Shun Okumura

Application of time-series quantum generative model to financial data

May 20, 2024

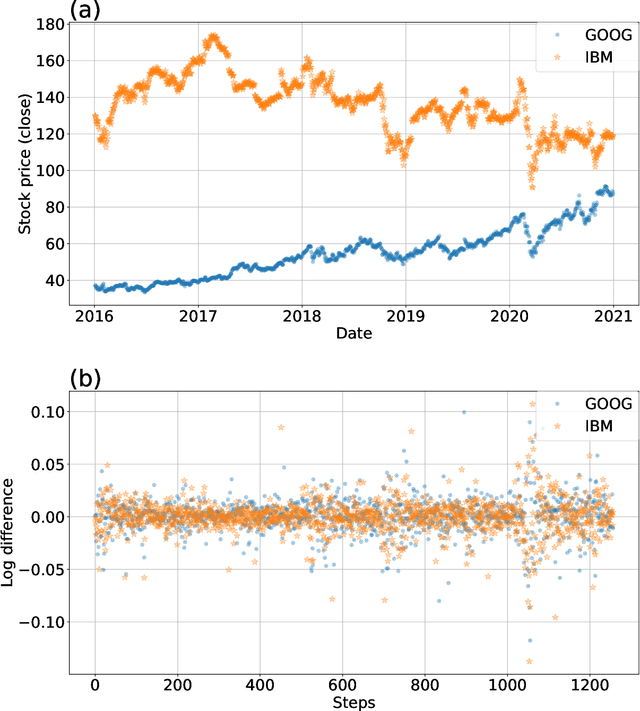

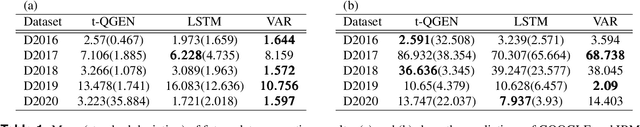

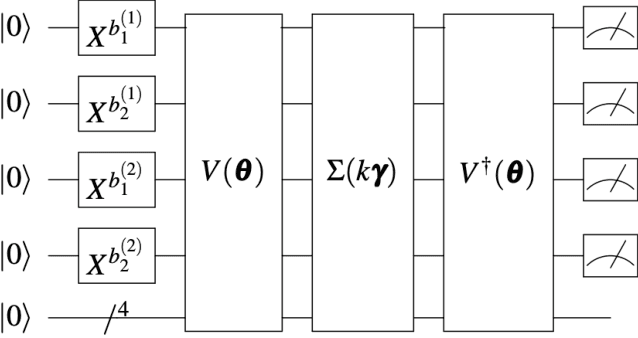

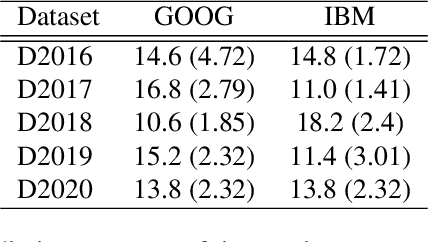

Abstract:Despite proposing a quantum generative model for time series that successfully learns correlated series with multiple Brownian motions, the model has not been adapted and evaluated for financial problems. In this study, a time-series generative model was applied as a quantum generative model to actual financial data. Future data for two correlated time series were generated and compared with classical methods such as long short-term memory and vector autoregression. Furthermore, numerical experiments were performed to complete missing values. Based on the results, we evaluated the practical applications of the time-series quantum generation model. It was observed that fewer parameter values were required compared with the classical method. In addition, the quantum time-series generation model was feasible for both stationary and nonstationary data. These results suggest that several parameters can be applied to various types of time-series data.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge