Sequential Asset Ranking within Nonstationary Time Series

Paper and Code

Feb 24, 2022

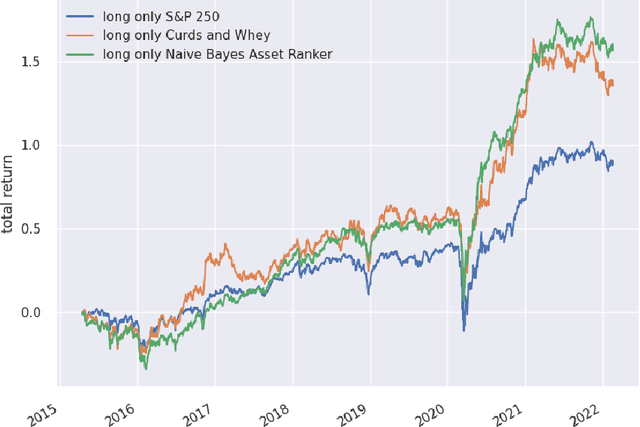

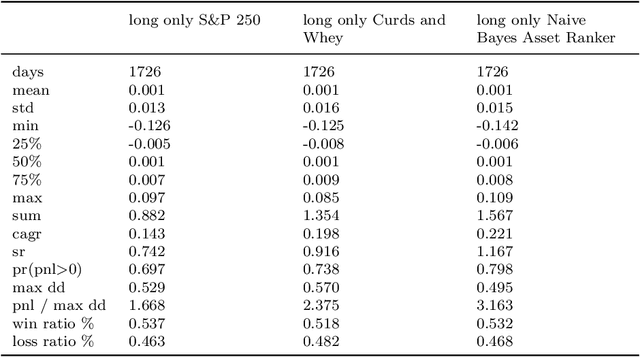

Financial time series are both autocorrelated and nonstationary, presenting modelling challenges that violate the independent and identically distributed random variables assumption of most regression and classification models. The prediction with expert advice framework makes no assumptions on the data-generating mechanism yet generates predictions that work well for all sequences, with performance nearly as good as the best expert with hindsight. We conduct research using S&P 250 daily sampled data, extending the academic research into cross-sectional momentum trading strategies. We introduce a novel ranking algorithm from the prediction with expert advice framework, the naive Bayes asset ranker, to select subsets of assets to hold in either long-only or long/short portfolios. Our algorithm generates the best total returns and risk-adjusted returns, net of transaction costs, outperforming the long-only holding of the S&P 250 with hindsight. Furthermore, our ranking algorithm outperforms a proxy for the regress-then-rank cross-sectional momentum trader, a sequentially fitted curds and whey multivariate regression procedure.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge