Qiangqiang Liu

Detecting Sybil Addresses in Blockchain Airdrops: A Subgraph-based Feature Propagation and Fusion Approach

May 14, 2025Abstract:Sybil attacks pose a significant security threat to blockchain ecosystems, particularly in token airdrop events. This paper proposes a novel sybil address identification method based on subgraph feature extraction lightGBM. The method first constructs a two-layer deep transaction subgraph for each address, then extracts key event operation features according to the lifecycle of sybil addresses, including the time of first transaction, first gas acquisition, participation in airdrop activities, and last transaction. These temporal features effectively capture the consistency of sybil address behavior operations. Additionally, the method extracts amount and network structure features, comprehensively describing address behavior patterns and network topology through feature propagation and fusion. Experiments conducted on a dataset containing 193,701 addresses (including 23,240 sybil addresses) show that this method outperforms existing approaches in terms of precision, recall, F1 score, and AUC, with all metrics exceeding 0.9. The methods and results of this study can be further applied to broader blockchain security areas such as transaction manipulation identification and token liquidity risk assessment, contributing to the construction of a more secure and fair blockchain ecosystem.

Coordinate-Based Neural Representation Enabling Zero-Shot Learning for 3D Multiparametric Quantitative MRI

Oct 02, 2024

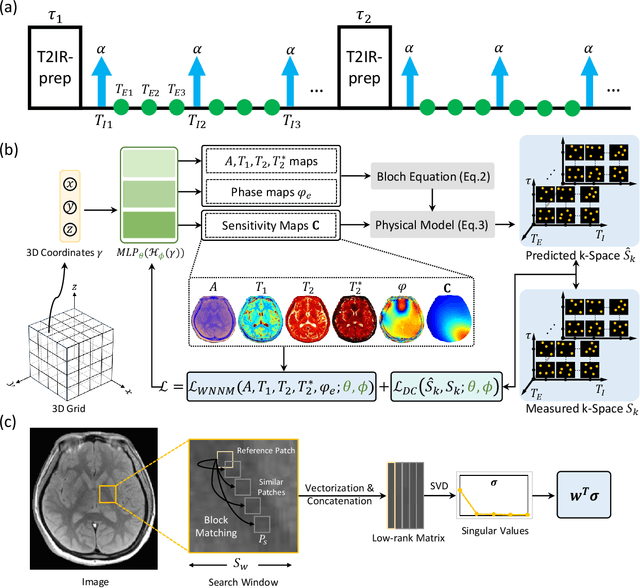

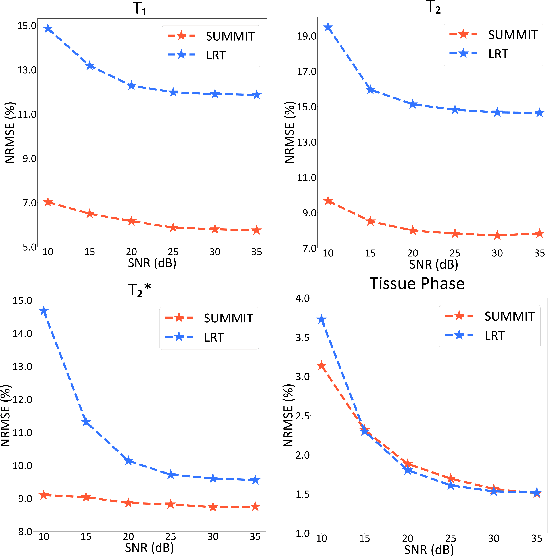

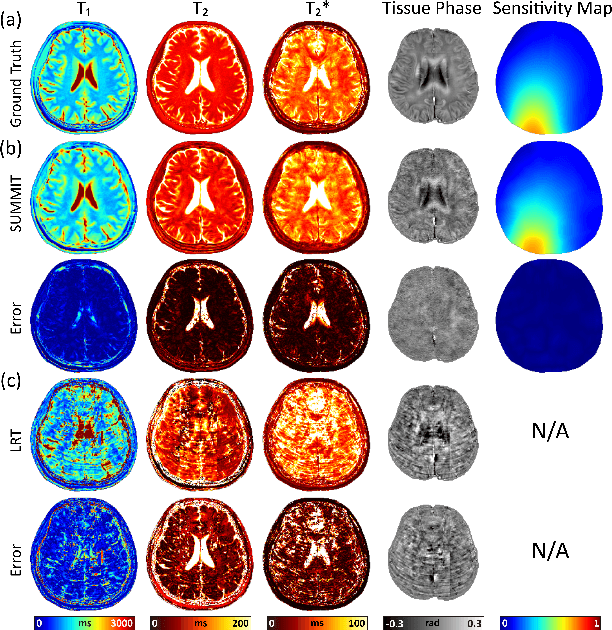

Abstract:Quantitative magnetic resonance imaging (qMRI) offers tissue-specific physical parameters with significant potential for neuroscience research and clinical practice. However, lengthy scan times for 3D multiparametric qMRI acquisition limit its clinical utility. Here, we propose SUMMIT, an innovative imaging methodology that includes data acquisition and an unsupervised reconstruction for simultaneous multiparametric qMRI. SUMMIT first encodes multiple important quantitative properties into highly undersampled k-space. It further leverages implicit neural representation incorporated with a dedicated physics model to reconstruct the desired multiparametric maps without needing external training datasets. SUMMIT delivers co-registered T1, T2, T2*, and quantitative susceptibility mapping. Extensive simulations and phantom imaging demonstrate SUMMIT's high accuracy. Additionally, the proposed unsupervised approach for qMRI reconstruction also introduces a novel zero-shot learning paradigm for multiparametric imaging applicable to various medical imaging modalities.

Inspecting the Process of Bank Credit Rating via Visual Analytics

Aug 06, 2021

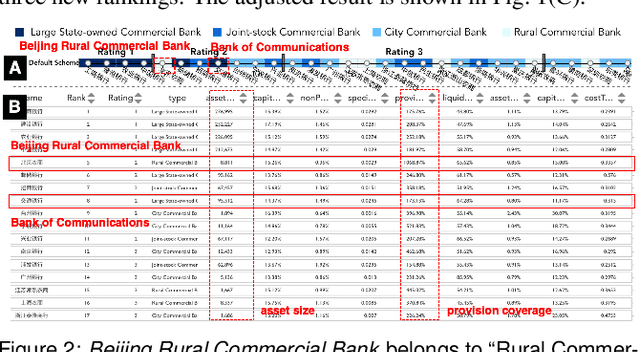

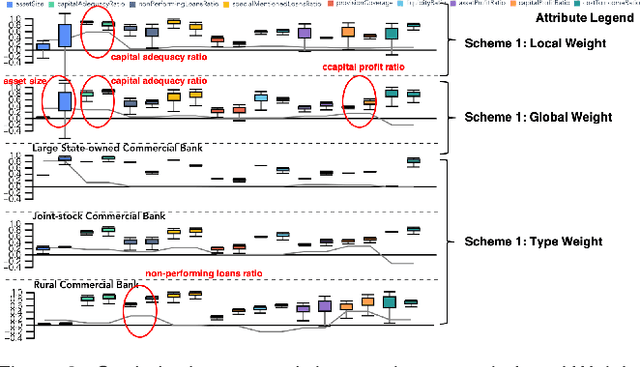

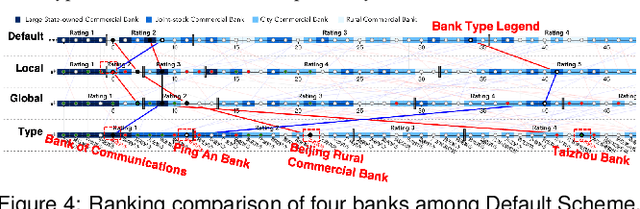

Abstract:Bank credit rating classifies banks into different levels based on publicly disclosed and internal information, serving as an important input in financial risk management. However, domain experts have a vague idea of exploring and comparing different bank credit rating schemes. A loose connection between subjective and quantitative analysis and difficulties in determining appropriate indicator weights obscure understanding of bank credit ratings. Furthermore, existing models fail to consider bank types by just applying a unified indicator weight set to all banks. We propose RatingVis to assist experts in exploring and comparing different bank credit rating schemes. It supports interactively inferring indicator weights for banks by involving domain knowledge and considers bank types in the analysis loop. We conduct a case study with real-world bank data to verify the efficacy of RatingVis. Expert feedback suggests that our approach helps them better understand different rating schemes.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge