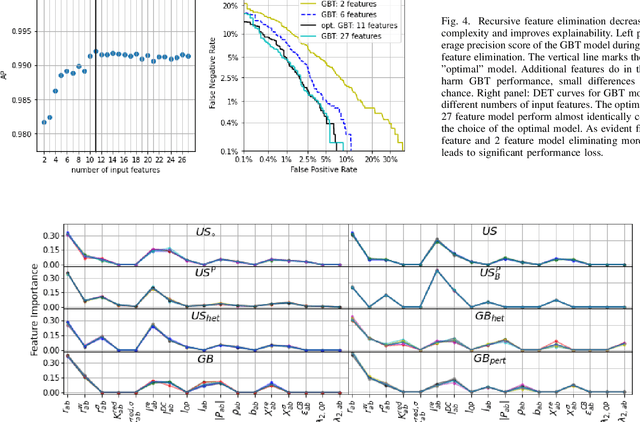

Oct 17, 2022

Abstract:A reliable supply with electric power is vital for our society. Transmission line failures are among the biggest threats for power grid stability as they may lead to a splitting of the grid into mutual asynchronous fragments. New conceptual methods are needed to assess system stability that complement existing simulation models. In this article we propose a combination of network science metrics and machine learning models to predict the risk of desynchronisation events. Network science provides metrics for essential properties of transmission lines such as their redundancy or centrality. Machine learning models perform inherent feature selection and thus reveal key factors that determine network robustness and vulnerability. As a case study, we train and test such models on simulated data from several synthetic test grids. We find that the integrated models are capable of predicting desynchronisation events after line failures with an average precision greater than $0.996$ when averaging over all data sets. Learning transfer between different data sets is generally possible, at a slight loss of prediction performance. Our results suggest that power grid desynchronisation is essentially governed by only a few network metrics that quantify the networks ability to reroute flow without creating exceedingly high static line loadings.

Predicting the power grid frequency of European islands

Sep 27, 2022

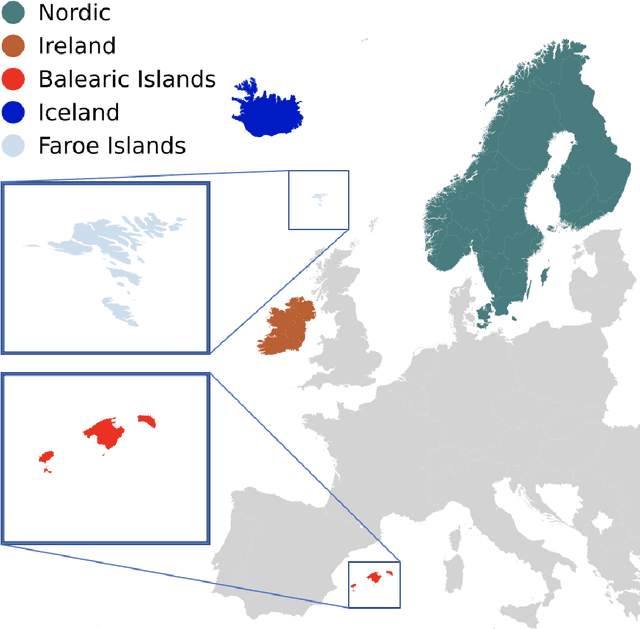

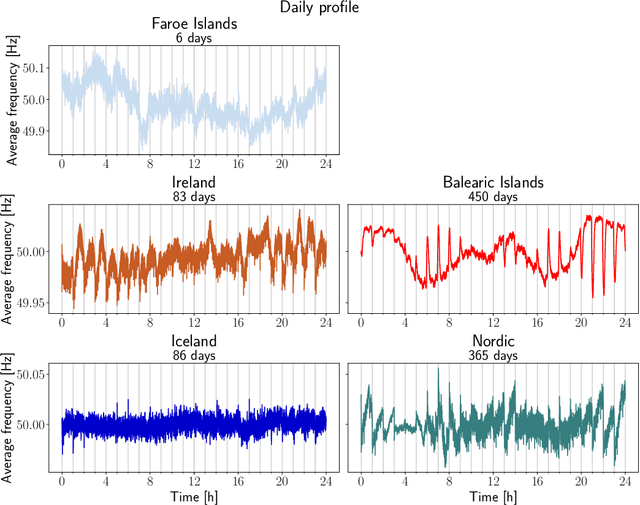

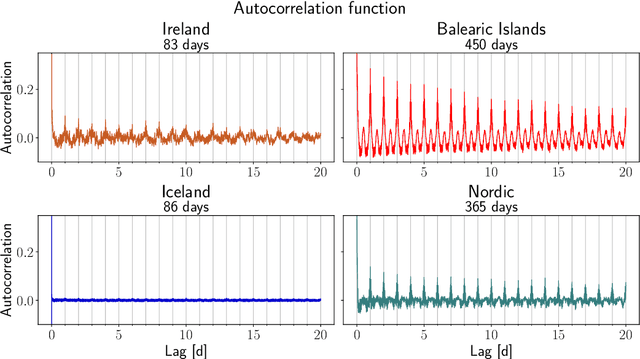

Abstract:Modelling, forecasting and overall understanding of the dynamics of the power grid and its frequency is essential for the safe operation of existing and future power grids. Much previous research was focused on large continental areas, while small systems, such as islands are less well-studied. These natural island systems are ideal testing environments for microgrid proposals and artificially islanded grid operation. In the present paper, we utilize measurements of the power grid frequency obtained in European islands: the Faroe Islands, Ireland, the Balearic Islands and Iceland and investigate how their frequency can be predicted, compared to the Nordic power system, acting as a reference. The Balearic islands are found to be particularly deterministic and easy to predict in contrast to hard-to-predict Iceland. Furthermore, we show that typically 2-4 weeks of data are needed to improve prediction performance beyond simple benchmarks.

Multivariate Probabilistic Forecasting of Intraday Electricity Prices using Normalizing Flows

May 27, 2022

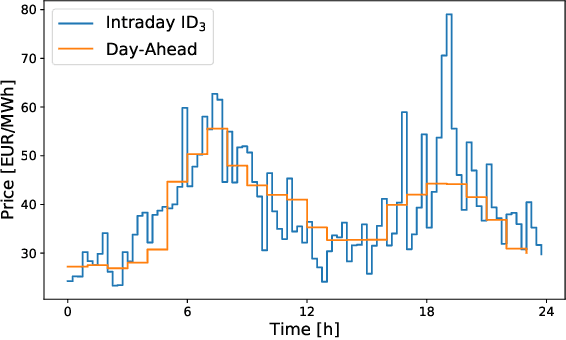

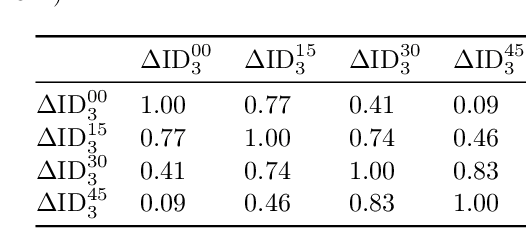

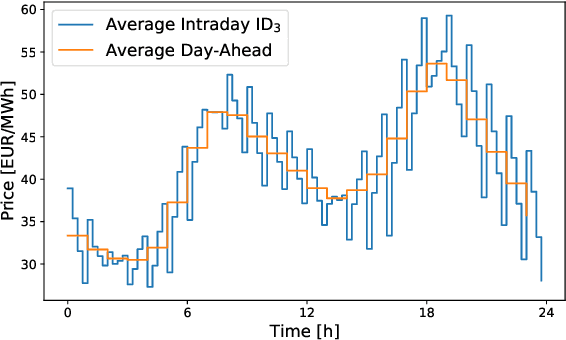

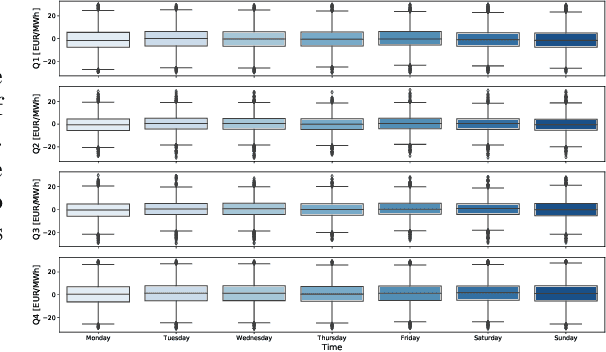

Abstract:Electricity is traded on various markets with different time horizons and regulations. Short-term trading becomes increasingly important due to higher penetration of renewables. In Germany, the intraday electricity price typically fluctuates around the day-ahead price of the EPEX spot markets in a distinct hourly pattern. This work proposes a probabilistic modeling approach that models the intraday price difference to the day-ahead contracts. The model captures the emerging hourly pattern by considering the four 15 min intervals in each day-ahead price interval as a four-dimensional joint distribution. The resulting nontrivial, multivariate price difference distribution is learned using a normalizing flow, i.e., a deep generative model that combines conditional multivariate density estimation and probabilistic regression. The normalizing flow is compared to a selection of historical data, a Gaussian copula, and a Gaussian regression model. Among the different models, the normalizing flow identifies the trends most accurately and has the narrowest prediction intervals. Notably, the normalizing flow is the only approach that identifies rare price peaks. Finally, this work discusses the influence of different external impact factors and finds that, individually, most of these factors have negligible impact. Only the immediate history of the price difference realization and the combination of all input factors lead to notable improvements in the forecasts.

Revealing interactions between HVDC cross-area flows and frequency stability with explainable AI

Apr 22, 2022

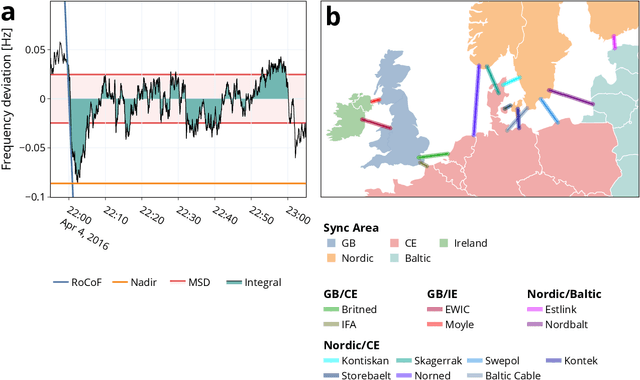

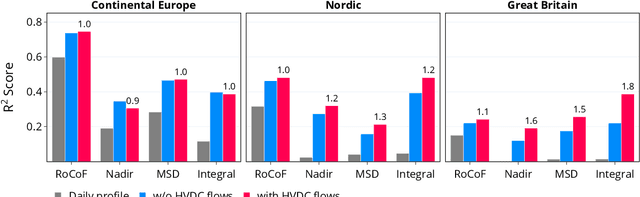

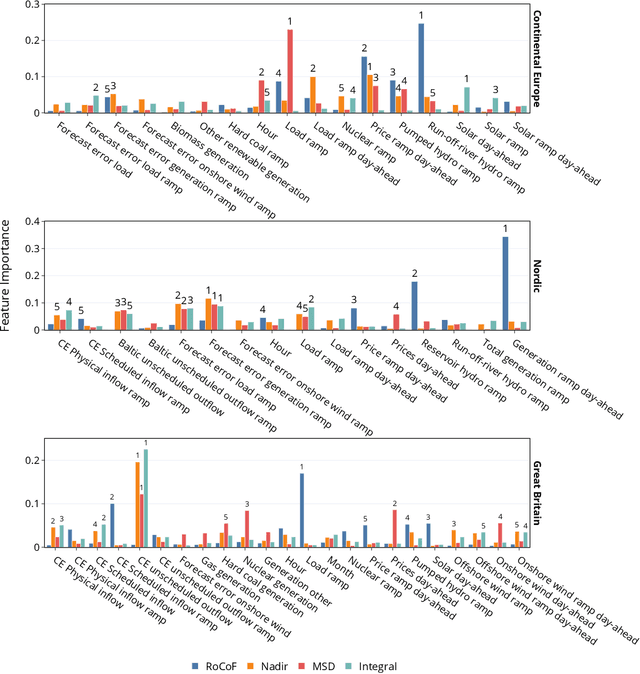

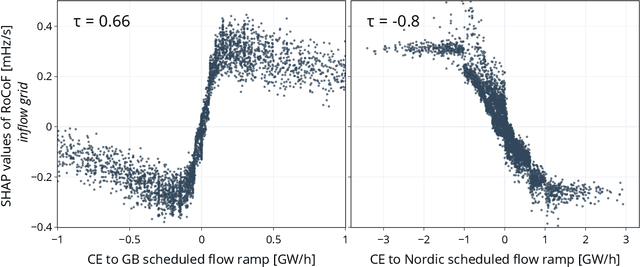

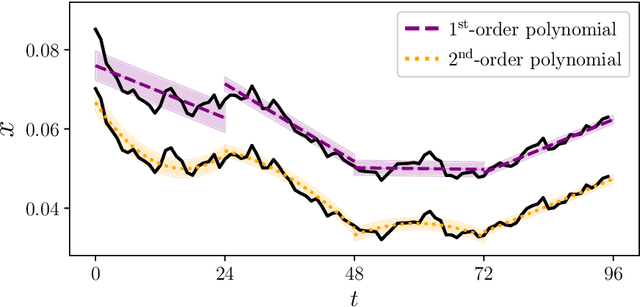

Abstract:The energy transition introduces more volatile energy sources into the power grids. In this context, power transfer between different synchronous areas through High Voltage Direct Current (HVDC) links becomes increasingly important. Such links can balance volatile generation by enabling long-distance transport or by leveraging their fast control behavior. Here, we investigate the interaction of power imbalances - represented through the power grid frequency - and power flows on HVDC links between synchronous areas in Europe. We use explainable machine learning to identify key dependencies and disentangle the interaction of critical features. Our results show that market-based HVDC flows introduce deterministic frequency deviations, which however can be mitigated through strict ramping limits. Moreover, varying HVDC operation modes strongly affect the interaction with the grid. In particular, we show that load-frequency control via HVDC links can both have control-like or disturbance-like impacts on frequency stability.

Validation Methods for Energy Time Series Scenarios from Deep Generative Models

Oct 27, 2021

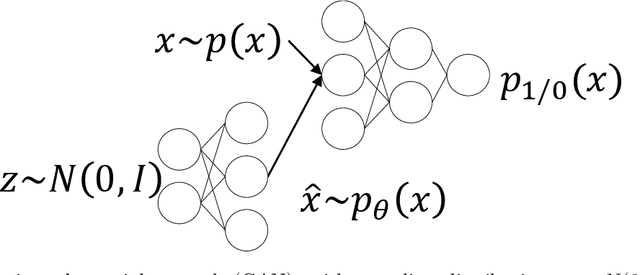

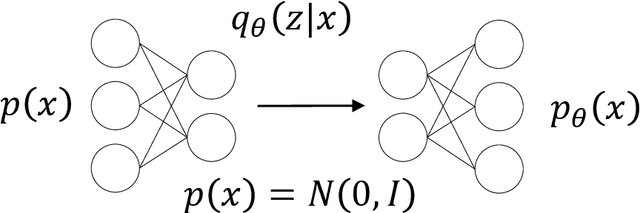

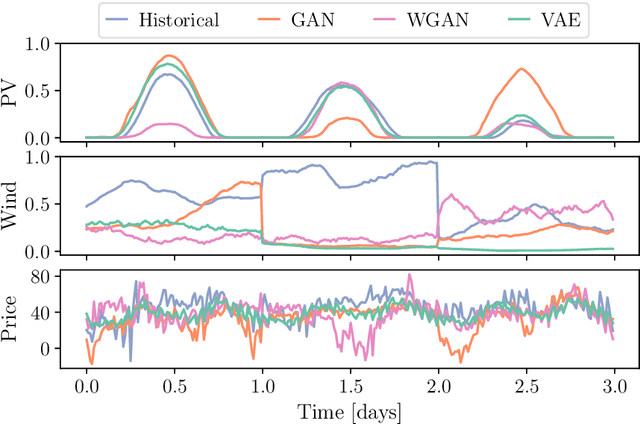

Abstract:The design and operation of modern energy systems are heavily influenced by time-dependent and uncertain parameters, e.g., renewable electricity generation, load-demand, and electricity prices. These are typically represented by a set of discrete realizations known as scenarios. A popular scenario generation approach uses deep generative models (DGM) that allow scenario generation without prior assumptions about the data distribution. However, the validation of generated scenarios is difficult, and a comprehensive discussion about appropriate validation methods is currently lacking. To start this discussion, we provide a critical assessment of the currently used validation methods in the energy scenario generation literature. In particular, we assess validation methods based on probability density, auto-correlation, and power spectral density. Furthermore, we propose using the multifractal detrended fluctuation analysis (MFDFA) as an additional validation method for non-trivial features like peaks, bursts, and plateaus. As representative examples, we train generative adversarial networks (GANs), Wasserstein GANs (WGANs), and variational autoencoders (VAEs) on two renewable power generation time series (photovoltaic and wind from Germany in 2013 to 2015) and an intra-day electricity price time series form the European Energy Exchange in 2017 to 2019. We apply the four validation methods to both the historical and the generated data and discuss the interpretation of validation results as well as common mistakes, pitfalls, and limitations of the validation methods. Our assessment shows that no single method sufficiently characterizes a scenario but ideally validation should include multiple methods and be interpreted carefully in the context of scenarios over short time periods.

Secondary control activation analysed and predicted with explainable AI

Sep 10, 2021

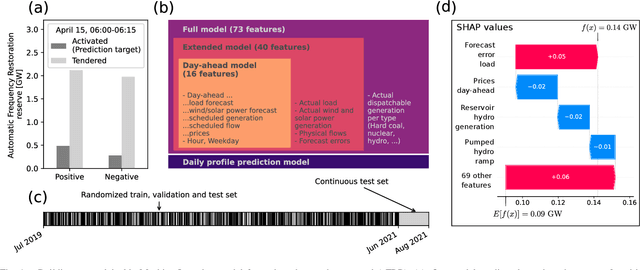

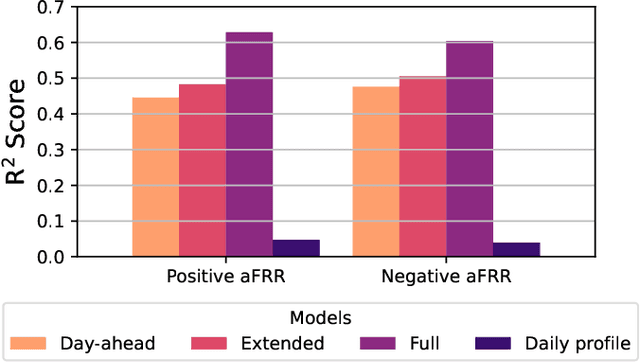

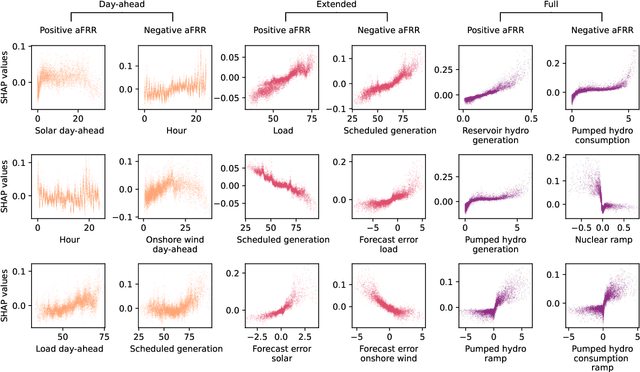

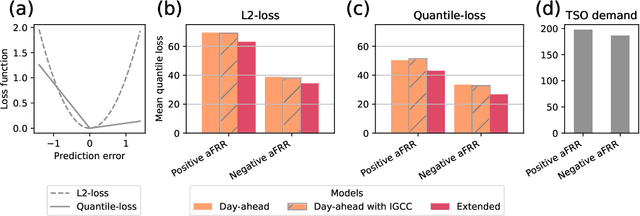

Abstract:The transition to a renewable energy system poses challenges for power grid operation and stability. Secondary control is key in restoring the power system to its reference following a disturbance. Underestimating the necessary control capacity may require emergency measures, such as load shedding. Hence, a solid understanding of the emerging risks and the driving factors of control is needed. In this contribution, we establish an explainable machine learning model for the activation of secondary control power in Germany. Training gradient boosted trees, we obtain an accurate description of control activation. Using SHapely Additive exPlanation (SHAP) values, we investigate the dependency between control activation and external features such as the generation mix, forecasting errors, and electricity market data. Thereby, our analysis reveals drivers that lead to high reserve requirements in the German power system. Our transparent approach, utilizing open data and making machine learning models interpretable, opens new scientific discovery avenues.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge