Zhen Pan

Variance Reduced Local SGD with Lower Communication Complexity

Dec 30, 2019

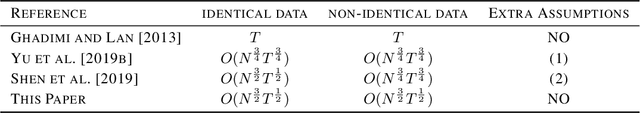

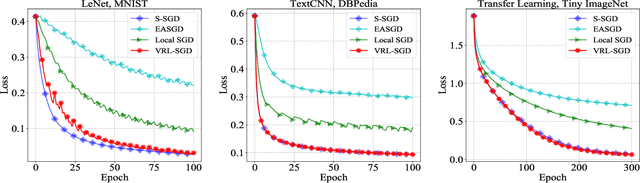

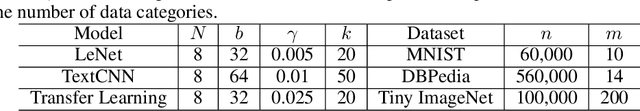

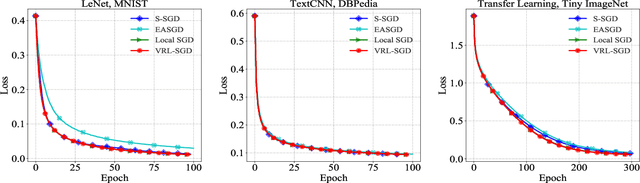

Abstract:To accelerate the training of machine learning models, distributed stochastic gradient descent (SGD) and its variants have been widely adopted, which apply multiple workers in parallel to speed up training. Among them, Local SGD has gained much attention due to its lower communication cost. Nevertheless, when the data distribution on workers is non-identical, Local SGD requires $O(T^{\frac{3}{4}} N^{\frac{3}{4}})$ communications to maintain its \emph{linear iteration speedup} property, where $T$ is the total number of iterations and $N$ is the number of workers. In this paper, we propose Variance Reduced Local SGD (VRL-SGD) to further reduce the communication complexity. Benefiting from eliminating the dependency on the gradient variance among workers, we theoretically prove that VRL-SGD achieves a \emph{linear iteration speedup} with a lower communication complexity $O(T^{\frac{1}{2}} N^{\frac{3}{2}})$ even if workers access non-identical datasets. We conduct experiments on three machine learning tasks, and the experimental results demonstrate that VRL-SGD performs impressively better than Local SGD when the data among workers are quite diverse.

Crowdfunding Dynamics Tracking: A Reinforcement Learning Approach

Dec 27, 2019

Abstract:Recent years have witnessed the increasing interests in research of crowdfunding mechanism. In this area, dynamics tracking is a significant issue but is still under exploration. Existing studies either fit the fluctuations of time-series or employ regularization terms to constrain learned tendencies. However, few of them take into account the inherent decision-making process between investors and crowdfunding dynamics. To address the problem, in this paper, we propose a Trajectory-based Continuous Control for Crowdfunding (TC3) algorithm to predict the funding progress in crowdfunding. Specifically, actor-critic frameworks are employed to model the relationship between investors and campaigns, where all of the investors are viewed as an agent that could interact with the environment derived from the real dynamics of campaigns. Then, to further explore the in-depth implications of patterns (i.e., typical characters) in funding series, we propose to subdivide them into $\textit{fast-growing}$ and $\textit{slow-growing}$ ones. Moreover, for the purpose of switching from different kinds of patterns, the actor component of TC3 is extended with a structure of options, which comes to the TC3-Options. Finally, extensive experiments on the Indiegogo dataset not only demonstrate the effectiveness of our methods, but also validate our assumption that the entire pattern learned by TC3-Options is indeed the U-shaped one.

Estimating Early Fundraising Performance of Innovations via Graph-based Market Environment Model

Dec 14, 2019

Abstract:Well begun is half done. In the crowdfunding market, the early fundraising performance of the project is a concerned issue for both creators and platforms. However, estimating the early fundraising performance before the project published is very challenging and still under-explored. To that end, in this paper, we present a focused study on this important problem in a market modeling view. Specifically, we propose a Graph-based Market Environment model (GME) for estimating the early fundraising performance of the target project by exploiting the market environment. In addition, we discriminatively model the market competition and market evolution by designing two graph-based neural network architectures and incorporating them into the joint optimization stage. Finally, we conduct extensive experiments on the real-world crowdfunding data collected from Indiegogo.com. The experimental results clearly demonstrate the effectiveness of our proposed model for modeling and estimating the early fundraising performance of the target project.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge