David Gunawan

Sub-band Domain Multi-Hypothesis Acoustic Echo Canceler Based Acoustic Scene Analysis

Jan 10, 2025

Abstract:This paper introduces a novel approach for acoustic scene analysis by exploiting an ensemble of statistics extracted from a sub-band domain multi-hypothesis acoustic echo canceler (SDMH-AEC). A well-designed SDMH-AEC employs multiple adaptive filtering strategies with potentially complementary behaviours during convergence, perturbations, and steady-state conditions. By aggregating statistics across the sub-bands, we derive a feature vector that exhibits strong discriminative power for distinguishing different acoustic events and estimating acoustic parameters. The complementary nature of the SDMH-AEC filters provides a rich source of information that can be extracted at insignificant cost for acoustic scene analysis tasks. We demonstrate the effectiveness of the proposed approach experimentally with real data containing double-talk, echo path change and events where the full-duplex device is physically moved. The extracted features enable acoustic scene analysis using existing echo cancellation algorithms and techniques.

DDSP-SFX: Acoustically-guided sound effects generation with differentiable digital signal processing

Sep 14, 2023

Abstract:Controlling the variations of sound effects using neural audio synthesis models has been a difficult task. Differentiable digital signal processing (DDSP) provides a lightweight solution that achieves high-quality sound synthesis while enabling deterministic acoustic attribute control by incorporating pre-processed audio features and digital synthesizers. In this research, we introduce DDSP-SFX, a model based on the DDSP architecture capable of synthesizing high-quality sound effects while enabling users to control the timbre variations easily. We propose a transient modelling technique with higher objective evaluation scores and subjective ratings over impulsive signals (footsteps, gunshots). We propose a simple method that achieves timbre variation control while also allowing deterministic attribute control. We further qualitatively show the timbre transfer performance using voice as the guiding sound.

A long short-term memory stochastic volatility model

Jun 07, 2019

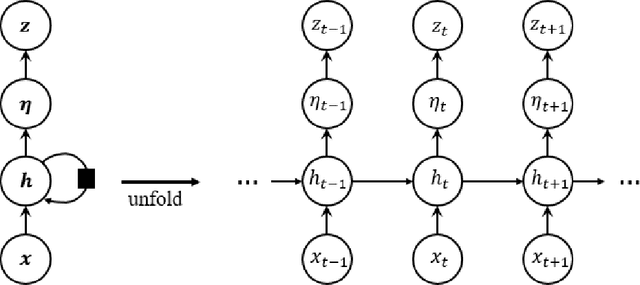

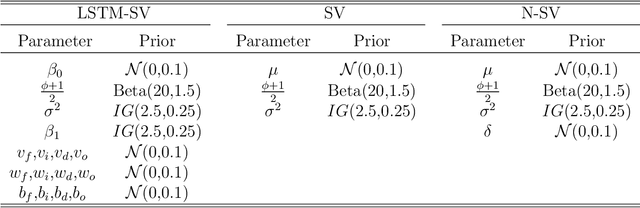

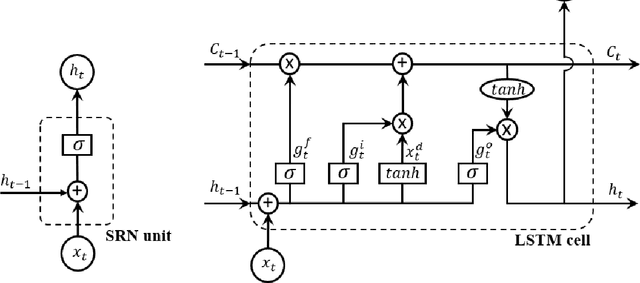

Abstract:Stochastic Volatility (SV) models are widely used in the financial sector while Long Short-Term Memory (LSTM) models have been successfully used in many large-scale industrial applications of Deep Learning. Our article combines these two methods non trivially and proposes a model for capturing the dynamics of financial volatility process, which we call the LSTM-SV model. The proposed model overcomes the short-term memory problem in conventional SV models, is able to capture non-linear dependence in the latent volatility process, and often has a better out-of-sample forecast performance than SV models. The conclusions are illustrated through simulation studies and applications to three financial time series datasets: US stock market weekly index SP500, Australian stock weekly index ASX200 and Australian-US dollar daily exchange rates. We argue that there are significant differences in the underlying dynamics between the volatility process of SP500 and ASX200 datasets and that of the exchange rate dataset. For the stock index data, there is strong evidence of long-term memory and non-linear dependence in the volatility process, while this is not the case for the exchange rates. An user-friendly software package together with the examples reported in the paper are available at https://github.com/vbayeslab.

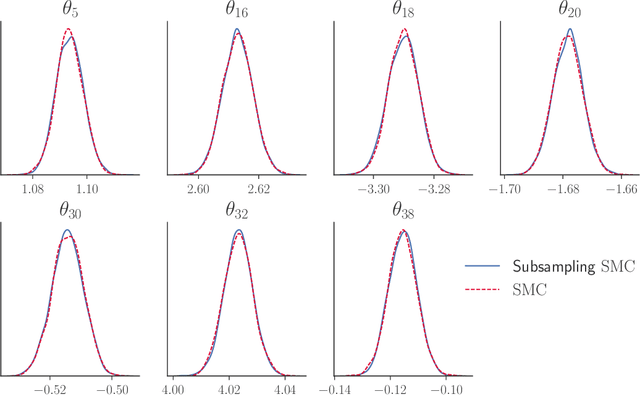

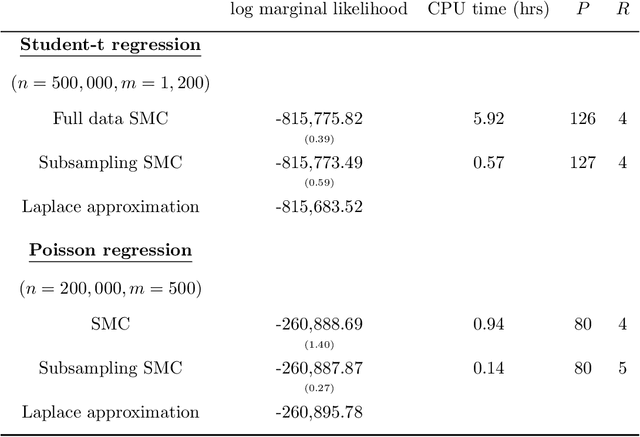

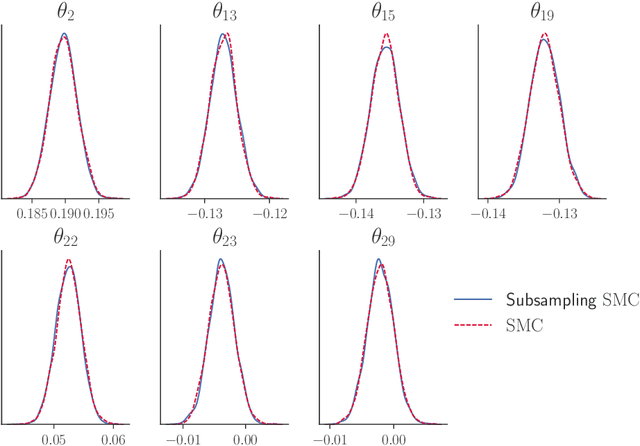

Subsampling Sequential Monte Carlo for Static Bayesian Models

May 08, 2018

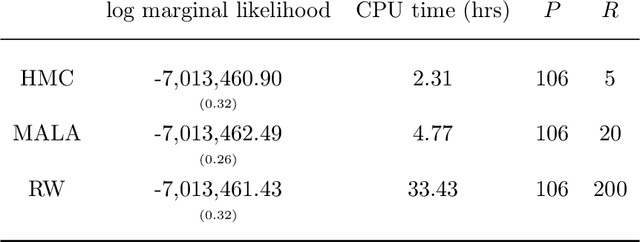

Abstract:Our article shows how to carry out Bayesian inference by combining data subsampling with Sequential Monte Carlo (SMC). This takes advantage of the attractive properties of SMC for Bayesian computations with the ability of subsampling to tackle big data problems. SMC sequentially updates a cloud of particles through a sequence of densities, beginning with a density that is easy to sample from such as the prior and ending with the posterior density. Each update of the particle cloud consists of three steps: reweighting, resampling, and moving. In the move step, each particle is moved using a Markov kernel and this is typically the most computationally expensive part, particularly when the dataset is large. It is crucial to have an efficient move step to ensure particle diversity. Our article makes two important contributions. First, in order to speed up the SMC computation, we use an approximately unbiased and efficient annealed likelihood estimator based on data subsampling. The subsampling approach is more memory efficient than the corresponding full data SMC, which is a great advantage for parallel computation. Second, we use a Metropolis within Gibbs kernel with two conditional updates. First, a Hamiltonian Monte Carlo update makes distant moves for the model parameters. Second, a block pseudo-marginal proposal is used for the particles corresponding to the auxiliary variables for the data subsampling. We demonstrate the usefulness of the methodology using two large datasets.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge