Wee Ling Tan

Deep Learning for Options Trading: An End-To-End Approach

Jul 31, 2024

Abstract:We introduce a novel approach to options trading strategies using a highly scalable and data-driven machine learning algorithm. In contrast to traditional approaches that often require specifications of underlying market dynamics or assumptions on an option pricing model, our models depart fundamentally from the need for these prerequisites, directly learning non-trivial mappings from market data to optimal trading signals. Backtesting on more than a decade of option contracts for equities listed on the S&P 100, we demonstrate that deep learning models trained according to our end-to-end approach exhibit significant improvements in risk-adjusted performance over existing rules-based trading strategies. We find that incorporating turnover regularization into the models leads to further performance enhancements at prohibitively high levels of transaction costs.

Spatio-Temporal Momentum: Jointly Learning Time-Series and Cross-Sectional Strategies

Feb 20, 2023

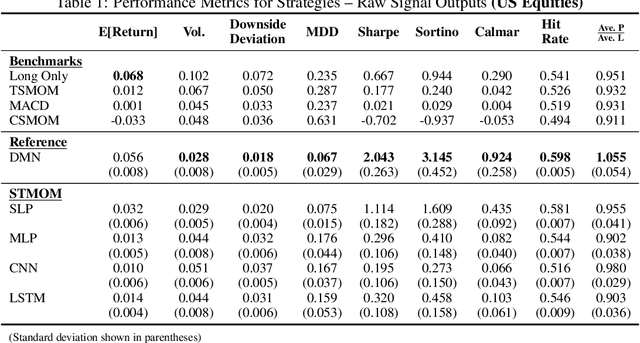

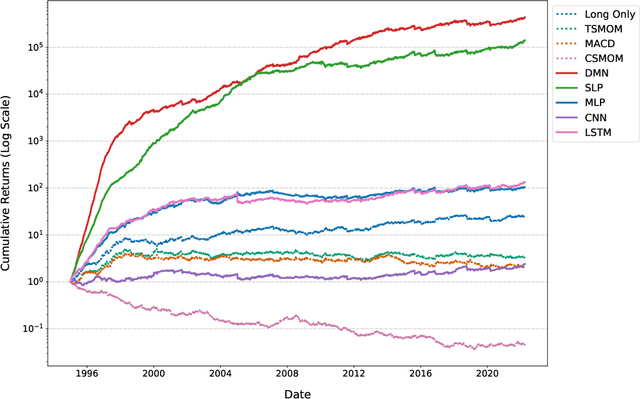

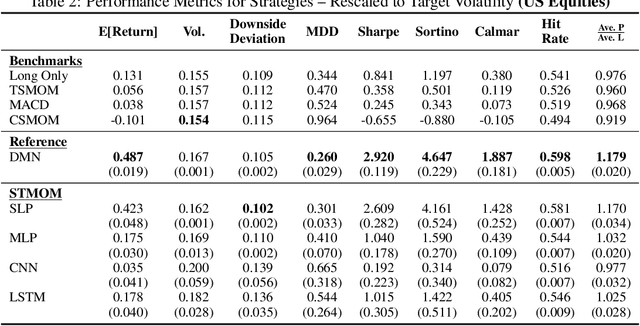

Abstract:We introduce Spatio-Temporal Momentum strategies, a class of models that unify both time-series and cross-sectional momentum strategies by trading assets based on their cross-sectional momentum features over time. While both time-series and cross-sectional momentum strategies are designed to systematically capture momentum risk premia, these strategies are regarded as distinct implementations and do not consider the concurrent relationship and predictability between temporal and cross-sectional momentum features of different assets. We model spatio-temporal momentum with neural networks of varying complexities and demonstrate that a simple neural network with only a single fully connected layer learns to simultaneously generate trading signals for all assets in a portfolio by incorporating both their time-series and cross-sectional momentum features. Backtesting on portfolios of 46 actively-traded US equities and 12 equity index futures contracts, we demonstrate that the model is able to retain its performance over benchmarks in the presence of high transaction costs of up to 5-10 basis points. In particular, we find that the model when coupled with least absolute shrinkage and turnover regularization results in the best performance over various transaction cost scenarios.

ADATIME: A Benchmarking Suite for Domain Adaptation on Time Series Data

Mar 15, 2022

Abstract:Unsupervised domain adaptation methods aim to generalize well on unlabeled test data that may have a different (shifted) distribution from the training data. Such methods are typically developed on image data, and their application to time series data is less explored. Existing works on time series domain adaptation suffer from inconsistencies in evaluation schemes, datasets, and backbone neural network architectures. Moreover, labeled target data are usually employed for model selection, which violates the fundamental assumption of unsupervised domain adaptation. To address these issues, we develop a benchmarking evaluation suite (ADATIME) to systematically and fairly evaluate different domain adaptation methods on time series data. Specifically, we standardize the backbone neural network architectures and benchmarking datasets, while also exploring more realistic model selection approaches that can work with no labeled data or just few labeled samples. Our evaluation includes adapting state-of-the-art visual domain adaptation methods to time series data in addition to the recent methods specifically developed for time series data. We conduct extensive experiments to evaluate 10 state-of-the-art methods on four representative datasets spanning 20 cross-domain scenarios. Our results suggest that with careful selection of hyper-parameters, visual domain adaptation methods are competitive with methods proposed for time series domain adaptation. In addition, we find that hyper-parameters could be selected based on realistic model selection approaches. Our work unveils practical insights for applying domain adaptation methods on time series data and builds a solid foundation for future works in the field. The code is available at \href{https://github.com/emadeldeen24/AdaTime}{github.com/emadeldeen24/AdaTime}.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge