Spatio-Temporal Momentum: Jointly Learning Time-Series and Cross-Sectional Strategies

Paper and Code

Feb 20, 2023

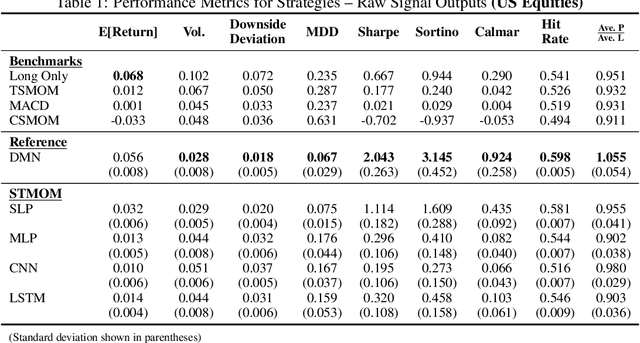

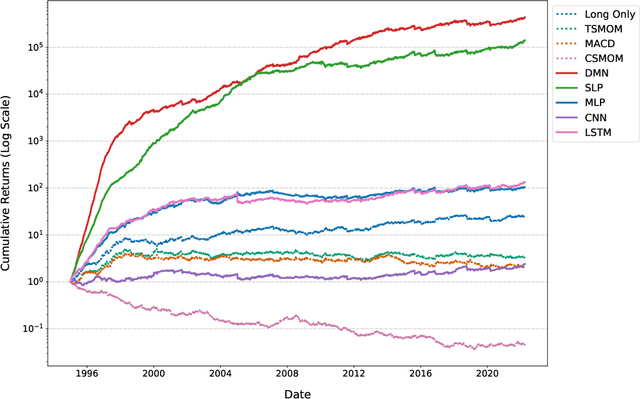

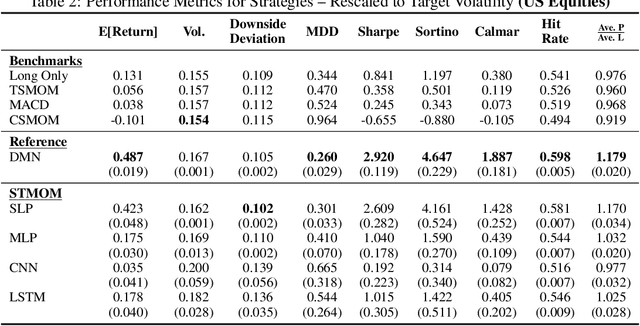

We introduce Spatio-Temporal Momentum strategies, a class of models that unify both time-series and cross-sectional momentum strategies by trading assets based on their cross-sectional momentum features over time. While both time-series and cross-sectional momentum strategies are designed to systematically capture momentum risk premia, these strategies are regarded as distinct implementations and do not consider the concurrent relationship and predictability between temporal and cross-sectional momentum features of different assets. We model spatio-temporal momentum with neural networks of varying complexities and demonstrate that a simple neural network with only a single fully connected layer learns to simultaneously generate trading signals for all assets in a portfolio by incorporating both their time-series and cross-sectional momentum features. Backtesting on portfolios of 46 actively-traded US equities and 12 equity index futures contracts, we demonstrate that the model is able to retain its performance over benchmarks in the presence of high transaction costs of up to 5-10 basis points. In particular, we find that the model when coupled with least absolute shrinkage and turnover regularization results in the best performance over various transaction cost scenarios.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge