Gabriel Borrageiro

Sequential Asset Ranking within Nonstationary Time Series

Feb 24, 2022

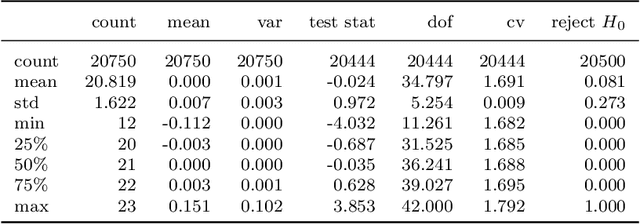

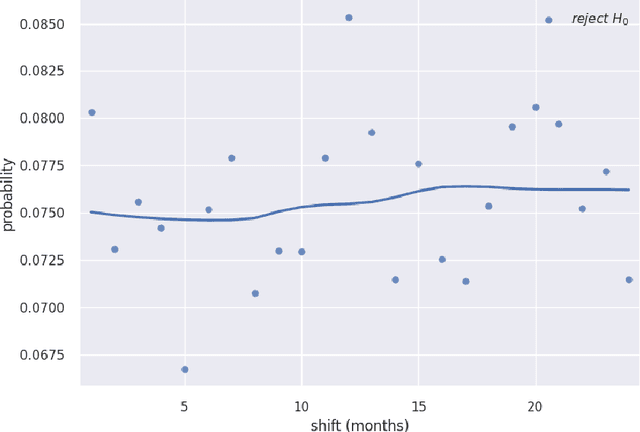

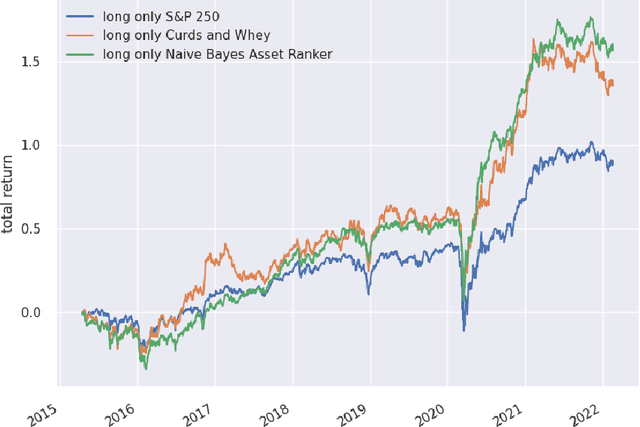

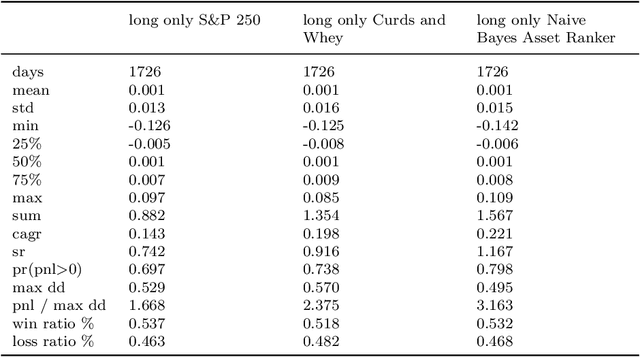

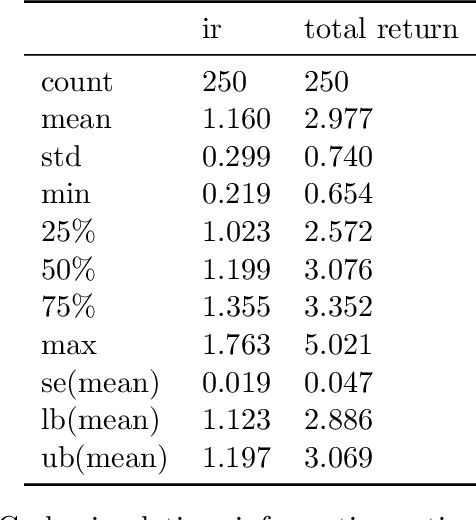

Abstract:Financial time series are both autocorrelated and nonstationary, presenting modelling challenges that violate the independent and identically distributed random variables assumption of most regression and classification models. The prediction with expert advice framework makes no assumptions on the data-generating mechanism yet generates predictions that work well for all sequences, with performance nearly as good as the best expert with hindsight. We conduct research using S&P 250 daily sampled data, extending the academic research into cross-sectional momentum trading strategies. We introduce a novel ranking algorithm from the prediction with expert advice framework, the naive Bayes asset ranker, to select subsets of assets to hold in either long-only or long/short portfolios. Our algorithm generates the best total returns and risk-adjusted returns, net of transaction costs, outperforming the long-only holding of the S&P 250 with hindsight. Furthermore, our ranking algorithm outperforms a proxy for the regress-then-rank cross-sectional momentum trader, a sequentially fitted curds and whey multivariate regression procedure.

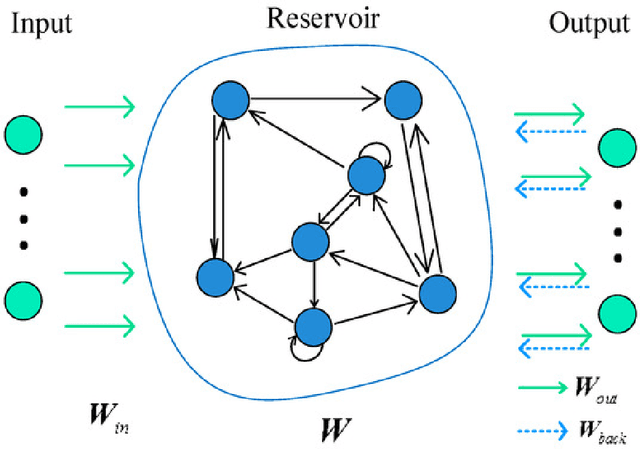

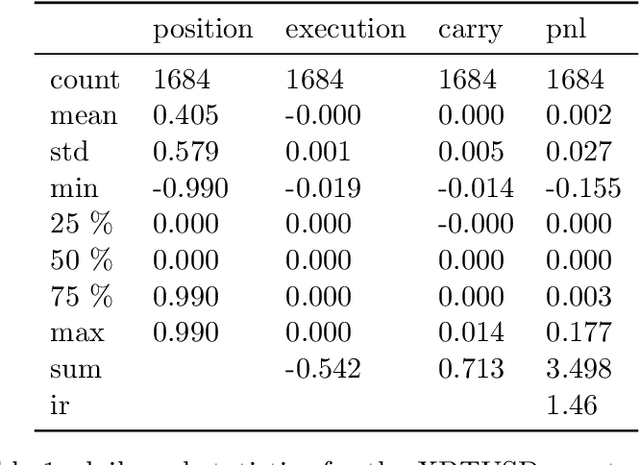

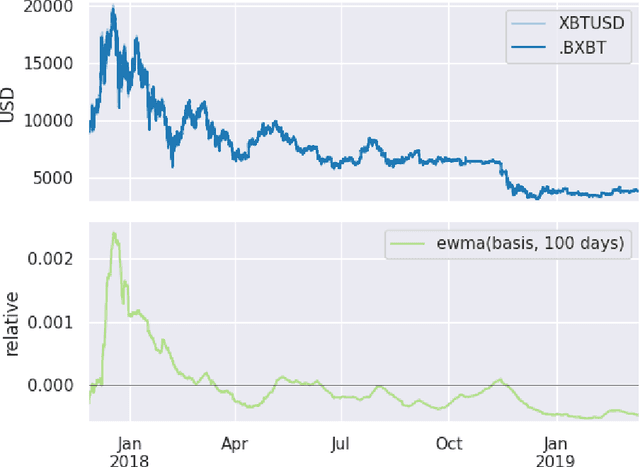

The Recurrent Reinforcement Learning Crypto Agent

Jan 29, 2022

Abstract:We demonstrate a novel application of online transfer learning for a digital assets trading agent. This agent makes use of a powerful feature space representation in the form of an echo state network, the output of which is made available to a direct, recurrent reinforcement learning agent. The agent learns to trade the XBTUSD (Bitcoin versus US Dollars) perpetual swap derivatives contract on BitMEX on an intraday basis. By learning from the multiple sources of impact on the quadratic risk-adjusted utility that it seeks to maximise, the agent avoids excessive over-trading, captures a funding profit, and can predict the market's direction. Overall, our crypto agent realises a total return of 350%, net of transaction costs, over roughly five years, 71% of which is down to funding profit. The annualised information ratio that it achieves is 1.46.

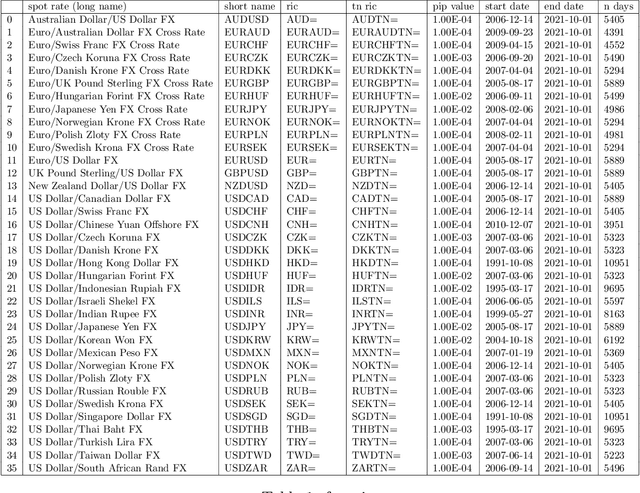

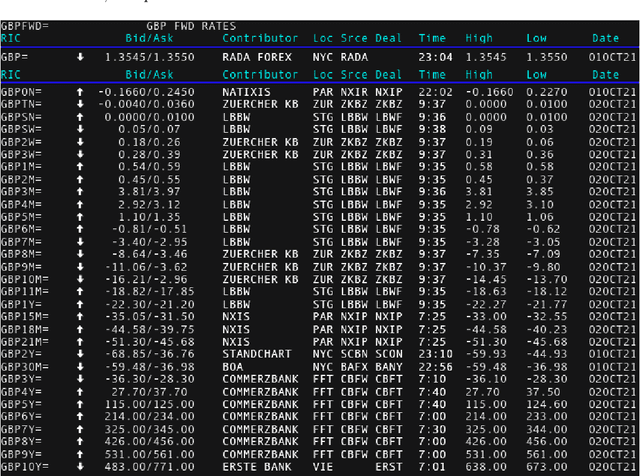

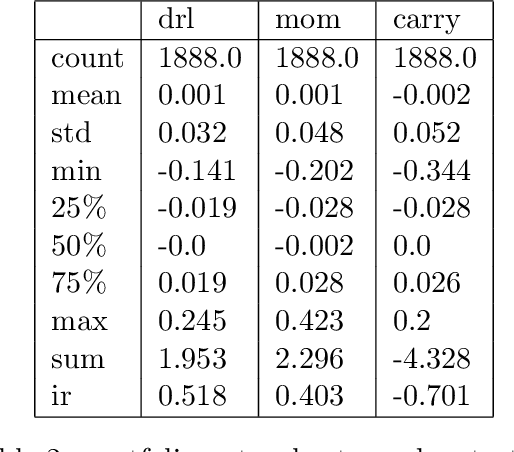

Reinforcement Learning for Systematic FX Trading

Oct 27, 2021

Abstract:We explore online, inductive transfer learning, with a feature representation transfer from a radial basis function network, which is formed of Gaussian mixture model hidden processing units, whose output is made available to a direct, recurrent reinforcement learning agent. This recurrent reinforcement learning agent learns a desired position, via the policy gradient reinforcement learning paradigm. This transfer learner is put to work trading the major spot market currency pairs. In our experiment, we accurately account for transaction and funding costs. These sources of profit and loss, including the price trends that occur in the currency markets, are made available to the recurrent reinforcement learner via a quadratic utility, who learns to target a position directly. We improve upon earlier work by casting the problem of learning to target a risk position, in an online transfer learning context. Our agent achieves an annualised portfolio information ratio of 0.52 with compound return of 9.3\%, net of execution and funding cost, over a 7 year test set. This is despite forcing the model to trade at the close of the trading day 5pm EST, when trading costs are statistically the most expensive.

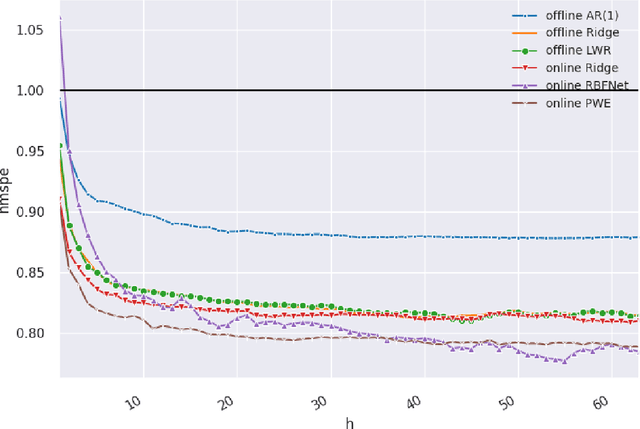

Online Learning with Radial Basis Function Networks

Mar 15, 2021

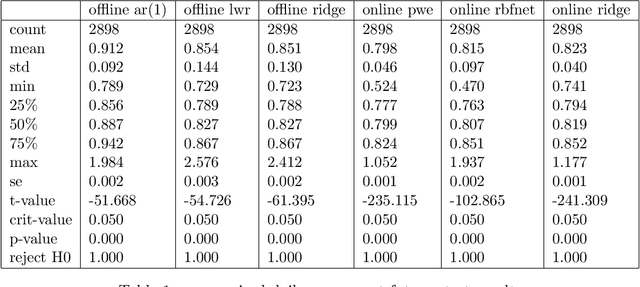

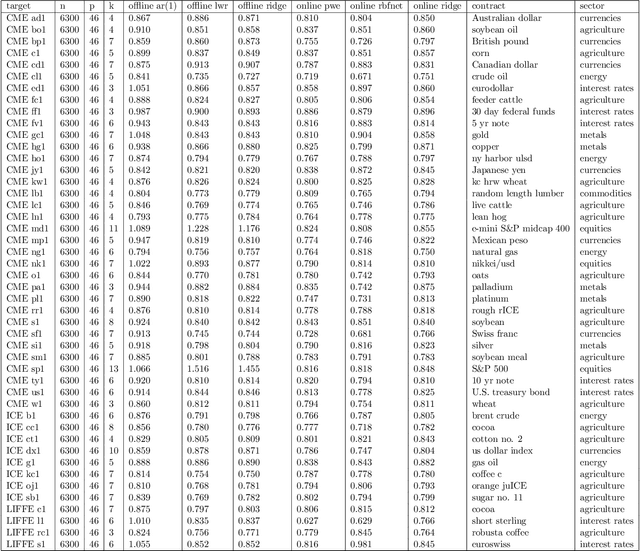

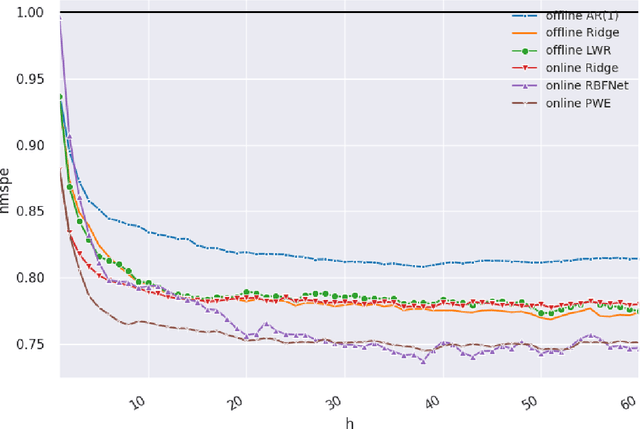

Abstract:We investigate the benefits of feature selection, nonlinear modelling and online learning with forecasting in financial time series. We consider the sequential and continual learning sub-genres of online learning. Through empirical experimentation, which involves long term forecasting in daily sampled cross-asset futures, and short term forecasting in minutely sampled cash currency pairs, we find that the online learning techniques outperform the offline learning ones. We also find that, in the subset of models we use, sequential learning in time with online Ridge regression, provides the best next step ahead forecasts, and continual learning with an online radial basis function network, provides the best multi-step ahead forecasts. We combine the benefits of both in a precision weighted ensemble of the forecast errors and find superior forecast performance overall.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge