Nina Kaploukhaya

Adversarial Attacks on Deep Models for Financial Transaction Records

Jun 15, 2021

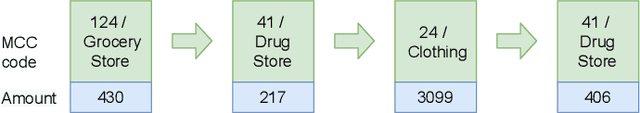

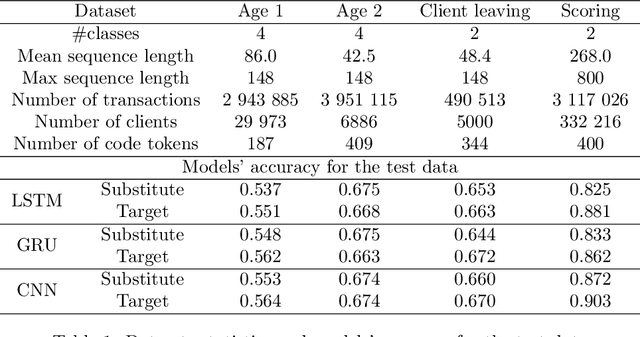

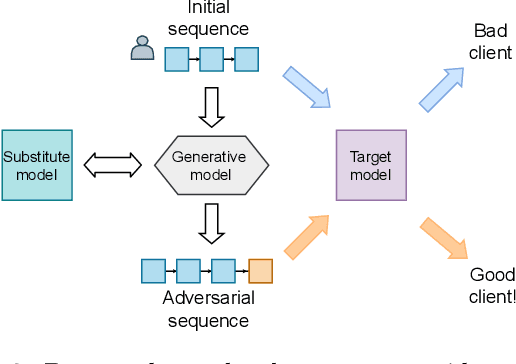

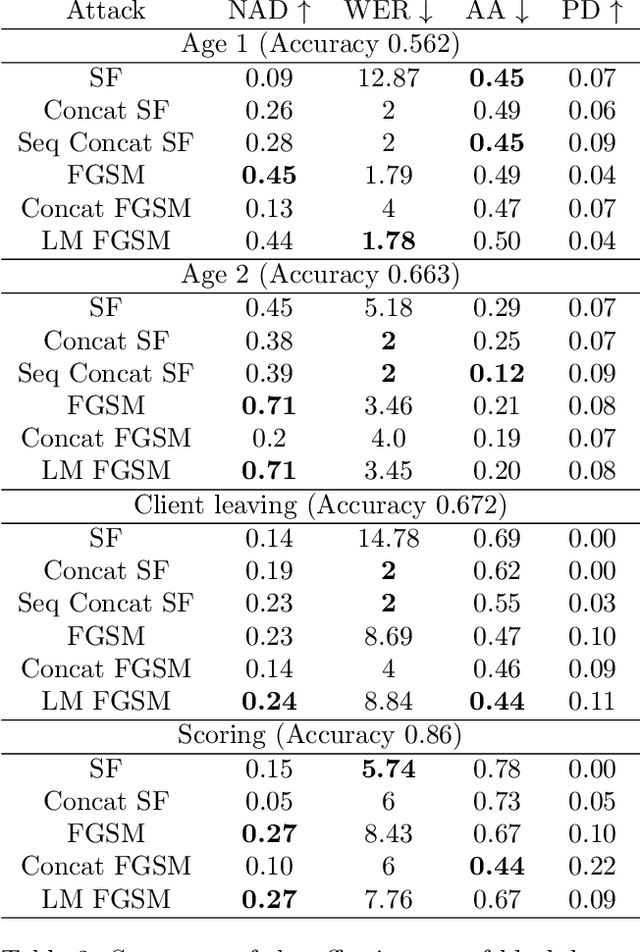

Abstract:Machine learning models using transaction records as inputs are popular among financial institutions. The most efficient models use deep-learning architectures similar to those in the NLP community, posing a challenge due to their tremendous number of parameters and limited robustness. In particular, deep-learning models are vulnerable to adversarial attacks: a little change in the input harms the model's output. In this work, we examine adversarial attacks on transaction records data and defences from these attacks. The transaction records data have a different structure than the canonical NLP or time series data, as neighbouring records are less connected than words in sentences, and each record consists of both discrete merchant code and continuous transaction amount. We consider a black-box attack scenario, where the attack doesn't know the true decision model, and pay special attention to adding transaction tokens to the end of a sequence. These limitations provide more realistic scenario, previously unexplored in NLP world. The proposed adversarial attacks and the respective defences demonstrate remarkable performance using relevant datasets from the financial industry. Our results show that a couple of generated transactions are sufficient to fool a deep-learning model. Further, we improve model robustness via adversarial training or separate adversarial examples detection. This work shows that embedding protection from adversarial attacks improves model robustness, allowing a wider adoption of deep models for transaction records in banking and finance.

COHORTNEY: Deep Clustering for Heterogeneous Event Sequences

Apr 03, 2021

Abstract:There is emerging attention towards working with event sequences. In particular, clustering of event sequences is widely applicable in domains such as healthcare, marketing, and finance. Use cases include analysis of visitors to websites, hospitals, or bank transactions. Unlike traditional time series, event sequences tend to be sparse and not equally spaced in time. As a result, they exhibit different properties, which are essential to account for when developing state-of-the-art methods. The community has paid little attention to the specifics of heterogeneous event sequences. Existing research in clustering primarily focuses on classic times series data. It is unclear if proposed methods in the literature generalize well to event sequences. Here we propose COHORTNEY as a novel deep learning method for clustering heterogeneous event sequences. Our contributions include (i) a novel method using a combination of LSTM and the EM algorithm and code implementation; (ii) a comparison of this method to previous research on time series and event sequence clustering; (iii) a performance benchmark of different approaches on a new dataset from the finance industry and fourteen additional datasets. Our results show that COHORTNEY vastly outperforms in speed and cluster quality the state-of-the-art algorithm for clustering event sequences.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge