R. Kohn

Recurrent Conditional Heteroskedasticity

Oct 25, 2020

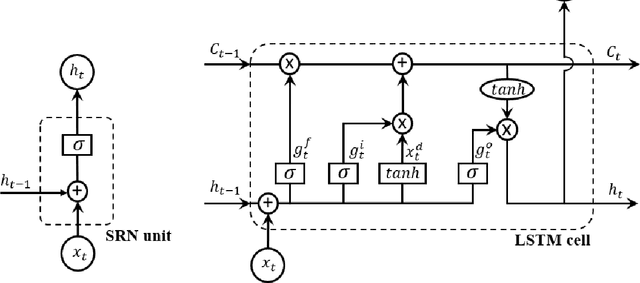

Abstract:We propose a new class of financial volatility models, which we call the REcurrent Conditional Heteroskedastic (RECH) models, to improve both the in-sample analysis and out-of-sample forecast performance of the traditional conditional heteroskedastic models. In particular, we incorporate auxiliary deterministic processes, governed by recurrent neural networks, into the conditional variance of the traditional conditional heteroskedastic models, e.g. the GARCH-type models, to flexibly capture the dynamics of the underlying volatility. The RECH models can detect interesting effects in financial volatility overlooked by the existing conditional heteroskedastic models such as the GARCH (Bollerslev, 1986), GJR (Glosten et al., 1993) and EGARCH (Nelson, 1991). The new models often have good out-of-sample forecasts while still explain well the stylized facts of financial volatility by retaining the well-established structures of the econometric GARCH-type models. These properties are illustrated through simulation studies and applications to four real stock index datasets. An user-friendly software package together with the examples reported in the paper are available at https://github.com/vbayeslab.

A long short-term memory stochastic volatility model

Jun 07, 2019

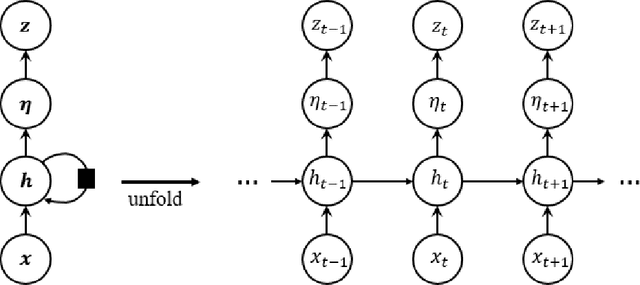

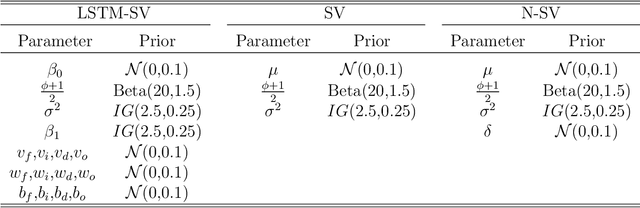

Abstract:Stochastic Volatility (SV) models are widely used in the financial sector while Long Short-Term Memory (LSTM) models have been successfully used in many large-scale industrial applications of Deep Learning. Our article combines these two methods non trivially and proposes a model for capturing the dynamics of financial volatility process, which we call the LSTM-SV model. The proposed model overcomes the short-term memory problem in conventional SV models, is able to capture non-linear dependence in the latent volatility process, and often has a better out-of-sample forecast performance than SV models. The conclusions are illustrated through simulation studies and applications to three financial time series datasets: US stock market weekly index SP500, Australian stock weekly index ASX200 and Australian-US dollar daily exchange rates. We argue that there are significant differences in the underlying dynamics between the volatility process of SP500 and ASX200 datasets and that of the exchange rate dataset. For the stock index data, there is strong evidence of long-term memory and non-linear dependence in the volatility process, while this is not the case for the exchange rates. An user-friendly software package together with the examples reported in the paper are available at https://github.com/vbayeslab.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge