Paolo Barucca

University College London

Granger Causality Detection with Kolmogorov-Arnold Networks

Dec 19, 2024

Abstract:Discovering causal relationships in time series data is central in many scientific areas, ranging from economics to climate science. Granger causality is a powerful tool for causality detection. However, its original formulation is limited by its linear form and only recently nonlinear machine-learning generalizations have been introduced. This study contributes to the definition of neural Granger causality models by investigating the application of Kolmogorov-Arnold networks (KANs) in Granger causality detection and comparing their capabilities against multilayer perceptrons (MLP). In this work, we develop a framework called Granger Causality KAN (GC-KAN) along with a tailored training approach designed specifically for Granger causality detection. We test this framework on both Vector Autoregressive (VAR) models and chaotic Lorenz-96 systems, analysing the ability of KANs to sparsify input features by identifying Granger causal relationships, providing a concise yet accurate model for Granger causality detection. Our findings show the potential of KANs to outperform MLPs in discerning interpretable Granger causal relationships, particularly for the ability of identifying sparse Granger causality patterns in high-dimensional settings, and more generally, the potential of AI in causality discovery for the dynamical laws in physical systems.

Deep Reinforcement Learning for Optimal Investment and Saving Strategy Selection in Heterogeneous Profiles: Intelligent Agents working towards retirement

Jun 12, 2022

Abstract:The transition from defined benefit to defined contribution pension plans shifts the responsibility for saving toward retirement from governments and institutions to the individuals. Determining optimal saving and investment strategy for individuals is paramount for stable financial stance and for avoiding poverty during work-life and retirement, and it is a particularly challenging task in a world where form of employment and income trajectory experienced by different occupation groups are highly diversified. We introduce a model in which agents learn optimal portfolio allocation and saving strategies that are suitable for their heterogeneous profiles. We use deep reinforcement learning to train agents. The environment is calibrated with occupation and age dependent income evolution dynamics. The research focuses on heterogeneous income trajectories dependent on agent profiles and incorporates the behavioural parameterisation of agents. The model provides a flexible methodology to estimate lifetime consumption and investment choices for heterogeneous profiles under varying scenarios.

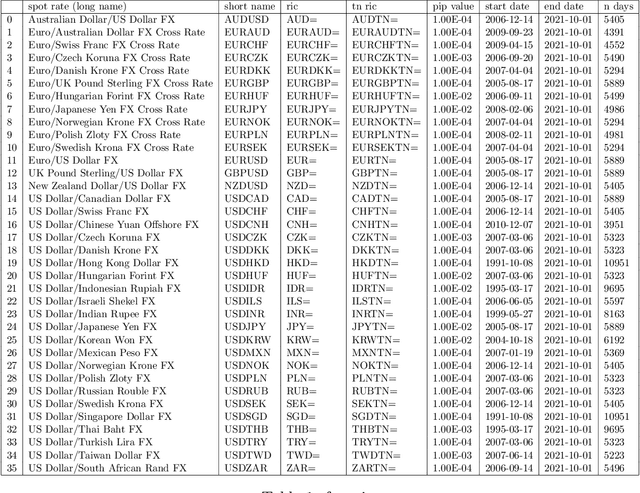

Variational Heteroscedastic Volatility Model

Apr 11, 2022

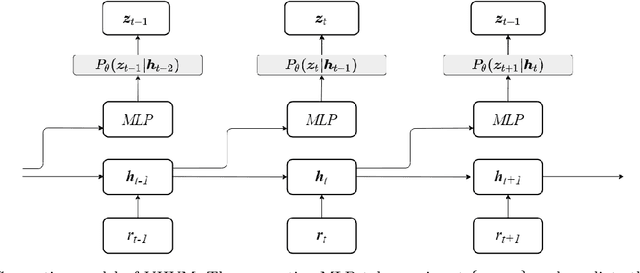

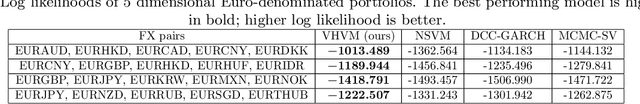

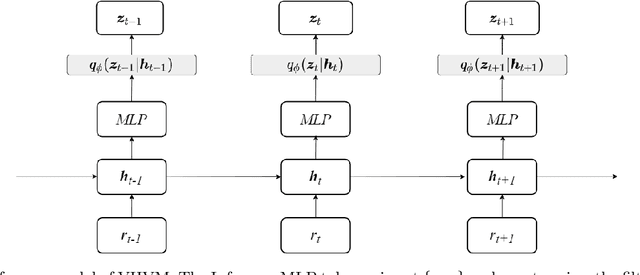

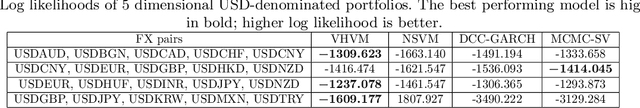

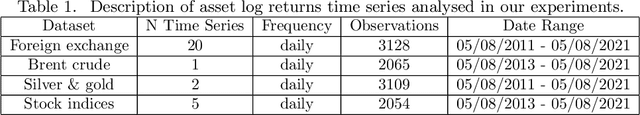

Abstract:We propose Variational Heteroscedastic Volatility Model (VHVM) -- an end-to-end neural network architecture capable of modelling heteroscedastic behaviour in multivariate financial time series. VHVM leverages recent advances in several areas of deep learning, namely sequential modelling and representation learning, to model complex temporal dynamics between different asset returns. At its core, VHVM consists of a variational autoencoder to capture relationships between assets, and a recurrent neural network to model the time-evolution of these dependencies. The outputs of VHVM are time-varying conditional volatilities in the form of covariance matrices. We demonstrate the effectiveness of VHVM against existing methods such as Generalised AutoRegressive Conditional Heteroscedasticity (GARCH) and Stochastic Volatility (SV) models on a wide range of multivariate foreign currency (FX) datasets.

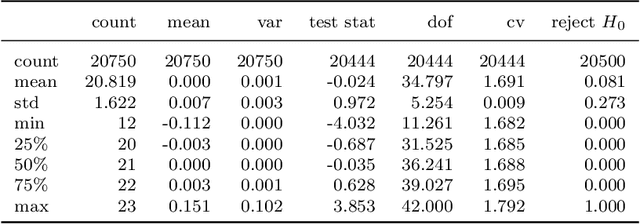

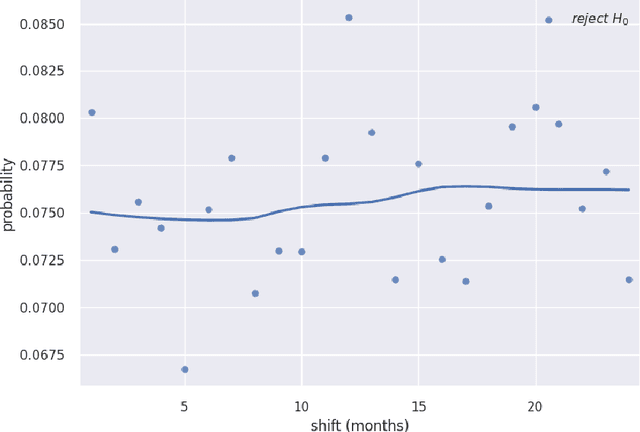

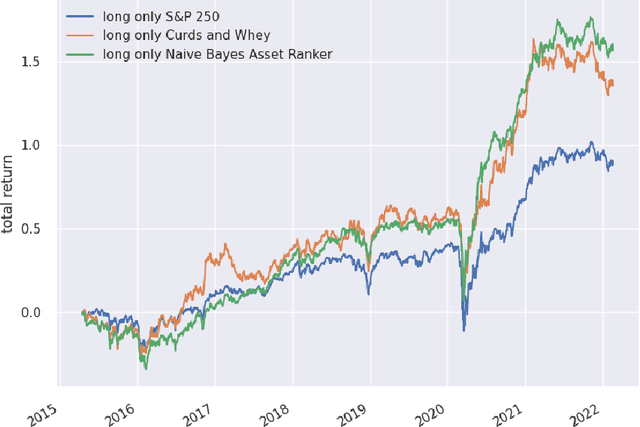

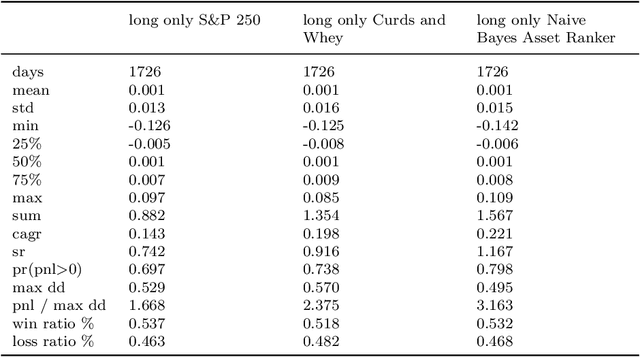

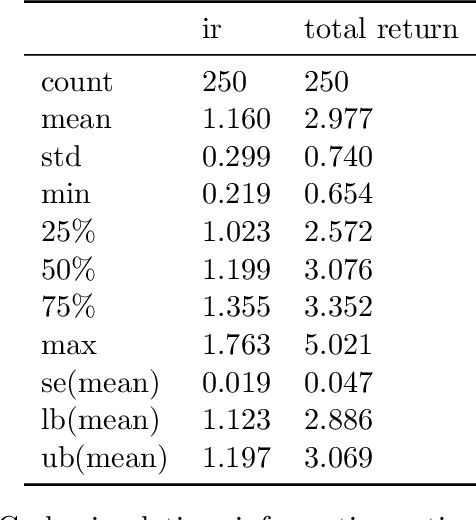

Sequential Asset Ranking within Nonstationary Time Series

Feb 24, 2022

Abstract:Financial time series are both autocorrelated and nonstationary, presenting modelling challenges that violate the independent and identically distributed random variables assumption of most regression and classification models. The prediction with expert advice framework makes no assumptions on the data-generating mechanism yet generates predictions that work well for all sequences, with performance nearly as good as the best expert with hindsight. We conduct research using S&P 250 daily sampled data, extending the academic research into cross-sectional momentum trading strategies. We introduce a novel ranking algorithm from the prediction with expert advice framework, the naive Bayes asset ranker, to select subsets of assets to hold in either long-only or long/short portfolios. Our algorithm generates the best total returns and risk-adjusted returns, net of transaction costs, outperforming the long-only holding of the S&P 250 with hindsight. Furthermore, our ranking algorithm outperforms a proxy for the regress-then-rank cross-sectional momentum trader, a sequentially fitted curds and whey multivariate regression procedure.

Deep Recurrent Modelling of Granger Causality with Latent Confounding

Feb 23, 2022

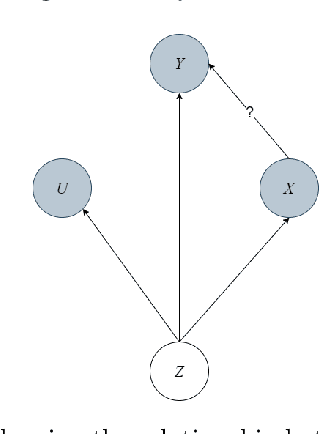

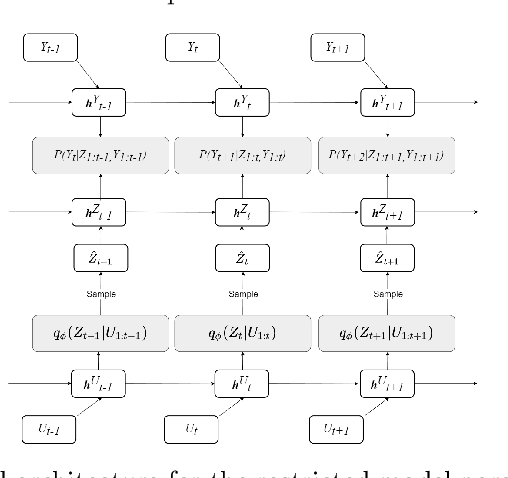

Abstract:Inferring causal relationships in observational time series data is an important task when interventions cannot be performed. Granger causality is a popular framework to infer potential causal mechanisms between different time series. The original definition of Granger causality is restricted to linear processes and leads to spurious conclusions in the presence of a latent confounder. In this work, we harness the expressive power of recurrent neural networks and propose a deep learning-based approach to model non-linear Granger causality by directly accounting for latent confounders. Our approach leverages multiple recurrent neural networks to parameterise predictive distributions and we propose the novel use of a dual-decoder setup to conduct the Granger tests. We demonstrate the model performance on non-linear stochastic time series for which the latent confounder influences the cause and effect with different time lags; results show the effectiveness of our model compared to existing benchmarks.

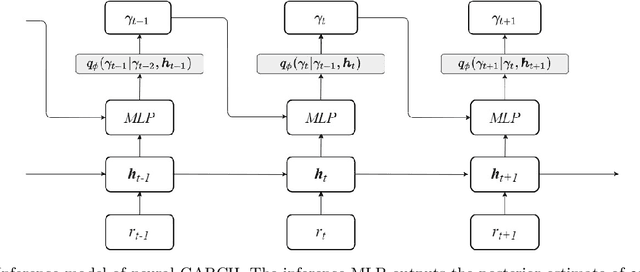

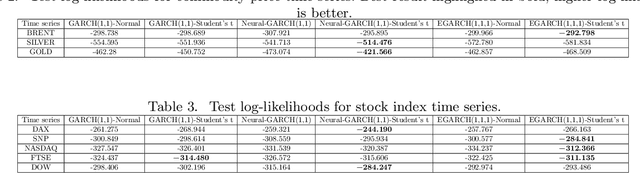

Neural Generalised AutoRegressive Conditional Heteroskedasticity

Feb 23, 2022

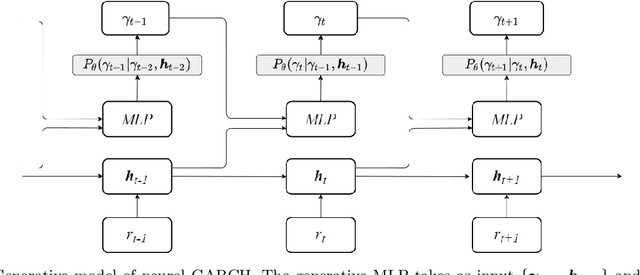

Abstract:We propose Neural GARCH, a class of methods to model conditional heteroskedasticity in financial time series. Neural GARCH is a neural network adaptation of the GARCH 1,1 model in the univariate case, and the diagonal BEKK 1,1 model in the multivariate case. We allow the coefficients of a GARCH model to be time varying in order to reflect the constantly changing dynamics of financial markets. The time varying coefficients are parameterised by a recurrent neural network that is trained with stochastic gradient variational Bayes. We propose two variants of our model, one with normal innovations and the other with Students t innovations. We test our models on a wide range of univariate and multivariate financial time series, and we find that the Neural Students t model consistently outperforms the others.

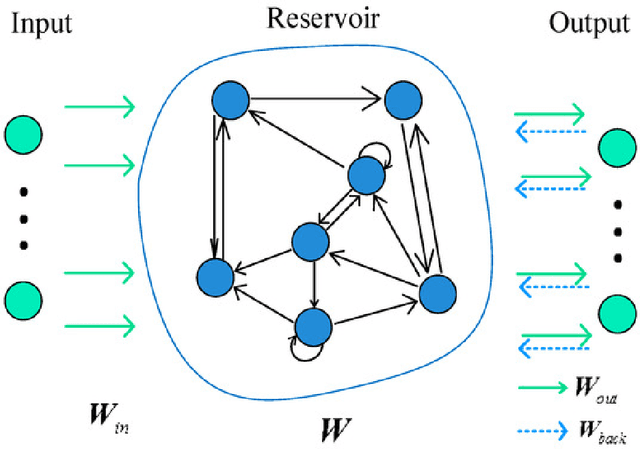

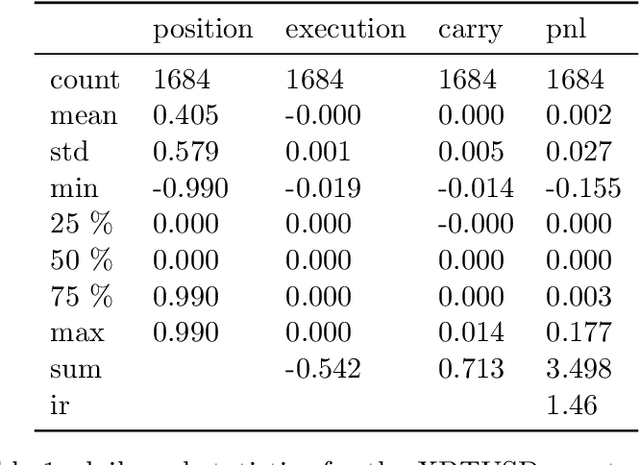

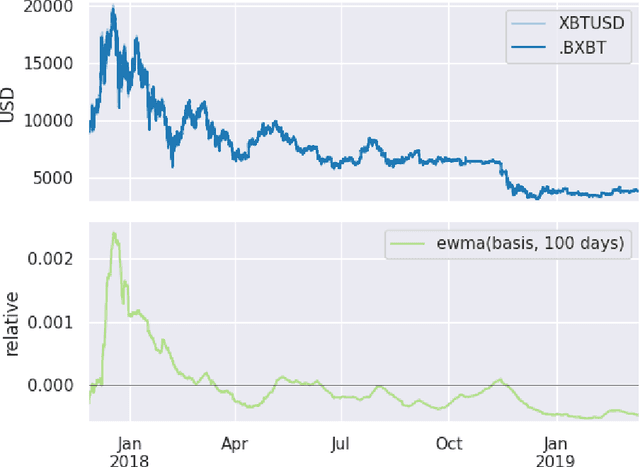

The Recurrent Reinforcement Learning Crypto Agent

Jan 29, 2022

Abstract:We demonstrate a novel application of online transfer learning for a digital assets trading agent. This agent makes use of a powerful feature space representation in the form of an echo state network, the output of which is made available to a direct, recurrent reinforcement learning agent. The agent learns to trade the XBTUSD (Bitcoin versus US Dollars) perpetual swap derivatives contract on BitMEX on an intraday basis. By learning from the multiple sources of impact on the quadratic risk-adjusted utility that it seeks to maximise, the agent avoids excessive over-trading, captures a funding profit, and can predict the market's direction. Overall, our crypto agent realises a total return of 350%, net of transaction costs, over roughly five years, 71% of which is down to funding profit. The annualised information ratio that it achieves is 1.46.

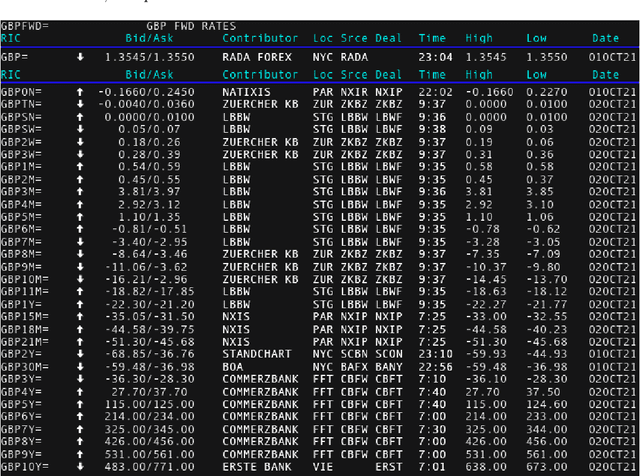

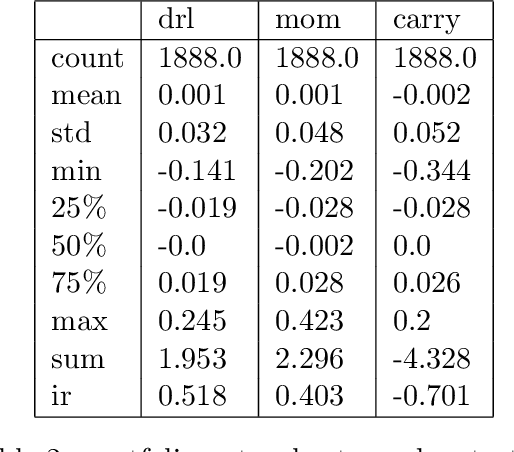

Reinforcement Learning for Systematic FX Trading

Oct 27, 2021

Abstract:We explore online, inductive transfer learning, with a feature representation transfer from a radial basis function network, which is formed of Gaussian mixture model hidden processing units, whose output is made available to a direct, recurrent reinforcement learning agent. This recurrent reinforcement learning agent learns a desired position, via the policy gradient reinforcement learning paradigm. This transfer learner is put to work trading the major spot market currency pairs. In our experiment, we accurately account for transaction and funding costs. These sources of profit and loss, including the price trends that occur in the currency markets, are made available to the recurrent reinforcement learner via a quadratic utility, who learns to target a position directly. We improve upon earlier work by casting the problem of learning to target a risk position, in an online transfer learning context. Our agent achieves an annualised portfolio information ratio of 0.52 with compound return of 9.3\%, net of execution and funding cost, over a 7 year test set. This is despite forcing the model to trade at the close of the trading day 5pm EST, when trading costs are statistically the most expensive.

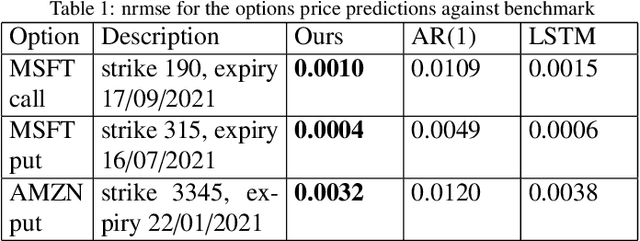

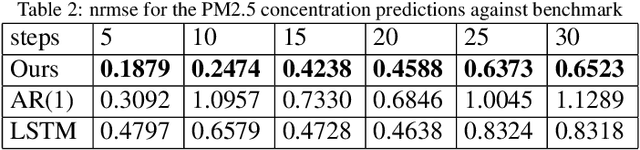

Stochastic Recurrent Neural Network for Multistep Time Series Forecasting

May 02, 2021

Abstract:Time series forecasting based on deep architectures has been gaining popularity in recent years due to their ability to model complex non-linear temporal dynamics. The recurrent neural network is one such model capable of handling variable-length input and output. In this paper, we leverage recent advances in deep generative models and the concept of state space models to propose a stochastic adaptation of the recurrent neural network for multistep-ahead time series forecasting, which is trained with stochastic gradient variational Bayes. In our model design, the transition function of the recurrent neural network, which determines the evolution of the hidden states, is stochastic rather than deterministic as in a regular recurrent neural network; this is achieved by incorporating a latent random variable into the transition process which captures the stochasticity of the temporal dynamics. Our model preserves the architectural workings of a recurrent neural network for which all relevant information is encapsulated in its hidden states, and this flexibility allows our model to be easily integrated into any deep architecture for sequential modelling. We test our model on a wide range of datasets from finance to healthcare; results show that the stochastic recurrent neural network consistently outperforms its deterministic counterpart.

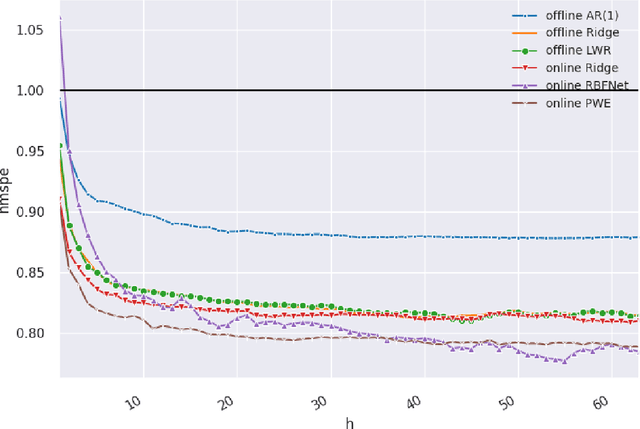

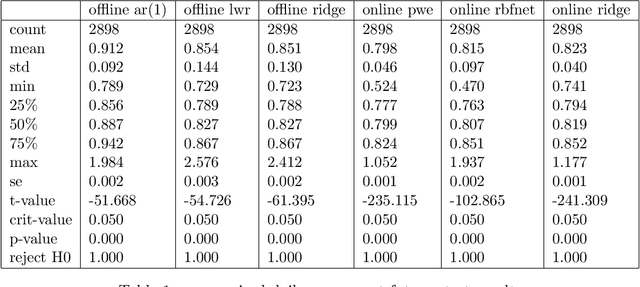

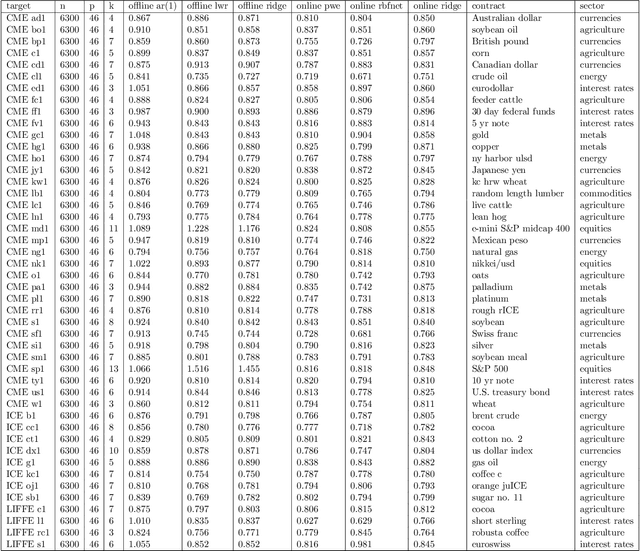

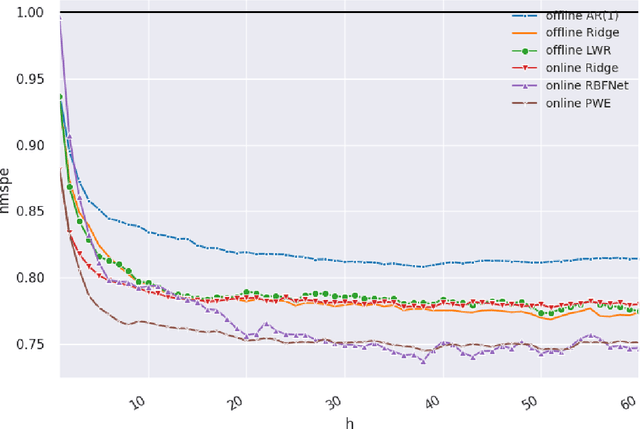

Online Learning with Radial Basis Function Networks

Mar 15, 2021

Abstract:We investigate the benefits of feature selection, nonlinear modelling and online learning with forecasting in financial time series. We consider the sequential and continual learning sub-genres of online learning. Through empirical experimentation, which involves long term forecasting in daily sampled cross-asset futures, and short term forecasting in minutely sampled cash currency pairs, we find that the online learning techniques outperform the offline learning ones. We also find that, in the subset of models we use, sequential learning in time with online Ridge regression, provides the best next step ahead forecasts, and continual learning with an online radial basis function network, provides the best multi-step ahead forecasts. We combine the benefits of both in a precision weighted ensemble of the forecast errors and find superior forecast performance overall.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge