Pengbin Feng

NeRF-Based defect detection

Mar 31, 2025Abstract:The rapid growth of industrial automation has highlighted the need for precise and efficient defect detection in large-scale machinery. Traditional inspection techniques, involving manual procedures such as scaling tall structures for visual evaluation, are labor-intensive, subjective, and often hazardous. To overcome these challenges, this paper introduces an automated defect detection framework built on Neural Radiance Fields (NeRF) and the concept of digital twins. The system utilizes UAVs to capture images and reconstruct 3D models of machinery, producing both a standard reference model and a current-state model for comparison. Alignment of the models is achieved through the Iterative Closest Point (ICP) algorithm, enabling precise point cloud analysis to detect deviations that signify potential defects. By eliminating manual inspection, this method improves accuracy, enhances operational safety, and offers a scalable solution for defect detection. The proposed approach demonstrates great promise for reliable and efficient industrial applications.

Collaborative Optimization in Financial Data Mining Through Deep Learning and ResNeXt

Dec 23, 2024

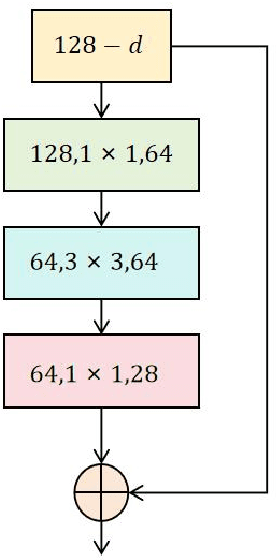

Abstract:This study proposes a multi-task learning framework based on ResNeXt, aiming to solve the problem of feature extraction and task collaborative optimization in financial data mining. Financial data usually has the complex characteristics of high dimensionality, nonlinearity, and time series, and is accompanied by potential correlations between multiple tasks, making it difficult for traditional methods to meet the needs of data mining. This study introduces the ResNeXt model into the multi-task learning framework and makes full use of its group convolution mechanism to achieve efficient extraction of local patterns and global features of financial data. At the same time, through the design of task sharing layers and dedicated layers, it is established between multiple related tasks. Deep collaborative optimization relationships. Through flexible multi-task loss weight design, the model can effectively balance the learning needs of different tasks and improve overall performance. Experiments are conducted on a real S&P 500 financial data set, verifying the significant advantages of the proposed framework in classification and regression tasks. The results indicate that, when compared to other conventional deep learning models, the proposed method delivers superior performance in terms of accuracy, F1 score, root mean square error, and other metrics, highlighting its outstanding effectiveness and robustness in handling complex financial data. This research provides an efficient and adaptable solution for financial data mining, and at the same time opens up a new research direction for the combination of multi-task learning and deep learning, which has important theoretical significance and practical application value.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge