Luxuan Yang

Meta contrastive label correction for financial time series

Mar 09, 2023

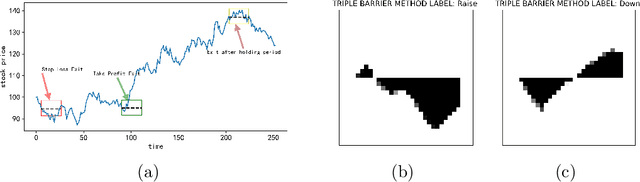

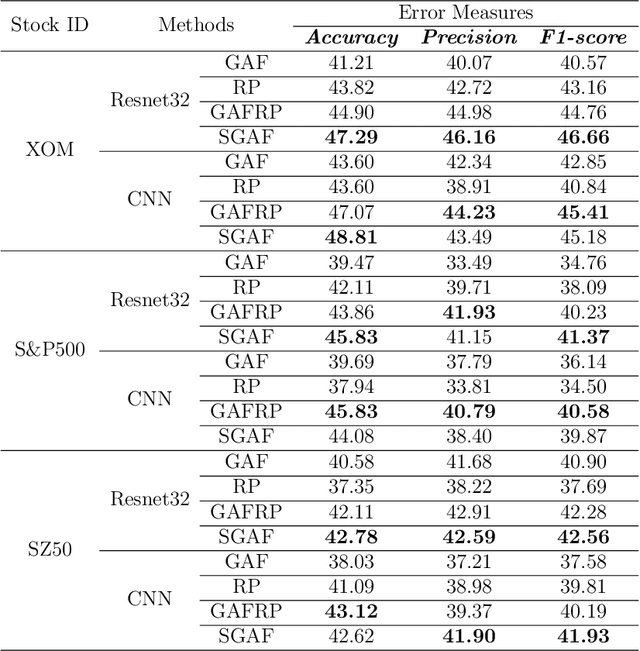

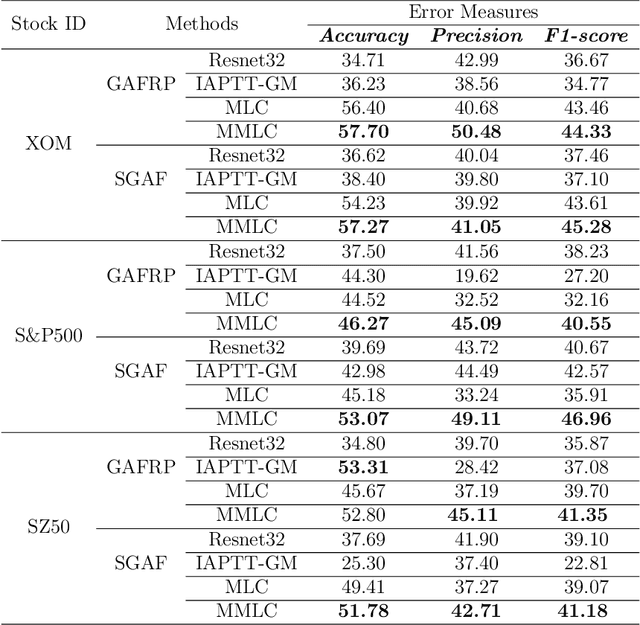

Abstract:Financial applications such as stock price forecasting, usually face an issue that under the predefined labeling rules, it is hard to accurately predict the directions of stock movement. This is because traditional ways of labeling, taking Triple Barrier Method, for example, usually gives us inaccurate or even corrupted labels. To address this issue, we focus on two main goals. One is that our proposed method can automatically generate correct labels for noisy time series patterns, while at the same time, the method is capable of boosting classification performance on this new labeled dataset. Based on the aforementioned goals, our approach has the following three novelties: First, we fuse a new contrastive learning algorithm into the meta-learning framework to estimate correct labels iteratively when updating the classification model inside. Moreover, we utilize images generated from time series data through Gramian angular field and representative learning. Most important of all, we adopt multi-task learning to forecast temporal-variant labels. In the experiments, we work on 6% clean data and the rest unlabeled data. It is shown that our method is competitive and outperforms a lot compared with benchmarks.

Time Series Forecasting with Ensembled Stochastic Differential Equations Driven by Lévy Noise

Nov 25, 2021

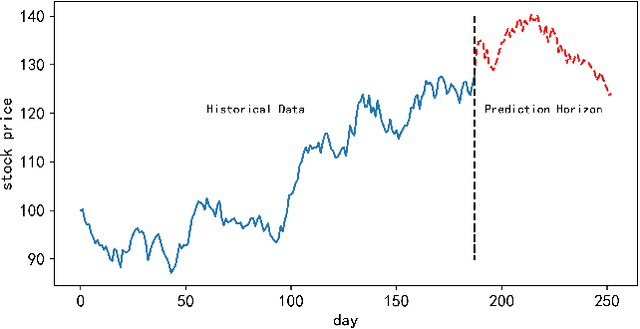

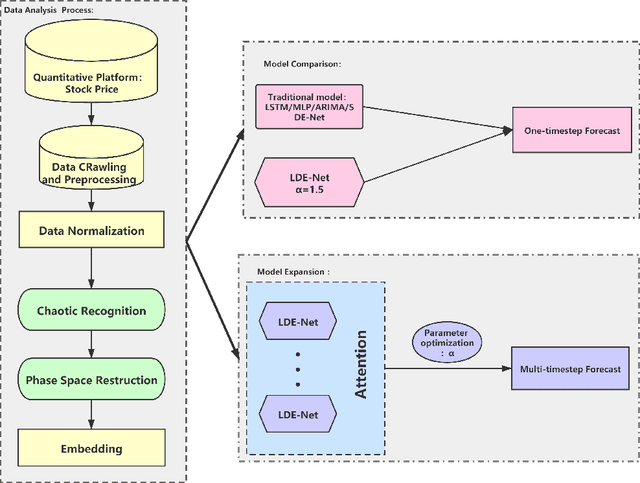

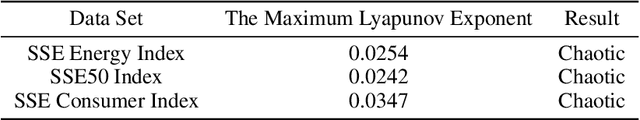

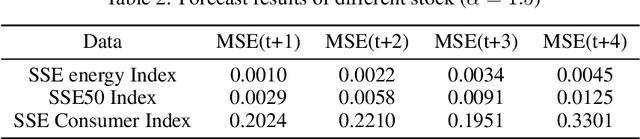

Abstract:With the fast development of modern deep learning techniques, the study of dynamic systems and neural networks is increasingly benefiting each other in a lot of different ways. Since uncertainties often arise in real world observations, SDEs (stochastic differential equations) come to play an important role. To be more specific, in this paper, we use a collection of SDEs equipped with neural networks to predict long-term trend of noisy time series which has big jump properties and high probability distribution shift. Our contributions are, first, we use the phase space reconstruction method to extract intrinsic dimension of the time series data so as to determine the input structure for our forecasting model. Second, we explore SDEs driven by $\alpha$-stable L\'evy motion to model the time series data and solve the problem through neural network approximation. Third, we construct the attention mechanism to achieve multi-time step prediction. Finally, we illustrate our method by applying it to stock marketing time series prediction and show the results outperform several baseline deep learning models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge