Masaya Abe

Application of time-series quantum generative model to financial data

May 20, 2024

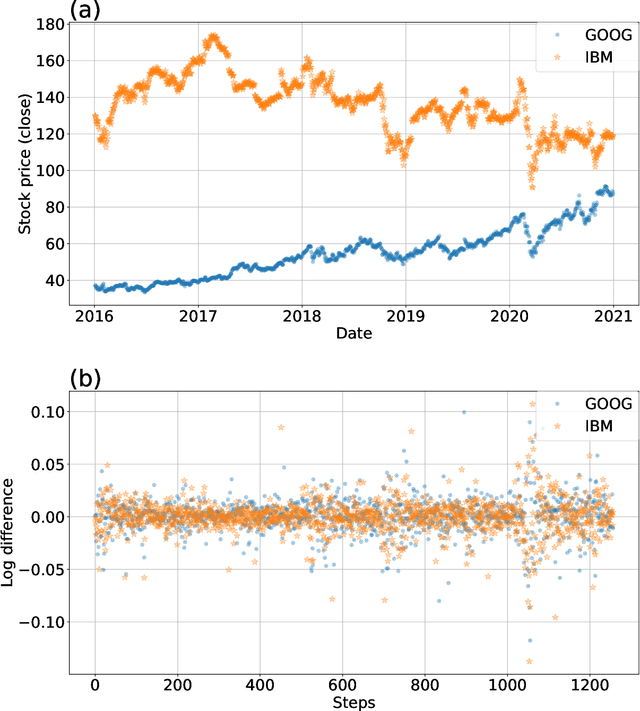

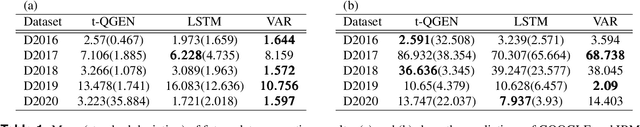

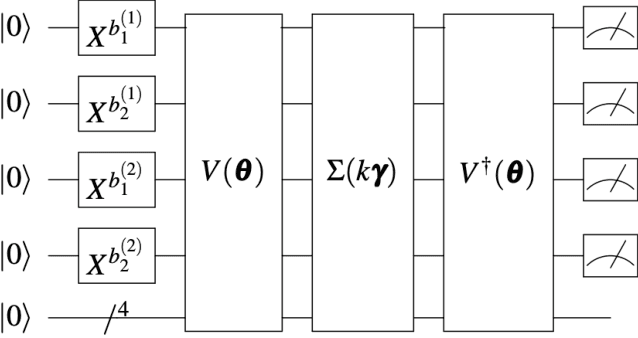

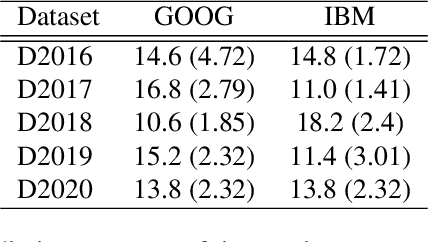

Abstract:Despite proposing a quantum generative model for time series that successfully learns correlated series with multiple Brownian motions, the model has not been adapted and evaluated for financial problems. In this study, a time-series generative model was applied as a quantum generative model to actual financial data. Future data for two correlated time series were generated and compared with classical methods such as long short-term memory and vector autoregression. Furthermore, numerical experiments were performed to complete missing values. Based on the results, we evaluated the practical applications of the time-series quantum generation model. It was observed that fewer parameter values were required compared with the classical method. In addition, the quantum time-series generation model was feasible for both stationary and nonstationary data. These results suggest that several parameters can be applied to various types of time-series data.

Controlling False Discovery Rates Using Null Bootstrapping

Feb 15, 2021

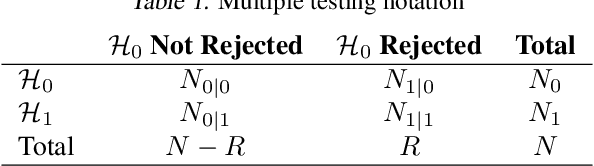

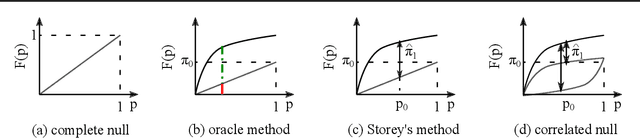

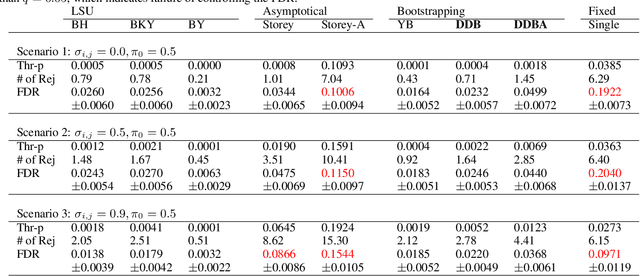

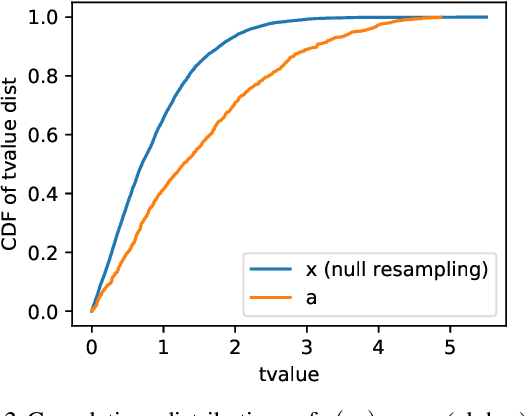

Abstract:We consider controlling the false discovery rate for many tests with unknown correlation structure. Given a large number of hypotheses, false and missing discoveries can plague an analysis. While many procedures have been proposed to control false discovery, they either assume independent hypotheses or lack statistical power. We propose a novel method for false discovery control using null bootstrapping. By bootstrapping from the correlated null, we achieve superior statistical power to existing methods and prove that the false discovery rate is controlled. Simulated examples illustrate the efficacy of our method over existing methods. We apply our proposed methodology to financial asset pricing, where the goal is to determine which "factors" lead to excess returns out of a large number of potential factors.

A Robust Transferable Deep Learning Framework for Cross-sectional Investment Strategy

Oct 02, 2019

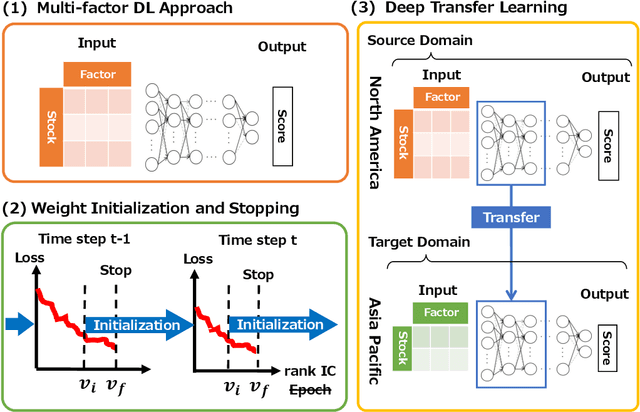

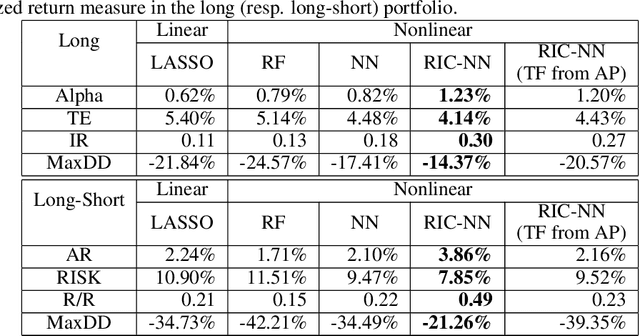

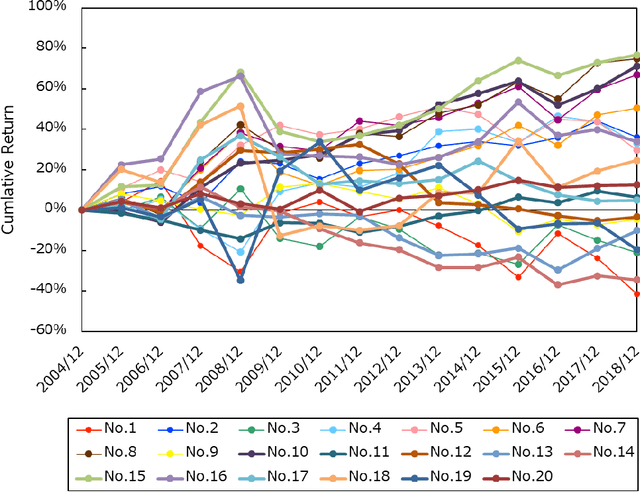

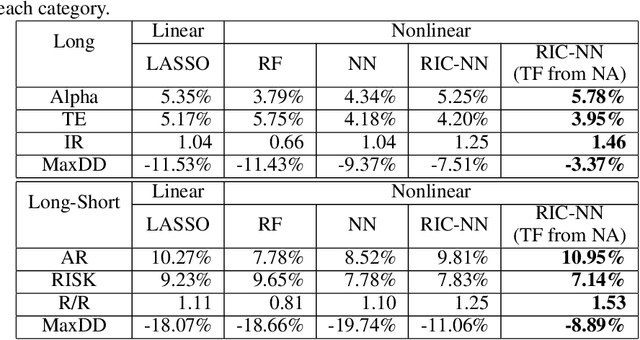

Abstract:Stock return predictability is an important research theme as it reflects our economic and social organization, and significant efforts are made to explain the dynamism therein. Statistics of strong explanative power, called "factor" have been proposed to summarize the essence of predictive stock returns. Although machine learning methods are increasingly popular in stock return prediction, an inference of the stock returns is highly elusive, and still most investors, if partly, rely on their intuition to build a better decision making. The challenge here is to make an investment strategy that is consistent over a reasonably long period, with the minimum human decision on the entire process. To this end, we propose a new stock return prediction framework that we call Ranked Information Coefficient Neural Network (RIC-NN). RIC-NN is a deep learning approach and includes the following three novel ideas: (1) nonlinear multi-factor approach, (2) stopping criteria with ranked information coefficient (rank IC), and (3) deep transfer learning among multiple regions. Experimental comparison with the stocks in the Morgan Stanley Capital International (MSCI) indices shows that RIC-NN outperforms not only off-the-shelf machine learning methods but also the average return of major equity investment funds in the last fourteen years.

Deep Learning for Forecasting Stock Returns in the Cross-Section

Jun 13, 2018

Abstract:Many studies have been undertaken by using machine learning techniques, including neural networks, to predict stock returns. Recently, a method known as deep learning, which achieves high performance mainly in image recognition and speech recognition, has attracted attention in the machine learning field. This paper implements deep learning to predict one-month-ahead stock returns in the cross-section in the Japanese stock market and investigates the performance of the method. Our results show that deep neural networks generally outperform shallow neural networks, and the best networks also outperform representative machine learning models. These results indicate that deep learning shows promise as a skillful machine learning method to predict stock returns in the cross-section.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge