Reinforcement Learning for Systematic FX Trading

Paper and Code

Oct 27, 2021

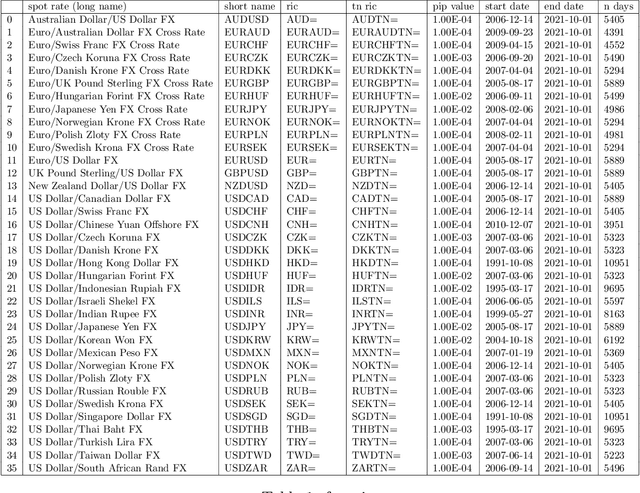

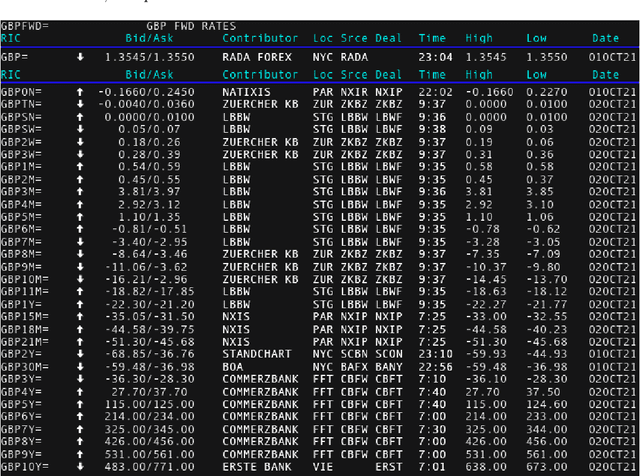

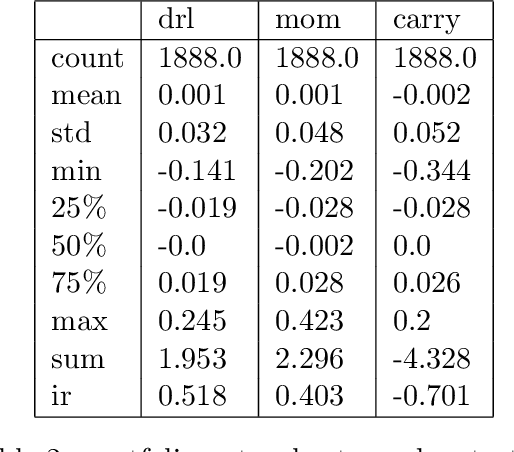

We explore online, inductive transfer learning, with a feature representation transfer from a radial basis function network, which is formed of Gaussian mixture model hidden processing units, whose output is made available to a direct, recurrent reinforcement learning agent. This recurrent reinforcement learning agent learns a desired position, via the policy gradient reinforcement learning paradigm. This transfer learner is put to work trading the major spot market currency pairs. In our experiment, we accurately account for transaction and funding costs. These sources of profit and loss, including the price trends that occur in the currency markets, are made available to the recurrent reinforcement learner via a quadratic utility, who learns to target a position directly. We improve upon earlier work by casting the problem of learning to target a risk position, in an online transfer learning context. Our agent achieves an annualised portfolio information ratio of 0.52 with compound return of 9.3\%, net of execution and funding cost, over a 7 year test set. This is despite forcing the model to trade at the close of the trading day 5pm EST, when trading costs are statistically the most expensive.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge