Barna Pásztor

RewardUQ: A Unified Framework for Uncertainty-Aware Reward Models

Feb 27, 2026Abstract:Reward models are central to aligning large language models (LLMs) with human preferences. Yet most approaches rely on pointwise reward estimates that overlook the epistemic uncertainty in reward models arising from limited human feedback. Recent work suggests that quantifying this uncertainty can reduce the costs of human annotation via uncertainty-guided active learning and mitigate reward overoptimization in LLM post-training. However, uncertainty-aware reward models have so far been adopted without thorough comparison, leaving them poorly understood. This work introduces a unified framework, RewardUQ, to systematically evaluate uncertainty quantification for reward models. We compare common methods along standard metrics measuring accuracy and calibration, and we propose a new ranking strategy incorporating both dimensions for a simplified comparison. Our experimental results suggest that model size and initialization have the most meaningful impact on performance, and most prior work could have benefited from alternative design choices. To foster the development and evaluation of new methods and aid the deployment in downstream applications, we release our open-source framework as a Python package. Our code is available at https://github.com/lasgroup/rewarduq.

Stackelberg Learning from Human Feedback: Preference Optimization as a Sequential Game

Dec 18, 2025Abstract:We introduce Stackelberg Learning from Human Feedback (SLHF), a new framework for preference optimization. SLHF frames the alignment problem as a sequential-move game between two policies: a Leader, which commits to an action, and a Follower, which responds conditionally on the Leader's action. This approach decomposes preference optimization into a refinement problem for the Follower and an optimization problem against an adversary for the Leader. Unlike Reinforcement Learning from Human Feedback (RLHF), which assigns scalar rewards to actions, or Nash Learning from Human Feedback (NLHF), which seeks a simultaneous-move equilibrium, SLHF leverages the asymmetry of sequential play to capture richer preference structures. The sequential design of SLHF naturally enables inference-time refinement, as the Follower learns to improve the Leader's actions, and these refinements can be leveraged through iterative sampling. We compare the solution concepts of SLHF, RLHF, and NLHF, and lay out key advantages in consistency, data sensitivity, and robustness to intransitive preferences. Experiments on large language models demonstrate that SLHF achieves strong alignment across diverse preference datasets, scales from 0.5B to 8B parameters, and yields inference-time refinements that transfer across model families without further fine-tuning.

Ride-Sourcing Vehicle Rebalancing with Service Accessibility Guarantees via Constrained Mean-Field Reinforcement Learning

Mar 31, 2025Abstract:The rapid expansion of ride-sourcing services such as Uber, Lyft, and Didi Chuxing has fundamentally reshaped urban transportation by offering flexible, on-demand mobility via mobile applications. Despite their convenience, these platforms confront significant operational challenges, particularly vehicle rebalancing - the strategic repositioning of thousands of vehicles to address spatiotemporal mismatches in supply and demand. Inadequate rebalancing results in prolonged rider waiting times, inefficient vehicle utilization, and inequitable distribution of services, leading to disparities in driver availability and income. To tackle these complexities, we introduce scalable continuous-state mean-field control (MFC) and reinforcement learning (MFRL) models that explicitly represent each vehicle's precise location and employ continuous repositioning actions guided by the distribution of other vehicles. To ensure equitable service distribution, an accessibility constraint is integrated within our optimal control formulation, balancing operational efficiency with equitable access to the service across geographic regions. Our approach acknowledges realistic conditions, including inherent stochasticity in transitions, the simultaneous occurrence of vehicle-rider matching, vehicles' rebalancing and cruising, and variability in rider behaviors. Crucially, we relax the traditional mean-field assumption of equal supply-demand volume, better reflecting practical scenarios. Extensive empirical evaluation using real-world data-driven simulation of Shenzhen demonstrates the real-time efficiency and robustness of our approach at the scale of tens of thousands of vehicles. The code is available at https://github.com/mjusup1501/mf-vehicle-rebalancing.

Bandits with Preference Feedback: A Stackelberg Game Perspective

Jun 24, 2024

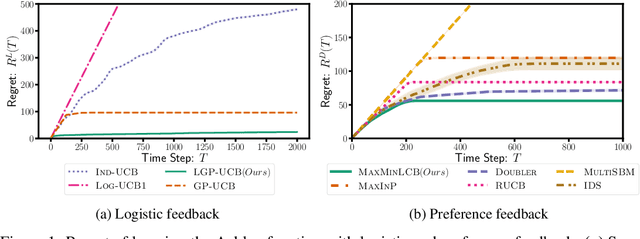

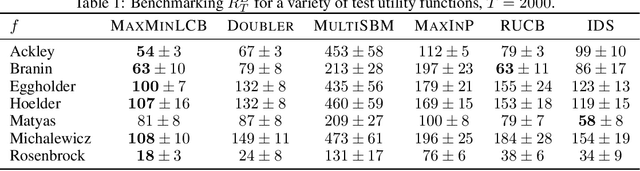

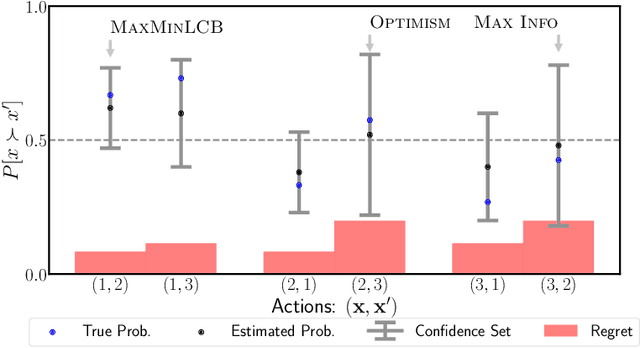

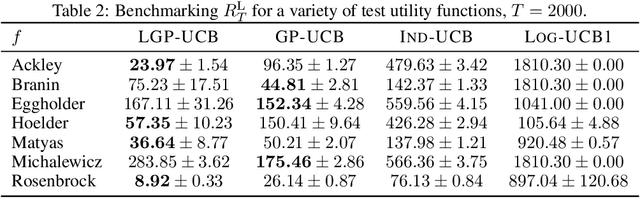

Abstract:Bandits with preference feedback present a powerful tool for optimizing unknown target functions when only pairwise comparisons are allowed instead of direct value queries. This model allows for incorporating human feedback into online inference and optimization and has been employed in systems for fine-tuning large language models. The problem is well understood in simplified settings with linear target functions or over finite small domains that limit practical interest. Taking the next step, we consider infinite domains and nonlinear (kernelized) rewards. In this setting, selecting a pair of actions is quite challenging and requires balancing exploration and exploitation at two levels: within the pair, and along the iterations of the algorithm. We propose MAXMINLCB, which emulates this trade-off as a zero-sum Stackelberg game, and chooses action pairs that are informative and yield favorable rewards. MAXMINLCB consistently outperforms existing algorithms and satisfies an anytime-valid rate-optimal regret guarantee. This is due to our novel preference-based confidence sequences for kernelized logistic estimators.

Safe Model-Based Multi-Agent Mean-Field Reinforcement Learning

Jun 29, 2023

Abstract:Many applications, e.g., in shared mobility, require coordinating a large number of agents. Mean-field reinforcement learning addresses the resulting scalability challenge by optimizing the policy of a representative agent. In this paper, we address an important generalization where there exist global constraints on the distribution of agents (e.g., requiring capacity constraints or minimum coverage requirements to be met). We propose Safe-$\text{M}^3$-UCRL, the first model-based algorithm that attains safe policies even in the case of unknown transition dynamics. As a key ingredient, it uses epistemic uncertainty in the transition model within a log-barrier approach to ensure pessimistic constraints satisfaction with high probability. We showcase Safe-$\text{M}^3$-UCRL on the vehicle repositioning problem faced by many shared mobility operators and evaluate its performance through simulations built on Shenzhen taxi trajectory data. Our algorithm effectively meets the demand in critical areas while ensuring service accessibility in regions with low demand.

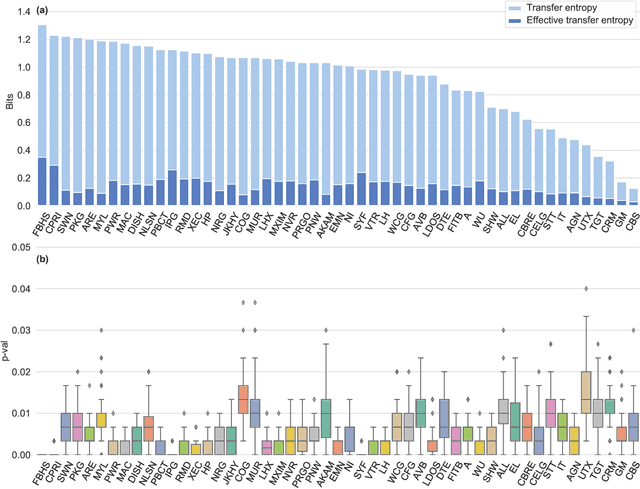

On the impact of publicly available news and information transfer to financial markets

Oct 22, 2020

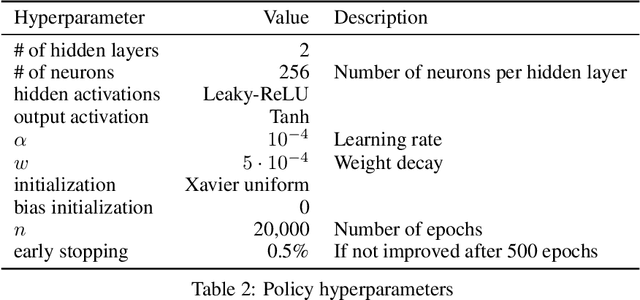

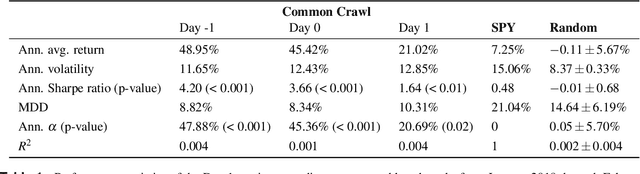

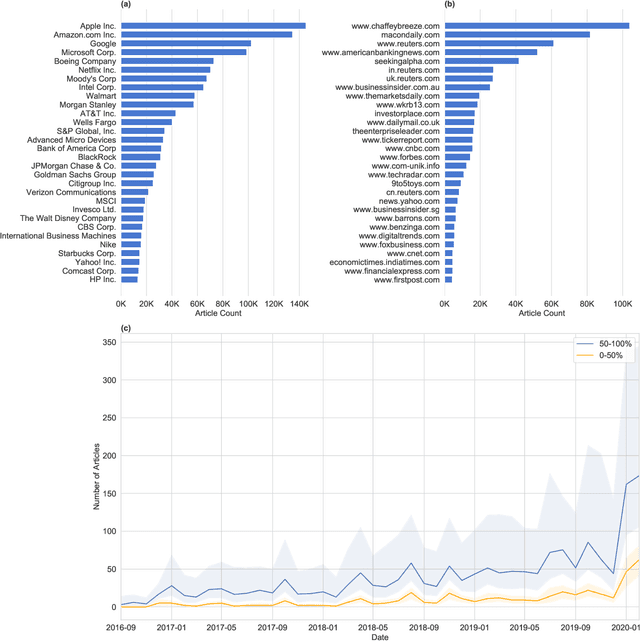

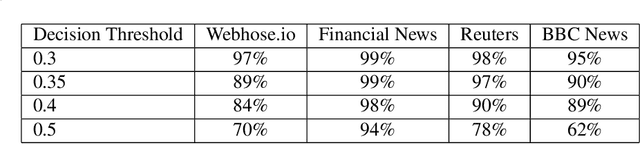

Abstract:We quantify the propagation and absorption of large-scale publicly available news articles from the World Wide Web to financial markets. To extract publicly available information, we use the news archives from the Common Crawl, a nonprofit organization that crawls a large part of the web. We develop a processing pipeline to identify news articles associated with the constituent companies in the S\&P 500 index, an equity market index that measures the stock performance of U.S. companies. Using machine learning techniques, we extract sentiment scores from the Common Crawl News data and employ tools from information theory to quantify the information transfer from public news articles to the U.S. stock market. Furthermore, we analyze and quantify the economic significance of the news-based information with a simple sentiment-based portfolio trading strategy. Our findings provides support for that information in publicly available news on the World Wide Web has a statistically and economically significant impact on events in financial markets.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge