Song Zuo

Accelerating Scientific Research with Gemini: Case Studies and Common Techniques

Feb 03, 2026Abstract:Recent advances in large language models (LLMs) have opened new avenues for accelerating scientific research. While models are increasingly capable of assisting with routine tasks, their ability to contribute to novel, expert-level mathematical discovery is less understood. We present a collection of case studies demonstrating how researchers have successfully collaborated with advanced AI models, specifically Google's Gemini-based models (in particular Gemini Deep Think and its advanced variants), to solve open problems, refute conjectures, and generate new proofs across diverse areas in theoretical computer science, as well as other areas such as economics, optimization, and physics. Based on these experiences, we extract common techniques for effective human-AI collaboration in theoretical research, such as iterative refinement, problem decomposition, and cross-disciplinary knowledge transfer. While the majority of our results stem from this interactive, conversational methodology, we also highlight specific instances that push beyond standard chat interfaces. These include deploying the model as a rigorous adversarial reviewer to detect subtle flaws in existing proofs, and embedding it within a "neuro-symbolic" loop that autonomously writes and executes code to verify complex derivations. Together, these examples highlight the potential of AI not just as a tool for automation, but as a versatile, genuine partner in the creative process of scientific discovery.

Procurement Auctions via Approximately Optimal Submodular Optimization

Nov 20, 2024Abstract:We study procurement auctions, where an auctioneer seeks to acquire services from strategic sellers with private costs. The quality of services is measured by a submodular function known to the auctioneer. Our goal is to design computationally efficient procurement auctions that (approximately) maximize the difference between the quality of the acquired services and the total cost of the sellers, while ensuring incentive compatibility (IC), individual rationality (IR) for sellers, and non-negative surplus (NAS) for the auctioneer. Our contributions are twofold: (i) we provide an improved analysis of existing algorithms for non-positive submodular function maximization, and (ii) we design efficient frameworks that transform submodular optimization algorithms into mechanisms that are IC, IR, NAS, and approximation-preserving. These frameworks apply to both the offline setting, where all sellers' bids and services are available simultaneously, and the online setting, where sellers arrive in an adversarial order, requiring the auctioneer to make irrevocable decisions. We also explore whether state-of-the-art submodular optimization algorithms can be converted into descending auctions in adversarial settings, where the schedule of descending prices is determined by an adversary. We show that a submodular optimization algorithm satisfying bi-criteria $(1/2, 1)$-approximation in welfare can be effectively adapted to a descending auction. Additionally, we establish a connection between descending auctions and online submodular optimization. Finally, we demonstrate the practical applications of our frameworks by instantiating them with state-of-the-art submodular optimization algorithms and empirically comparing their welfare performance on publicly available datasets with thousands of sellers.

Computer-aided mechanism design: designing revenue-optimal mechanisms via neural networks

May 09, 2018

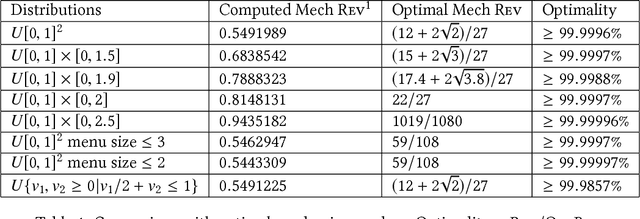

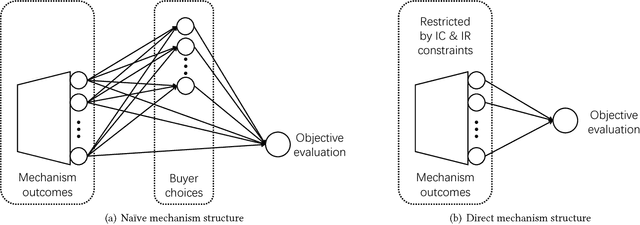

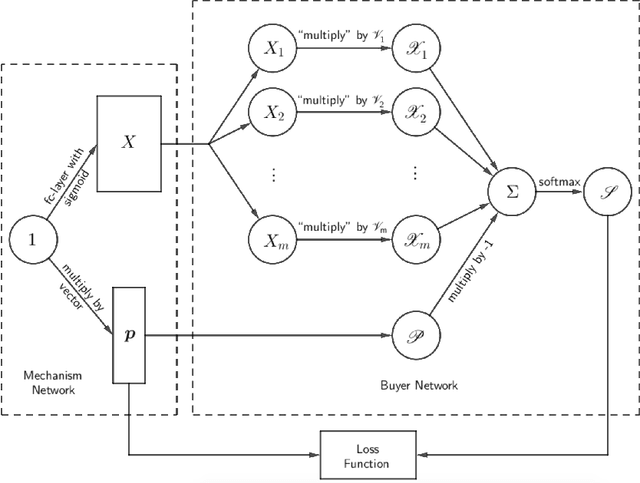

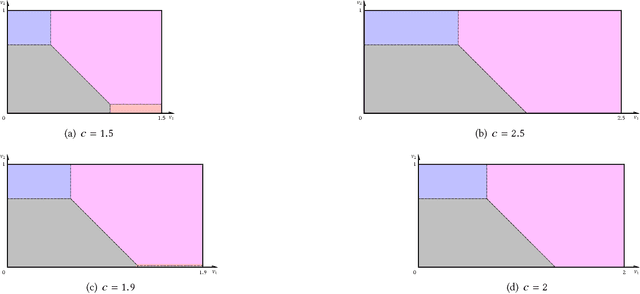

Abstract:Using AI approaches to automatically design mechanisms has been a central research mission at the interface of AI and economics [Conitzer and Sandholm, 2002]. Previous approaches that a empt to design revenue optimal auctions for the multi-dimensional settings fall short in at least one of the three aspects: 1) representation --- search in a space that probably does not even contain the optimal mechanism; 2) exactness --- finding a mechanism that is either not truthful or far from optimal; 3) domain dependence --- need a different design for different environment settings. To resolve the three difficulties, in this paper, we put forward a uni ed neural network based framework that automatically learns to design revenue optimal mechanisms. Our framework consists of a mechanism network that takes an input distribution for training and outputs a mechanism, as well as a buyer network that takes a mechanism as input and output an action. Such a separation in design mitigates the difficulty to impose incentive compatibility constraints on the mechanism, by making it a rational choice of the buyer. As a result, our framework easily overcomes the previously mentioned difficulty in incorporating IC constraints and always returns exactly incentive compatible mechanisms. We then applied our framework to a number of multi-item revenue optimal design settings, for a few of which the theoretically optimal mechanisms are unknown. We then go on to theoretically prove that the mechanisms found by our framework are indeed optimal.

Optimal Vehicle Dispatching Schemes via Dynamic Pricing

Mar 01, 2018

Abstract:Over the past few years, ride-sharing has emerged as an effective way to relieve traffic congestion. A key problem for these platforms is to come up with a revenue-optimal (or GMV-optimal) pricing scheme and an induced vehicle dispatching policy that incorporate geographic and temporal information. In this paper, we aim to tackle this problem via an economic approach. Modeled naively, the underlying optimization problem may be non-convex and thus hard to compute. To this end, we use a so-called "ironing" technique to convert the problem into an equivalent convex optimization one via a clean Markov decision process (MDP) formulation, where the states are the driver distributions and the decision variables are the prices for each pair of locations. Our main finding is an efficient algorithm that computes the exact revenue-optimal (or GMV-optimal) randomized pricing schemes. We characterize the optimal solution of the MDP by a primal-dual analysis of a corresponding convex program. We also conduct empirical evaluations of our solution through real data of a major ride-sharing platform and show its advantages over fixed pricing schemes as well as several prevalent surge-based pricing schemes.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge